Schedule 3 Form 1040 SP Additional Credits and Payments Spanish Version 2023

What is the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

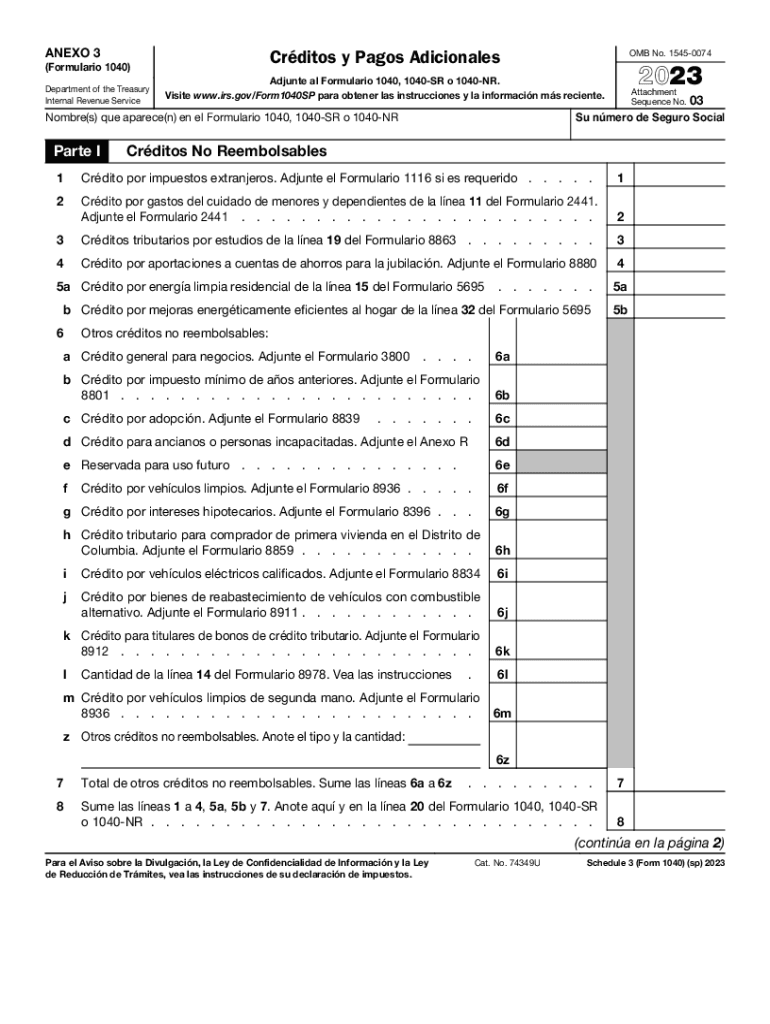

The Schedule 3 Form 1040 SP Additional Credits and Payments Spanish Version is a tax form used by individuals filing their federal income tax returns in Spanish. This form allows taxpayers to report various credits and payments that can reduce their overall tax liability. It is specifically designed for those who prefer to complete their tax forms in Spanish, ensuring accessibility and understanding for Spanish-speaking taxpayers. The Schedule 3 form includes information about credits such as the Earned Income Tax Credit, the Child Tax Credit, and other payments that may be applicable to the taxpayer's situation.

How to use the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

To effectively use the Schedule 3 Form 1040 SP Additional Credits and Payments Spanish Version, taxpayers should first gather all necessary documentation, including income statements and information on any applicable credits. After completing the main Form 1040 SP, taxpayers can fill out Schedule 3 by entering the relevant information regarding their credits and payments. It is essential to follow the instructions provided with the form carefully to ensure accurate reporting. Once completed, the form should be submitted along with the main tax return.

Steps to complete the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

Completing the Schedule 3 Form 1040 SP involves several steps:

- Gather all relevant documents, including W-2s, 1099s, and any records of payments or credits.

- Review the instructions for Schedule 3 to understand the specific credits and payments that apply to your situation.

- Fill out the form by entering your information in the appropriate fields, ensuring accuracy in calculations.

- Double-check your entries for any errors or omissions.

- Attach Schedule 3 to your completed Form 1040 SP before submission.

Eligibility Criteria

Eligibility for the credits reported on the Schedule 3 Form 1040 SP varies depending on individual circumstances. Generally, taxpayers must meet specific income thresholds and other requirements related to their filing status, age, and number of dependents. For example, to qualify for the Earned Income Tax Credit, individuals must have earned income within a certain range and meet residency and filing status criteria. It is important for taxpayers to review the eligibility requirements for each credit to ensure they can claim them appropriately.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Schedule 3 Form 1040 SP. Typically, the deadline for filing federal income tax returns is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any potential extensions they may need to file if they cannot meet the standard deadline. It is crucial to submit the Schedule 3 along with the main tax return by the deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Schedule 3 Form 1040 SP can be submitted through various methods. Taxpayers have the option to file their tax returns electronically using approved tax software, which often includes the Schedule 3 as part of the process. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address based on their state of residence. In-person submission is generally not available for tax forms; however, some local tax assistance centers may provide support for filing. It is important to choose a submission method that ensures timely delivery and compliance with IRS regulations.

Quick guide on how to complete schedule 3 form 1040 sp additional credits and payments spanish version

Effortlessly Prepare Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Handle Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and electronically sign Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version with ease

- Obtain Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or conceal confidential information using tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that require new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 3 form 1040 sp additional credits and payments spanish version

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 form 1040 sp additional credits and payments spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

The Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version is a specific tax form designed for Spanish-speaking individuals in the United States. It allows taxpayers to report additional credits and payments that can reduce their overall tax liabilities. Using this form ensures that Spanish speakers can easily navigate their tax responsibilities.

-

How can airSlate SignNow help in completing the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

airSlate SignNow simplifies the e-signature process for documents like the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version. With its intuitive interface, you can quickly fill out and sign your tax forms, ensuring compliance and reducing paperwork hassle. This makes tax filing more accessible for Spanish-speaking users.

-

Are there any costs associated with using airSlate SignNow for the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

Yes, airSlate SignNow offers various pricing plans, accommodating both individual users and businesses. Each plan provides access to essential features needed to complete and eSign the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version. You can choose a plan that best fits your needs and budget.

-

Can I integrate airSlate SignNow with other applications for filing the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

Absolutely! airSlate SignNow provides seamless integration with a wide range of applications, allowing you to streamline your workflow when handling the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version. This ensures that you can manage your tax documents alongside your existing tools efficiently.

-

Is there customer support available for assistance with the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

Yes, airSlate SignNow offers dedicated customer support to assist you with any inquiries related to the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version. Our support team is well-versed in the e-signing process and can guide you through any challenges you may encounter, ensuring a smooth experience.

-

What benefits does airSlate SignNow provide for users of the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

Using airSlate SignNow for the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version offers several benefits, including time savings, enhanced document security, and ease of access. The platform simplifies the e-signing process, making it user-friendly for Spanish speakers while ensuring that your sensitive information is protected.

-

Can I save my progress while filling out the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

Yes, airSlate SignNow allows you to save your progress while completing the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version. This feature ensures that you can pause and resume your work without losing any entered data, providing flexibility for busy individuals managing their taxes.

Get more for Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

- Capresso mt500 replacement carafe form

- New patient registration form bumrungrad international hospital

- Caroline blues credit report worksheet answers pdf form

- Evolve test bank form

- Avsec nomination form

- Vertrag bitte ausfllen ausdrucken und unterschreiben form

- Art sale agreement template form

- Article agreement template form

Find out other Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template