Form 14310 Rev 10 Partner and Volunteer Sign Up

Understanding the Form 14310 Rev 10 for Partner and Volunteer Sign Up

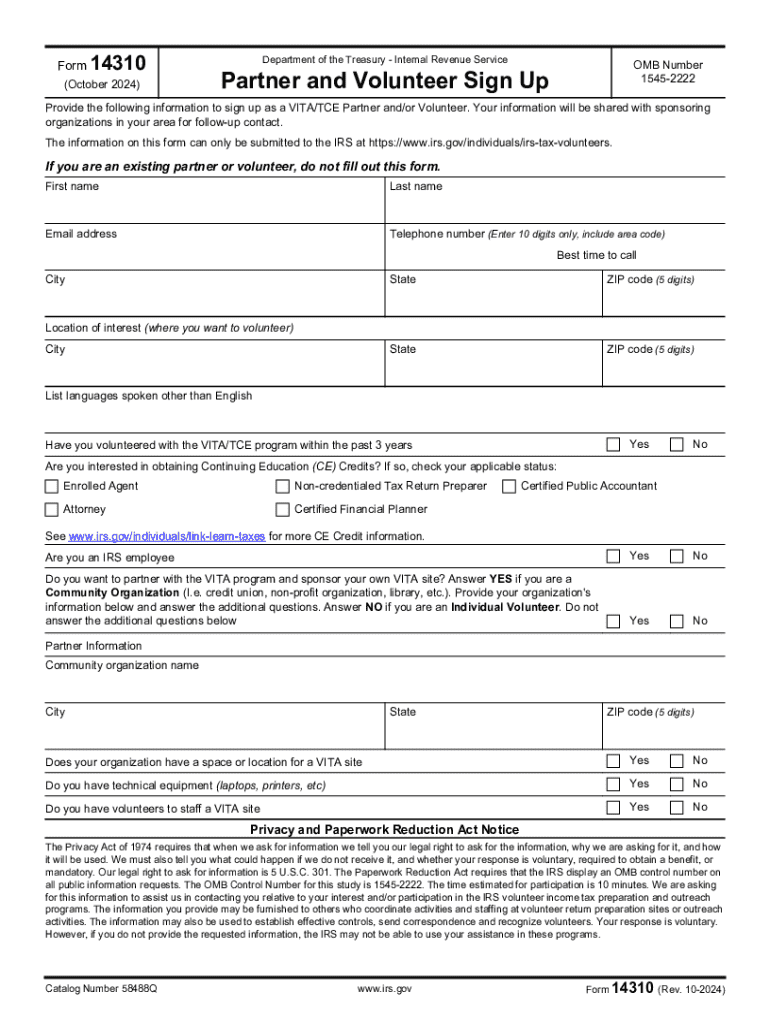

The Form 14310 Rev 10 is designed for individuals and organizations looking to partner with the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. This form facilitates the registration of volunteers who provide free tax assistance to eligible individuals, including low-income families and seniors. By signing up, volunteers can contribute to their communities while gaining valuable experience in tax preparation and assistance.

Steps to Complete the Form 14310 Rev 10

Completing the Form 14310 Rev 10 involves several key steps:

- Gather Required Information: Collect personal details such as your name, address, and contact information. You may also need to provide information about your tax preparation experience.

- Fill Out the Form: Carefully complete all sections of the form, ensuring that all information is accurate and up-to-date.

- Review Your Submission: Before submitting, double-check the form for any errors or omissions to avoid delays in processing.

- Submit the Form: Follow the specified submission methods, whether online, by mail, or in-person, as outlined in the form instructions.

Eligibility Criteria for the Form 14310 Rev 10

To qualify for participation through the Form 14310 Rev 10, applicants must meet specific eligibility criteria. Generally, volunteers should have a genuine interest in helping others with tax preparation and possess a basic understanding of tax laws. While prior tax experience is beneficial, it is not mandatory, as training is provided. Additionally, volunteers must be willing to commit to the program's schedule and adhere to the guidelines set forth by the IRS.

Filing Deadlines and Important Dates

It is crucial to be aware of filing deadlines associated with the Form 14310 Rev 10. Typically, applications for volunteer positions should be submitted well in advance of the tax season to ensure adequate training and preparation time. Specific deadlines may vary by state or organization, so it is advisable to check with local VITA or TCE coordinators for the most accurate information.

How to Obtain the Form 14310 Rev 10

The Form 14310 Rev 10 can be obtained through several channels. It is available for download on the IRS website, where you can access the most current version. Additionally, local VITA or TCE sites may have physical copies available for prospective volunteers. Ensure you are using the latest version of the form to avoid any complications during the application process.

Legal Use of the Form 14310 Rev 10

The Form 14310 Rev 10 is legally recognized as the official document for signing up as a volunteer with the VITA and TCE programs. It is essential to complete the form accurately and submit it according to the guidelines provided by the IRS. Misuse of the form or providing false information can lead to disqualification from the program and potential legal repercussions.

Handy tips for filling out Form 14310 Rev 10 Partner And Volunteer Sign Up online

Quick steps to complete and e-sign Form 14310 Rev 10 Partner And Volunteer Sign Up online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a GDPR and HIPAA compliant solution for optimum efficiency. Use signNow to e-sign and send Form 14310 Rev 10 Partner And Volunteer Sign Up for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14310 rev 10 partner and volunteer sign up

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the link and learn certification offered by airSlate SignNow?

The link and learn certification is a comprehensive program designed to help users master the features of airSlate SignNow. This certification equips you with the skills needed to efficiently send and eSign documents, enhancing your productivity and workflow.

-

How much does the link and learn certification cost?

The link and learn certification is offered at a competitive price, making it accessible for businesses of all sizes. Pricing details can be found on our website, where you can also explore any available discounts or promotions.

-

What are the benefits of obtaining the link and learn certification?

Obtaining the link and learn certification provides numerous benefits, including improved document management skills and enhanced eSigning capabilities. Certified users often experience increased efficiency in their workflows, leading to faster turnaround times for document processing.

-

Is the link and learn certification suitable for beginners?

Yes, the link and learn certification is designed to cater to users of all skill levels, including beginners. The program includes step-by-step guidance and resources to ensure that everyone can successfully complete the certification process.

-

What features are covered in the link and learn certification?

The link and learn certification covers a wide range of features, including document creation, eSigning, and workflow automation. Participants will gain hands-on experience with the platform, ensuring they can utilize all its capabilities effectively.

-

How long does it take to complete the link and learn certification?

The duration of the link and learn certification varies depending on your pace, but most users complete it within a few hours. The program is self-paced, allowing you to learn at your convenience while still gaining valuable skills.

-

Can I integrate airSlate SignNow with other applications after completing the link and learn certification?

Absolutely! After completing the link and learn certification, you will be well-equipped to integrate airSlate SignNow with various applications. This integration capability enhances your document management processes and streamlines your workflows.

Get more for Form 14310 Rev 10 Partner And Volunteer Sign Up

- 36326 19653 cv state of minnesota office of mn form

- Non receipt certificate fill online printable fillable blank form

- Fillable itd 3777 rev form

- Report on annual defensive driving performance for driver under article 19 a

- Wfd physical agility test release form and physician authorization form wfd physical agility test release form and physician

- Childhood and growing up himalaya publishing house form

- Instructions for form 2555 internal revenue service

- Form 8911 rev december alternative fuel vehicle refueling property credit

Find out other Form 14310 Rev 10 Partner And Volunteer Sign Up

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter