Notice 746 Sp Rev 10 Information About Your Notice, Penalty and Interest Spanish Version

Understanding Notice 746 Spanish Version

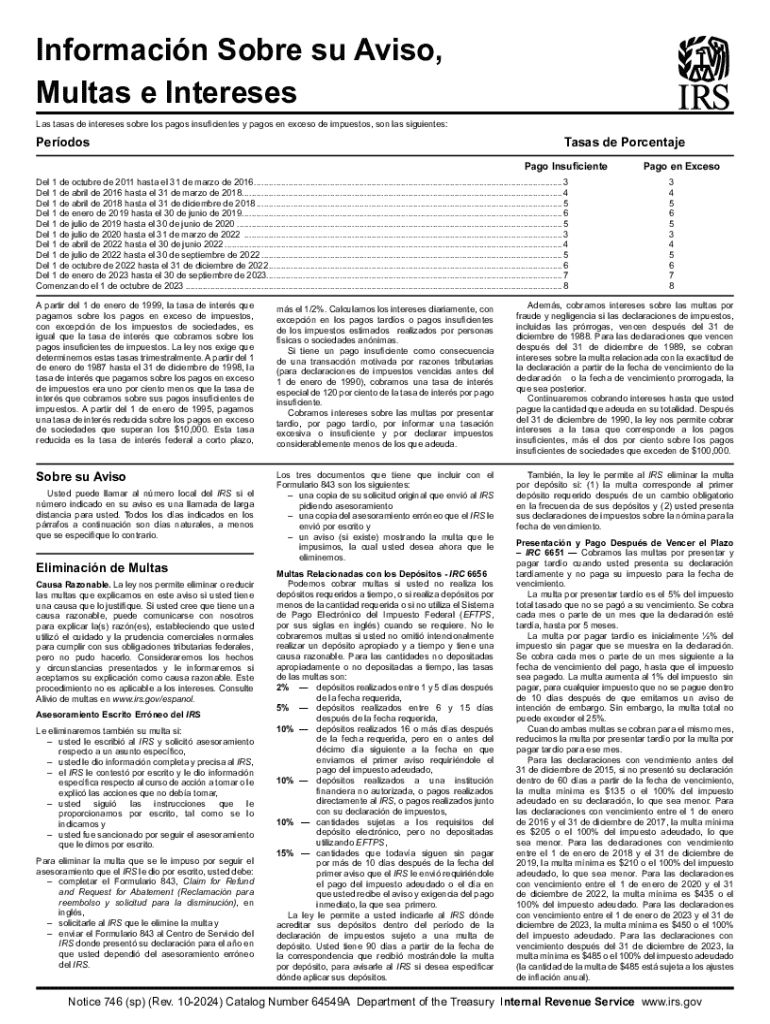

Notice 746, also known as "Información sobre su aviso, penalidad e intereses," is a crucial document issued by the IRS. This notice provides taxpayers with important details regarding any penalties and interest that may apply to their accounts. The Spanish version ensures accessibility for Spanish-speaking individuals, offering clarity on their tax obligations. It outlines the reasons for the notice, the specific penalties incurred, and how interest is calculated on unpaid taxes.

How to Utilize Notice 746 Spanish Version

The Notice 746 Spanish version serves as a guide for understanding the implications of any penalties or interest on your tax account. Taxpayers should carefully review the document to comprehend the reasons behind the notice. It is advisable to follow the instructions provided within the notice to address any outstanding issues. This may include making payments, responding to the IRS, or seeking additional information to resolve discrepancies.

Obtaining Notice 746 Spanish Version

Taxpayers can obtain the Notice 746 Spanish version directly from the IRS website or by contacting the IRS. If you have received a notice in English but require the Spanish version, you can request it through the IRS customer service. It is essential to ensure that you have the correct notice number and personal information ready to facilitate the request.

Key Elements of Notice 746 Spanish Version

The key elements of Notice 746 include details about the amount owed, the reason for the penalties, and the interest rates applicable to unpaid taxes. The notice also provides information on how to appeal or dispute the charges if you believe they are incorrect. Understanding these elements is vital for taxpayers to manage their tax responsibilities effectively.

Filing Deadlines and Important Dates

Notice 746 outlines specific deadlines for responding to the IRS regarding the penalties and interest indicated in the notice. It is important to adhere to these deadlines to avoid further complications or additional penalties. The notice will specify the due dates for any payments or responses required from the taxpayer.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in Notice 746 can result in additional penalties and interest. The IRS may take further action, including garnishing wages or placing liens on property. Understanding the consequences of non-compliance is crucial for taxpayers to avoid escalating tax issues.

Examples of Using Notice 746 Spanish Version

Taxpayers may encounter various scenarios in which Notice 746 is applicable. For instance, if a taxpayer has underreported income or failed to file a return, they may receive this notice detailing the penalties incurred. Additionally, individuals who have made late payments may also receive Notice 746, which will specify the interest charged on the outstanding balance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notice 746 sp rev 10 information about your notice penalty and interest spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is notice 746 Spanish and how can airSlate SignNow help?

Notice 746 Spanish is a document that provides important information regarding tax matters. With airSlate SignNow, you can easily eSign and send this document securely, ensuring that you meet all necessary deadlines and requirements.

-

How much does airSlate SignNow cost for handling notice 746 Spanish?

airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have the tools necessary to manage documents like notice 746 Spanish efficiently.

-

What features does airSlate SignNow offer for notice 746 Spanish?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These features make it easy to manage notice 746 Spanish and other important documents seamlessly.

-

Can I integrate airSlate SignNow with other applications for notice 746 Spanish?

Yes, airSlate SignNow integrates with various applications, allowing you to streamline your workflow. This means you can easily manage notice 746 Spanish alongside other tools you already use.

-

What are the benefits of using airSlate SignNow for notice 746 Spanish?

Using airSlate SignNow for notice 746 Spanish offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. This solution empowers businesses to handle their documents with ease and confidence.

-

Is airSlate SignNow user-friendly for managing notice 746 Spanish?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage notice 746 Spanish. The intuitive interface ensures that you can navigate the platform without any hassle.

-

How secure is airSlate SignNow when handling notice 746 Spanish?

Security is a top priority for airSlate SignNow. When managing notice 746 Spanish, you can trust that your documents are protected with advanced encryption and compliance with industry standards.

Get more for Notice 746 sp Rev 10 Information About Your Notice, Penalty And Interest Spanish Version

- Order defendant form

- Louisiana bond 497309026 form

- Motion to remand amount in controversy not in excess of 75000 exclusive of interest and costs louisiana form

- Louisiana succession form

- Louisiana personal injury form

- Production divorce form

- Resolution board pdf form

- Resolution authorizing donation of vehicle to corporate officer louisiana form

Find out other Notice 746 sp Rev 10 Information About Your Notice, Penalty And Interest Spanish Version

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT