Schedule 3 Form 1040 SP Additional Credits and Payments Spanish Version 2022

What is the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

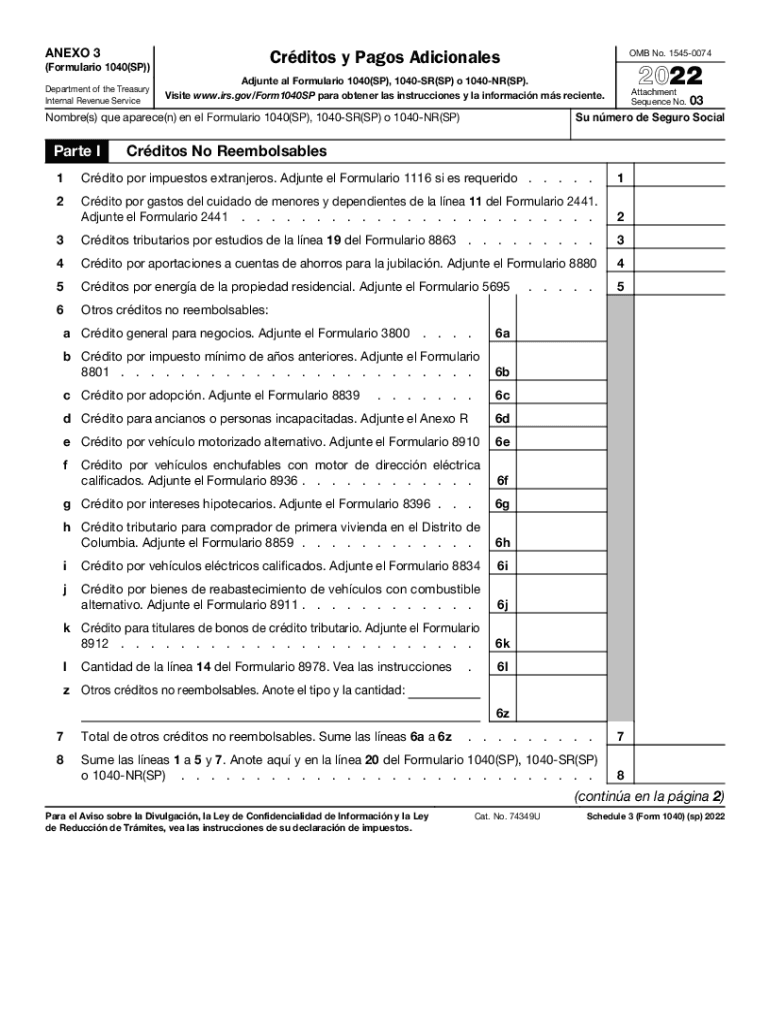

The Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version is a tax form used by individuals filing their federal income tax returns in the United States. This form allows taxpayers to report additional credits and payments that may reduce their overall tax liability. It is specifically designed for Spanish-speaking taxpayers, ensuring they can understand and accurately complete their tax obligations. The form includes various credits, such as the credit for child and dependent care expenses, education credits, and other payments that may be applicable to the taxpayer's situation.

How to use the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

Using the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version involves several steps. First, ensure you have the correct version of the form, which can be downloaded or printed from official sources. Next, gather all necessary documentation, including income statements and records of any credits or payments you wish to claim. Carefully fill out the form, providing accurate information in the designated sections. Once completed, attach it to your Form 1040 SP when filing your taxes. Ensure that all entries are clear and legible to avoid processing delays.

Steps to complete the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

Completing the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version involves a systematic approach:

- Begin by downloading the form from a reliable source.

- Read the instructions carefully to understand each section.

- Gather required documents, including W-2s, 1099s, and records of credits.

- Fill in your personal information at the top of the form.

- Report any additional credits and payments in the appropriate sections.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submitting it with your tax return.

Eligibility Criteria for the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

Eligibility for using the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version generally depends on your tax situation. Taxpayers must be filing a Form 1040 SP, which is intended for residents of Puerto Rico. Additionally, you must have qualifying expenses or payments that align with the credits listed on the form. Common eligibility criteria include having dependent children, qualifying education expenses, or other specific situations that warrant claiming additional credits. It is essential to review the form instructions to confirm your eligibility before completing it.

IRS Guidelines for the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

The IRS provides specific guidelines for completing the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version. These guidelines include detailed instructions on what qualifies as a credit or payment, how to report them accurately, and the importance of supporting documentation. Taxpayers should refer to the IRS website or the form instructions for the most current information regarding eligibility, required documentation, and any changes in tax law that may affect their filing. Adhering to these guidelines helps ensure compliance and reduces the risk of errors in tax filings.

Quick guide on how to complete schedule 3 form 1040 sp additional credits and payments spanish version 624654303

Complete Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version effortlessly on any device

Digital document management has surged in popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without hassle. Manage Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version on any platform with airSlate SignNow's Android or iOS applications and simplify your document-driven tasks today.

The easiest way to modify and electronically sign Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version with ease

- Locate Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential parts of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form searches, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 3 form 1040 sp additional credits and payments spanish version 624654303

Create this form in 5 minutes!

How to create an eSignature for the schedule 3 form 1040 sp additional credits and payments spanish version 624654303

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

The Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version is a tax form used by Spanish-speaking individuals to report various tax credits and payments. This form is crucial for those who want to claim additional credits on their federal tax returns. By providing this version, airSlate SignNow ensures that Spanish speakers can efficiently complete their tax obligations.

-

How can I access the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

You can easily access the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version through airSlate SignNow's user-friendly platform. Simply navigate to our extensive library of tax forms to find the Spanish version. Our platform is designed to streamline the process of obtaining and completing tax-related documents.

-

Is the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version compatible with eSign functionalities?

Yes, the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version is fully compatible with our eSign functionalities at airSlate SignNow. This means you can electronically sign the document securely and conveniently. Our platform ensures that your documents are legally binding and easy to manage.

-

What are the pricing options for using airSlate SignNow with the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

airSlate SignNow offers flexible pricing options tailored to meet different needs, allowing you to integrate the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version into your workflow affordably. We provide plans that cater to individuals, small businesses, and enterprises. Each plan grants access to comprehensive features that enhance your document management.

-

What features does airSlate SignNow offer for the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

Our platform offers several features for the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version, including customizable templates, electronic signatures, and document tracking. These features help simplify the workflow for tax preparations. By utilizing airSlate SignNow, you can ensure accurate and timely submissions.

-

Are there integrations available with airSlate SignNow for tax filing purposes?

Yes, airSlate SignNow offers various integrations that enhance the usability of the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version. You can integrate with popular accounting software and tax filing systems, making it easier to manage your financial documents. This seamless integration improves efficiency and helps maintain accurate records.

-

How does airSlate SignNow ensure the security of the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version?

At airSlate SignNow, we prioritize the security of all documents, including the Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version. Our platform utilizes advanced encryption protocols to protect sensitive information. Additionally, we provide secure cloud storage, ensuring that your tax documents are safe and accessible only to authorized users.

Get more for Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

Find out other Schedule 3 Form 1040 SP Additional Credits And Payments Spanish Version

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now