Schedule a Form 1040 NR Sp Itemized Deductions Spanish Version 2023

What is the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

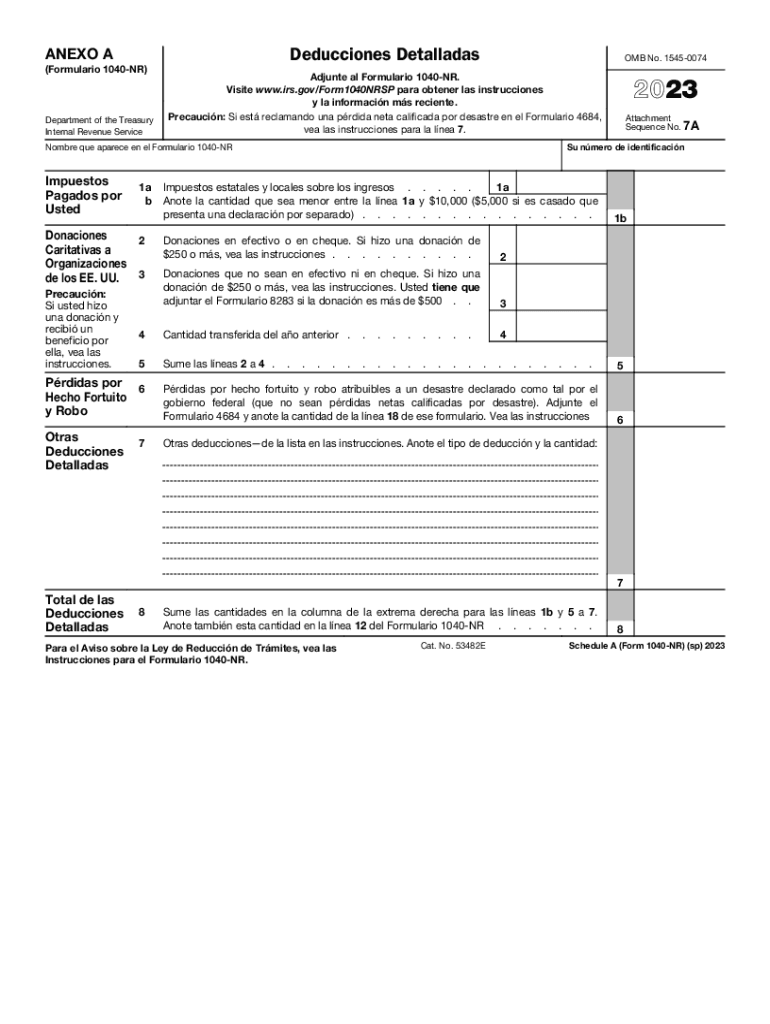

The Schedule A Form 1040 NR sp Itemized Deductions Spanish Version is a tax form used by non-resident aliens in the United States to report itemized deductions. This form allows individuals to detail specific deductible expenses, which can reduce their taxable income. Common deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions. The Spanish version ensures accessibility for Spanish-speaking taxpayers, facilitating their understanding of tax obligations and rights.

How to use the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

To utilize the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version, taxpayers should first gather all relevant financial documents that support their deductions. This includes receipts, invoices, and statements for medical expenses, property taxes, and charitable donations. After collecting the necessary information, individuals can fill out the form by entering the amounts in the appropriate sections. It is essential to ensure accuracy to avoid issues with the IRS.

Steps to complete the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

Completing the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version involves several steps:

- Gather documents: Collect all receipts and statements related to deductible expenses.

- Fill out personal information: Enter your name, address, and taxpayer identification number at the top of the form.

- Detail deductions: In the designated sections, list each type of deduction and the corresponding amounts.

- Calculate totals: Sum up the deductions to determine the total itemized deductions.

- Review for accuracy: Double-check all entries for correctness before submission.

Key elements of the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

The key elements of the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version include:

- Medical and dental expenses: Deductible costs related to healthcare.

- Taxes you paid: State and local taxes that can be deducted.

- Interest you paid: Mortgage interest and other eligible interest payments.

- Charitable contributions: Donations made to qualifying organizations.

- Other itemized deductions: Various other eligible expenses as outlined by the IRS.

Legal use of the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

The Schedule A Form 1040 NR sp Itemized Deductions Spanish Version is legally recognized by the IRS for non-resident aliens filing their taxes in the United States. It must be completed accurately and submitted in accordance with IRS guidelines. Using this form allows individuals to claim eligible deductions, which can significantly impact their overall tax liability. Failure to use the correct form or to report deductions accurately may lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version generally align with the annual tax return deadlines. Non-resident aliens typically must file their tax returns by April fifteenth of the year following the tax year. If additional time is needed, taxpayers can file for an extension, which may grant an additional six months. It is crucial to be aware of these deadlines to avoid late fees and penalties.

Quick guide on how to complete schedule a form 1040 nr sp itemized deductions spanish version

Effortlessly Prepare Schedule A Form 1040 NR sp Itemized Deductions Spanish Version on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without any delays. Manage Schedule A Form 1040 NR sp Itemized Deductions Spanish Version on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and electronically sign Schedule A Form 1040 NR sp Itemized Deductions Spanish Version effortlessly

- Obtain Schedule A Form 1040 NR sp Itemized Deductions Spanish Version and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Schedule A Form 1040 NR sp Itemized Deductions Spanish Version to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule a form 1040 nr sp itemized deductions spanish version

Create this form in 5 minutes!

How to create an eSignature for the schedule a form 1040 nr sp itemized deductions spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version?

The Schedule A Form 1040 NR sp Itemized Deductions Spanish Version is a tax form used by non-resident aliens to detail their itemized deductions for U.S. taxes. This form allows individuals to claim deductions related to medical expenses, taxes paid, and other qualifying expenses. It is crucial for ensuring accurate reporting and maximizing tax benefits.

-

How can I access the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version?

You can easily access the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version through the airSlate SignNow platform. Simply log in to your account, navigate to the tax forms section, and select the appropriate version in Spanish. This ensures you have the correct form for your filing needs.

-

Is airSlate SignNow the best option for filing the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version?

Yes, airSlate SignNow offers a user-friendly interface that simplifies the process of filing the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version. Our platform allows for easy document management and e-signatures, making compliance straightforward. Plus, our pricing is competitive, ensuring value for our users.

-

What features does airSlate SignNow offer for the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version?

airSlate SignNow provides several key features for the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version, including customizable templates, electronic signatures, and real-time tracking. Additionally, users can collaborate with their tax advisors seamlessly within the platform. These features enhance efficiency and accuracy in your tax filing process.

-

Are there any costs associated with using airSlate SignNow for the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version?

Yes, airSlate SignNow offers various pricing plans to cater to different needs and budgets. Users can choose a plan that fits their requirements, ensuring access to all necessary features for filing the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version. Our service is designed to be cost-effective while maintaining high quality.

-

How secure is airSlate SignNow when handling the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security measures to protect your information while you work on the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version. Your data remains confidential and safeguarded against unauthorized access.

-

Can I integrate airSlate SignNow with other tools for handling the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version?

Absolutely! airSlate SignNow integrates with numerous applications and tools to streamline your workflow when managing the Schedule A Form 1040 NR sp Itemized Deductions Spanish Version. This includes integration with various tax software and document management systems, enhancing collaboration and efficiency.

Get more for Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

- Financial aid and student records admissions form

- Nurse 2 certification of foreign nursing education form

- Request major form

- Stockton university intraweb stockton form

- After school program registration form bear creek services bearcreekservices

- Travel expense itemization sheet form

- Travel expense itemization sheet tams forms tulane university

- Credit card authorization form nova southeastern university

Find out other Schedule A Form 1040 NR sp Itemized Deductions Spanish Version

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later