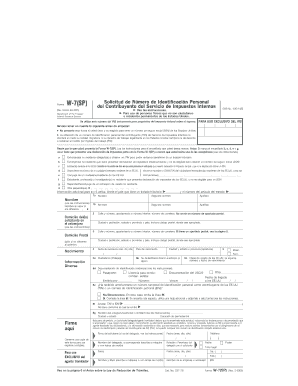

Form W 7SP Rev February Fill in Capable Application for IRS Individual Taxpayer Identification Number Spanish Vers

What is the W-7 Form PDF?

The W-7 form, officially known as the Application for IRS Individual Taxpayer Identification Number, is a critical document for individuals who are not eligible for a Social Security Number but need to comply with U.S. tax laws. This form allows non-resident aliens, their spouses, and dependents to obtain an Individual Taxpayer Identification Number (ITIN). The form is essential for filing U.S. tax returns and ensuring that individuals can meet their tax obligations even without a Social Security Number.

Steps to Complete the W-7 Form PDF

Completing the W-7 form involves several important steps:

- Gather necessary documents, including proof of identity and foreign status.

- Fill out the W-7 form accurately, ensuring all personal information is correct.

- Attach required documentation, such as a passport or national identification card.

- Submit the form along with your tax return or as a standalone application if filing separately.

It is vital to ensure that all information is complete to avoid delays in processing.

Required Documents for the W-7 Form PDF

When submitting the W-7 form, specific documents must be included to verify your identity and foreign status. These documents may include:

- A valid passport, which is the most preferred document.

- A national identification card that includes your photo.

- Birth certificates for dependents.

- Any other relevant documents that support your identity claim.

All documents must be original or certified copies, as photocopies are not accepted.

Legal Use of the W-7 Form PDF

The W-7 form is legally recognized for obtaining an ITIN, which is crucial for fulfilling U.S. tax obligations. It is important to understand that using the form incorrectly or submitting false information can lead to penalties. Compliance with IRS guidelines ensures that the form serves its intended purpose without legal repercussions.

Form Submission Methods for the W-7 Form PDF

The W-7 form can be submitted through various methods, including:

- Mailing the completed form along with your tax return to the IRS.

- Submitting the form in person at designated IRS offices, where assistance may be available.

- Utilizing authorized acceptance agents who can help with the application process.

Each submission method has its own processing times and requirements, so it is essential to choose the one that best fits your situation.

Eligibility Criteria for the W-7 Form PDF

To be eligible for an ITIN through the W-7 form, applicants must meet specific criteria. These include:

- Being a non-resident alien who is required to file a U.S. tax return.

- Being a dependent or spouse of a U.S. citizen or resident alien.

- Meeting other IRS requirements for tax purposes.

Understanding these criteria helps ensure that applicants qualify for an ITIN when submitting the W-7 form.

Quick guide on how to complete w 7sp

Prepare w 7sp effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage w7 form pdf on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign w 7sp with ease

- Locate w7 form filled sample and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign w7 form pdf while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to w7 form filled sample

Create this form in 5 minutes!

How to create an eSignature for the w7 form pdf

How to create an eSignature for your Form W 7sp Rev February 2005 Fill In Capable Application For Irs Individual Taxpayer Identification Number Spanish Version online

How to make an electronic signature for the Form W 7sp Rev February 2005 Fill In Capable Application For Irs Individual Taxpayer Identification Number Spanish Version in Google Chrome

How to make an eSignature for signing the Form W 7sp Rev February 2005 Fill In Capable Application For Irs Individual Taxpayer Identification Number Spanish Version in Gmail

How to generate an electronic signature for the Form W 7sp Rev February 2005 Fill In Capable Application For Irs Individual Taxpayer Identification Number Spanish Version from your mobile device

How to create an electronic signature for the Form W 7sp Rev February 2005 Fill In Capable Application For Irs Individual Taxpayer Identification Number Spanish Version on iOS

How to generate an eSignature for the Form W 7sp Rev February 2005 Fill In Capable Application For Irs Individual Taxpayer Identification Number Spanish Version on Android devices

People also ask w7 form filled sample

-

What is airSlate SignNow and how does it relate to w 7sp?

airSlate SignNow is a powerful tool that enables businesses to send and eSign documents seamlessly. With its intuitive interface and integration capabilities, it is designed to streamline workflows and enhance productivity, making it an excellent match for the w 7sp requirement.

-

How does airSlate SignNow's pricing structure work for w 7sp users?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. For w 7sp users, we provide various options that ensure cost-effectiveness while delivering top-notch features tailored to meet document management needs.

-

What features of airSlate SignNow can benefit w 7sp users?

For w 7sp users, airSlate SignNow offers features such as customizable templates, secure eSignatures, and real-time document tracking. These functionalities can signNowly enhance efficiency and ensure a smooth signing process, aligning perfectly with the needs of w 7sp.

-

Can I integrate airSlate SignNow with my existing tools for w 7sp operations?

Yes, airSlate SignNow provides extensive integration options with popular software solutions, allowing w 7sp users to connect seamlessly with existing platforms. This interoperability ensures that your document workflows remain efficient without disrupting your current systems.

-

Is airSlate SignNow secure for handling w 7sp documents?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a reliable choice for managing w 7sp documents. With advanced encryption methods and secure access features, your sensitive information remains protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for w 7sp?

Using airSlate SignNow provides numerous benefits for w 7sp users, including improved turnaround times, reduced paper usage, and enhanced collaboration. This platform not only simplifies document management but also helps businesses save costs and stay organized.

-

How can I get started with airSlate SignNow for w 7sp?

Getting started with airSlate SignNow for w 7sp is easy! Simply sign up for a free trial on our website, explore the features available, and see how it can transform your document signing process. Our user-friendly interface ensures that you’ll be up and running in no time.

Get more for w7 form pdf

- Sample letter to prosecutor to dismiss charges form

- Extension of lease agreement this is a 2 page form

- Russian jack chalet form

- Third amendment to lease agreement sample form

- Presser performing arts center lease agreement contract

- Mississippi residential rental lease agreement 495569162 form

- The impact of a childs chronic condition on the family form

- Ece 021 formerly known as cs 1067

Find out other w 7sp

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast