SCHEDULE 3 Form 1040 Sp Additional Credits and Payments Spanish Version 2024-2026

What is the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version

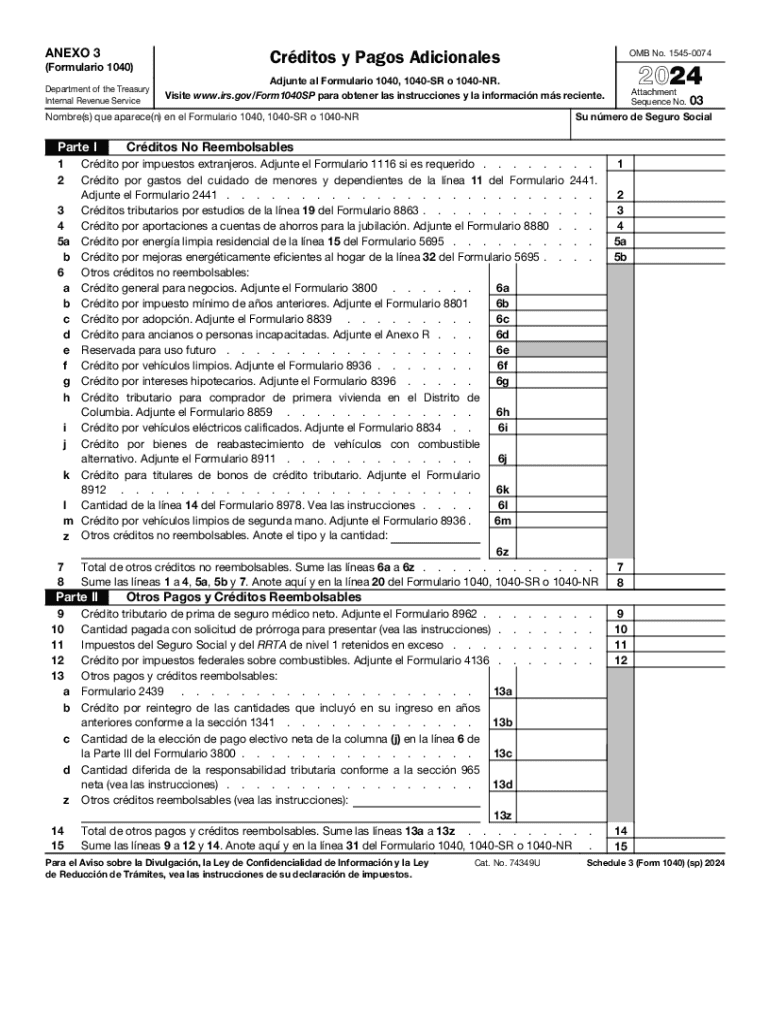

The SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version is a supplementary tax form used by individuals filing their federal income tax returns in the United States. This form allows taxpayers to report various credits and payments that may reduce their overall tax liability. It is specifically designed for Spanish-speaking individuals, ensuring accessibility and understanding of the tax process. The form includes sections for credits such as the foreign tax credit, credit for child and dependent care expenses, and other relevant payments that can affect the taxpayer's final tax obligation.

How to use the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version

Using the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version involves several steps. First, ensure that you have the correct version of the form, which is available in Spanish. Next, gather all necessary documentation, including income statements and records of any credits or payments you wish to claim. Complete the form by accurately filling in the required information, ensuring that each section is addressed. Once completed, the form should be attached to your main Form 1040 when filing your taxes, whether electronically or via mail.

Steps to complete the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version

Completing the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version involves the following steps:

- Obtain the form from the IRS website or other authorized sources.

- Read the instructions carefully to understand what information is required.

- Gather all relevant documents, such as W-2s, 1099s, and records of credits.

- Fill out the form, ensuring that all entries are accurate and complete.

- Review the form for any errors or omissions before submission.

- Attach the completed form to your Form 1040 and file it according to IRS guidelines.

Legal use of the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version

The SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version is legally recognized by the IRS for reporting additional credits and payments. It is essential for taxpayers to use this form correctly to ensure compliance with U.S. tax laws. Failing to report eligible credits may result in overpayment of taxes, while incorrect information could lead to penalties or audits. Taxpayers should retain copies of their completed forms and supporting documentation for their records.

Eligibility Criteria

Eligibility to use the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version typically depends on the taxpayer's specific financial situation. Individuals who qualify for certain tax credits, such as the credit for child and dependent care expenses or the foreign tax credit, should consider using this form. Additionally, it is important for taxpayers to meet the income thresholds and other requirements outlined by the IRS for each credit being claimed. Understanding these criteria helps ensure that taxpayers maximize their benefits while remaining compliant with tax regulations.

Form Submission Methods

The SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version can be submitted through various methods. Taxpayers have the option to file electronically using tax preparation software, which often simplifies the process and reduces errors. Alternatively, forms can be completed manually and mailed to the appropriate IRS address. In-person submission is also possible at designated IRS offices. Each method has its own set of guidelines, and taxpayers should choose the one that best suits their needs and preferences.

Create this form in 5 minutes or less

Find and fill out the correct schedule 3 form 1040 sp additional credits and payments spanish version 770493943

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 form 1040 sp additional credits and payments spanish version 770493943

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version?

The SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version is a tax form used by Spanish-speaking individuals to report additional credits and payments on their federal tax return. This version ensures that non-English speakers can accurately complete their tax obligations while understanding the necessary details in their native language.

-

How can airSlate SignNow help with the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version?

airSlate SignNow provides an easy-to-use platform for sending and eSigning the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version. Our solution simplifies the document management process, allowing users to complete their tax forms efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version without breaking the bank, providing excellent value for your document management needs.

-

What features does airSlate SignNow offer for the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version. These features enhance the user experience, making it easier to manage and complete tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to streamline your workflow when handling the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version. This integration capability enhances productivity and ensures that your documents are easily accessible across platforms.

-

What are the benefits of using airSlate SignNow for tax documents like the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version?

Using airSlate SignNow for tax documents like the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform empowers users to manage their documents digitally, saving time and resources.

-

Is airSlate SignNow user-friendly for completing the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete the SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform with ease.

Get more for SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version

- Bmc 91 form pdf 235549

- Std 65 form

- Forms used by dps

- Differences between theories of social process and social form

- Friends and family form university of michigan health system

- Form i 589 instructions for application for asylum and for withholding of removal

- Omb control number 1651 0086 form

- Can you travel outside of the united states while on form

Find out other SCHEDULE 3 Form 1040 sp Additional Credits And Payments Spanish Version

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement