Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL 2024-2026

Understanding the Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL

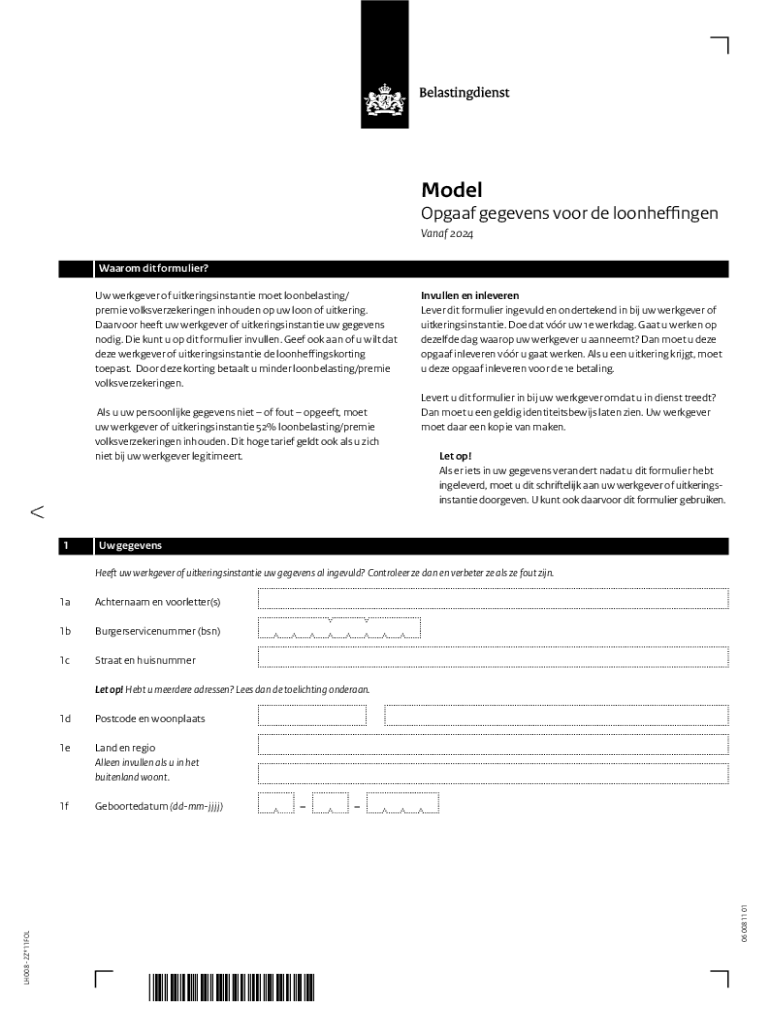

The Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL is a crucial document for employers in the Netherlands. It serves as a declaration of wage tax and social security contributions for employees. This form is essential for accurately reporting employee earnings and ensuring compliance with tax regulations. It includes detailed information about the employee's income, tax deductions, and applicable social security contributions, making it vital for both employers and employees to understand its implications.

Steps to Complete the Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL

Completing the Model Opgaaf Gegevens Voor De Loonheffingen is a straightforward process. Follow these steps to ensure accuracy:

- Gather employee information, including name, address, and social security number.

- Collect details about the employee's earnings, including gross salary and any bonuses.

- Calculate the applicable tax deductions based on the current tax rates.

- Fill out the form with the gathered information, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

Legal Use of the Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL

The legal use of the Model Opgaaf Gegevens is governed by Dutch tax laws. Employers are required to submit this form to the tax authorities to report wage tax and social security contributions for their employees. Failure to comply with these legal requirements can result in penalties, including fines or additional tax liabilities. It is essential for employers to stay informed about any changes in tax regulations that may affect the information reported on this form.

Obtaining the Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL

Employers can obtain the Model Opgaaf Gegevens from the official tax authority website or through authorized financial advisors. It is important to ensure that the version of the form is up to date, as tax regulations can change. Additionally, employers may also find resources and guidance on how to fill out the form correctly through these channels.

Key Elements of the Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL

The key elements of the Model Opgaaf Gegevens include:

- Employee's personal information

- Gross salary and any additional earnings

- Details of tax deductions applied

- Social security contributions

- Employer's identification information

Understanding these elements is crucial for accurate reporting and compliance with tax regulations.

Filing Deadlines and Important Dates

Filing deadlines for the Model Opgaaf Gegevens are typically set by the tax authority. Employers should be aware of these dates to avoid late submissions, which can incur penalties. It is advisable to keep track of any updates regarding filing deadlines, especially at the beginning of each tax year, to ensure timely compliance.

Create this form in 5 minutes or less

Find and fill out the correct model opgaaf gegevens voor de loonheffingen vanaf lh 008 2z11fol

Create this form in 5 minutes!

How to create an eSignature for the model opgaaf gegevens voor de loonheffingen vanaf lh 008 2z11fol

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loonbelastingverklaring and why is it important?

A loonbelastingverklaring is a tax declaration form used in the Netherlands to report income tax deductions for employees. It is important because it ensures that the correct amount of tax is withheld from your salary, helping you avoid underpayment or overpayment of taxes.

-

How can airSlate SignNow help with my loonbelastingverklaring?

airSlate SignNow simplifies the process of managing your loonbelastingverklaring by allowing you to easily send, sign, and store your tax documents electronically. This streamlines your workflow and ensures that your forms are securely handled and easily accessible.

-

Is airSlate SignNow cost-effective for managing loonbelastingverklaring?

Yes, airSlate SignNow offers a cost-effective solution for managing your loonbelastingverklaring. With various pricing plans, you can choose one that fits your budget while still benefiting from powerful features that enhance document management and eSigning.

-

What features does airSlate SignNow offer for loonbelastingverklaring?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage for your loonbelastingverklaring. These features help you manage your documents efficiently and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for my loonbelastingverklaring?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly connect your existing tools for managing your loonbelastingverklaring. This enhances your productivity and ensures a smooth workflow.

-

How secure is my loonbelastingverklaring when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your loonbelastingverklaring and other documents are protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Can I track the status of my loonbelastingverklaring with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your loonbelastingverklaring in real-time. You will receive notifications when documents are viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

Get more for Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL

- Purchase and sales agreement form

- Dl 389 form 403182565

- Verbal employment reference check form kansas adjutant kansastag

- Hw052 22520270 form

- Getting paid math answer key form

- Bond and or permit fee waiver form state of indiana state in

- Application for mechanical permit bondurant iowa form

- Form ca4 this form should be completed if you require a letter of clearance form it8 in respect of securities monies in bank

Find out other Model Opgaaf Gegevens Voor De Loonheffingen Vanaf LH 008 2Z*11FOL

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe