Form IRS 8582 Fill Online, Printable, Fillable, Blank

Understanding IRS Form 8582

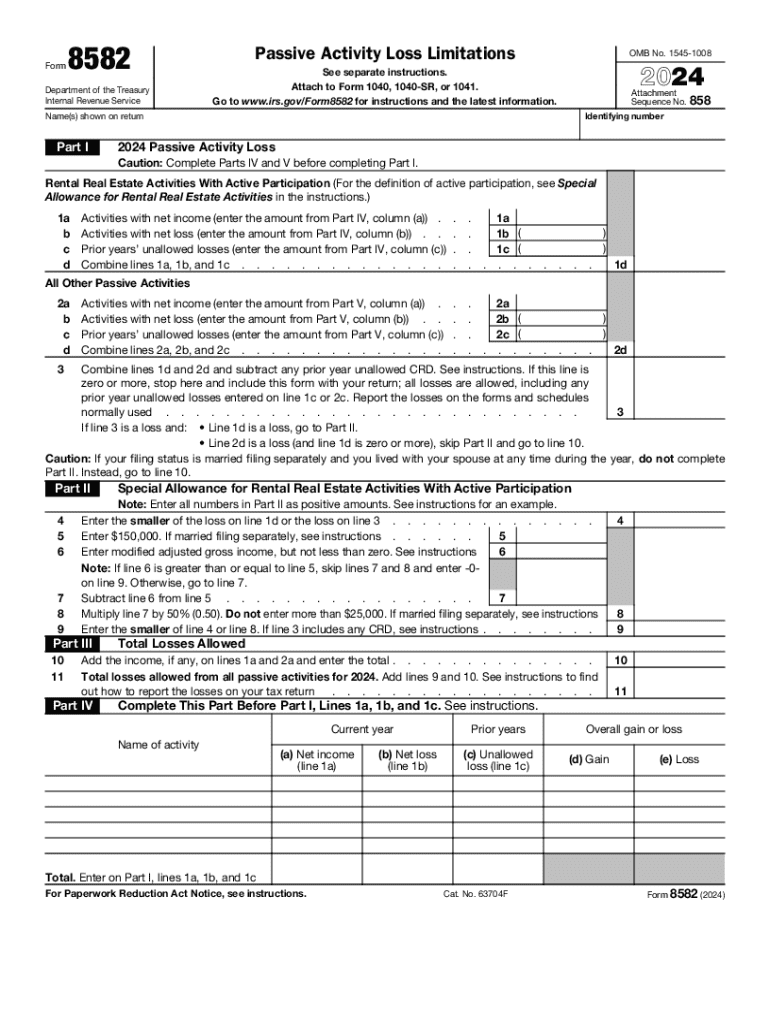

IRS Form 8582 is used to report passive activity losses and credits. This form is essential for taxpayers who have passive activities, such as rental properties or limited partnerships, and need to determine the allowable losses that can offset their income. The form helps in calculating the passive activity loss limitations as outlined by the IRS. Understanding the rules surrounding passive activities is crucial to ensure compliance and maximize potential tax benefits.

Steps to Complete IRS Form 8582

Completing Form 8582 involves several steps to accurately report your passive activity losses. Start by gathering all necessary information about your passive activities, including income, expenses, and any unallowed losses from previous years. Follow these steps:

- Enter your personal information at the top of the form.

- List each passive activity on the form, including income and losses.

- Calculate the total losses for each activity.

- Apply the passive loss limitations to determine the allowable losses.

- Complete the worksheet to track any unallowed losses that can be carried over to future years.

Ensure all calculations are accurate, as errors may lead to penalties or delays in processing.

Key Elements of IRS Form 8582

Form 8582 consists of several key sections that taxpayers must understand. These include:

- Passive Activity Information: This section requires details about each passive activity, including the type of activity and the income generated.

- Loss Calculation: Here, taxpayers calculate the total losses incurred from passive activities, which are essential for determining allowable deductions.

- Carryover Losses: Taxpayers must keep track of unallowed losses that can be carried over to future tax years, which is crucial for maximizing future tax benefits.

Understanding these elements ensures that taxpayers can accurately report their passive activity losses and comply with IRS regulations.

IRS Guidelines for Form 8582

The IRS provides specific guidelines for completing Form 8582, which include instructions on eligibility for passive activity loss deductions. Taxpayers must be aware of the following:

- Only losses from passive activities can be reported on this form.

- Taxpayers must meet certain criteria to qualify for passive activity loss deductions, such as material participation in the activity.

- The IRS updates guidelines regularly, so it is essential to refer to the latest instructions when completing the form.

Staying informed about these guidelines helps ensure compliance and reduces the risk of errors in tax filings.

Filing Deadlines for IRS Form 8582

Form 8582 must be filed along with your annual tax return, typically due on April 15 of each year. If you are unable to meet this deadline, you may file for an extension, which typically allows an additional six months. However, any taxes owed should still be paid by the original deadline to avoid penalties and interest. It is crucial to be aware of these deadlines to ensure timely filing and compliance with IRS regulations.

Eligibility Criteria for Passive Activity Loss Deductions

To qualify for passive activity loss deductions using Form 8582, taxpayers must meet specific eligibility criteria. These include:

- Engaging in passive activities, such as rental properties or limited partnerships.

- Not materially participating in the management of the passive activity.

- Meeting income thresholds that may affect the deductibility of passive losses.

Understanding these criteria is essential for taxpayers to accurately report their passive losses and maximize their tax benefits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form irs 8582 fill online printable fillable blank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8582 and why is it important?

Form 8582 is used to calculate passive activity loss limitations for individuals, estates, and trusts. Understanding how to properly fill out form 8582 is crucial for ensuring compliance with IRS regulations and maximizing tax benefits.

-

How can airSlate SignNow help with form 8582?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning form 8582. With our user-friendly interface, you can easily manage your tax documents and ensure they are signed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for form 8582?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your form 8582 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing form 8582?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easier to handle form 8582 and streamline your document management process.

-

Can I integrate airSlate SignNow with other software for form 8582?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 8582 alongside your existing tools. This integration enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for form 8582?

Using airSlate SignNow for form 8582 offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the eSigning process, making it easier to complete your tax documents efficiently.

-

Is airSlate SignNow secure for handling sensitive documents like form 8582?

Yes, airSlate SignNow prioritizes security and compliance. We use advanced encryption and security protocols to protect your sensitive documents, including form 8582, ensuring that your information remains confidential.

Get more for Form IRS 8582 Fill Online, Printable, Fillable, Blank

Find out other Form IRS 8582 Fill Online, Printable, Fillable, Blank

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online