About Form 1125 A, Cost of Goods Sold 2024-2026

Understanding Form 1125 A and Cost of Goods Sold

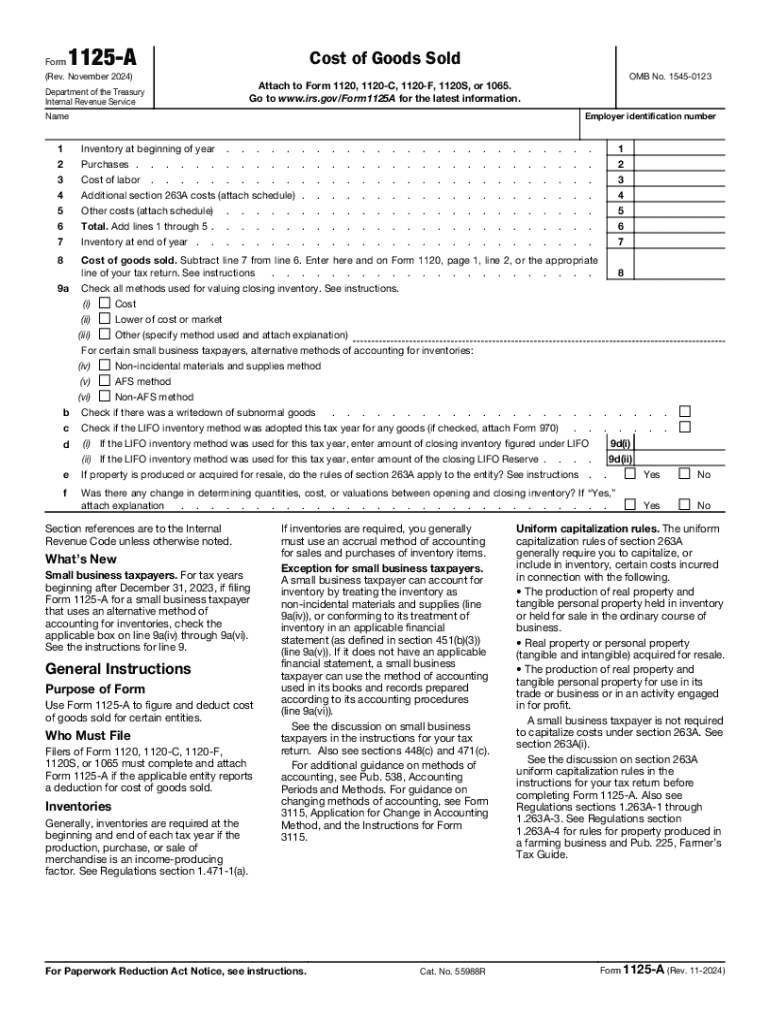

The IRS Form 1125 A is a crucial document for businesses that need to report their cost of goods sold (COGS). This form is particularly important for entities that manufacture or sell products, as it helps determine the gross profit by calculating the costs associated with producing or purchasing the goods sold during the tax year. Accurate reporting on this form can significantly impact a business's taxable income, making it essential for compliance with federal tax regulations.

Steps to Complete Form 1125 A

Completing Form 1125 A involves several key steps. First, gather all necessary financial records, including purchase invoices, inventory records, and any other documentation related to the costs incurred for producing or acquiring goods. Next, follow these steps:

- List the beginning inventory value at the start of the tax year.

- Add any purchases made during the year, including materials and supplies.

- Subtract the ending inventory value to determine the total cost of goods sold.

Ensure that all figures are accurate and reflect the true costs incurred. It is advisable to review the completed form for any discrepancies before submission.

IRS Guidelines for Form 1125 A

The IRS provides specific guidelines for completing Form 1125 A, which must be adhered to in order to avoid penalties. Key points include:

- Ensure that the form is filled out accurately, reflecting all relevant costs.

- File the form along with your tax return by the applicable deadline.

- Keep supporting documentation for at least three years in case of an audit.

Consulting the IRS instructions for Form 1125 A can provide additional clarity on requirements and best practices.

Filing Deadlines for Form 1125 A

Form 1125 A must be filed in conjunction with your federal tax return. The typical deadline for filing is April 15 for most businesses. However, if you are unable to meet this deadline, you may file for an extension, which typically grants an additional six months. It is important to note that an extension to file does not extend the time to pay any taxes owed.

Required Documents for Form 1125 A

To complete Form 1125 A accurately, several documents are necessary:

- Inventory records that detail beginning and ending inventory values.

- Purchase invoices for all goods acquired during the tax year.

- Any additional records that substantiate the costs associated with producing or purchasing goods.

Having these documents organized and readily available will streamline the process of filling out the form.

Penalties for Non-Compliance with Form 1125 A

Failing to file Form 1125 A or providing inaccurate information can lead to significant penalties. The IRS may impose fines for late filing, as well as additional penalties for underreporting income due to incorrect COGS calculations. It is essential to ensure that the form is completed accurately and submitted on time to avoid these repercussions.

Create this form in 5 minutes or less

Find and fill out the correct about form 1125 a cost of goods sold

Create this form in 5 minutes!

How to create an eSignature for the about form 1125 a cost of goods sold

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1125 A and why is it important?

Form 1125 A is a crucial document used by businesses to report the cost of goods sold. Understanding how to accurately complete form 1125 A can help ensure compliance with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help with form 1125 A?

airSlate SignNow simplifies the process of completing and eSigning form 1125 A. With our user-friendly interface, you can easily fill out the form, gather necessary signatures, and securely store your documents.

-

What features does airSlate SignNow offer for managing form 1125 A?

Our platform offers features such as customizable templates, real-time collaboration, and secure cloud storage, all designed to streamline the management of form 1125 A. These tools enhance efficiency and ensure that your documents are always accessible.

-

Is there a cost associated with using airSlate SignNow for form 1125 A?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can manage form 1125 A without breaking the bank, providing excellent value for your investment.

-

Can I integrate airSlate SignNow with other software for form 1125 A?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your workflow for form 1125 A with tools like CRM systems and accounting software. This integration enhances productivity and keeps your data synchronized.

-

What are the benefits of using airSlate SignNow for form 1125 A?

Using airSlate SignNow for form 1125 A offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind.

-

How secure is airSlate SignNow when handling form 1125 A?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your form 1125 A and other sensitive documents, ensuring that your information remains confidential and safe.

Get more for About Form 1125 A, Cost Of Goods Sold

- Bcbs of georgia provider general correspondence form

- Rtb 10 form

- Word problems involving rate of change answer key pdf form

- Pond ecosystem gizmo answer key 417557405 form

- Admission form 2 7 20 the nios download download nos

- Broward county board of county commissioners parks and recreation division workday volunteer application note workday form

- S072 formular 258503986

- 452 application to replace license plate or expiration year decal form

Find out other About Form 1125 A, Cost Of Goods Sold

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile