Form 1125 a 2016

What is the Form 1125 A

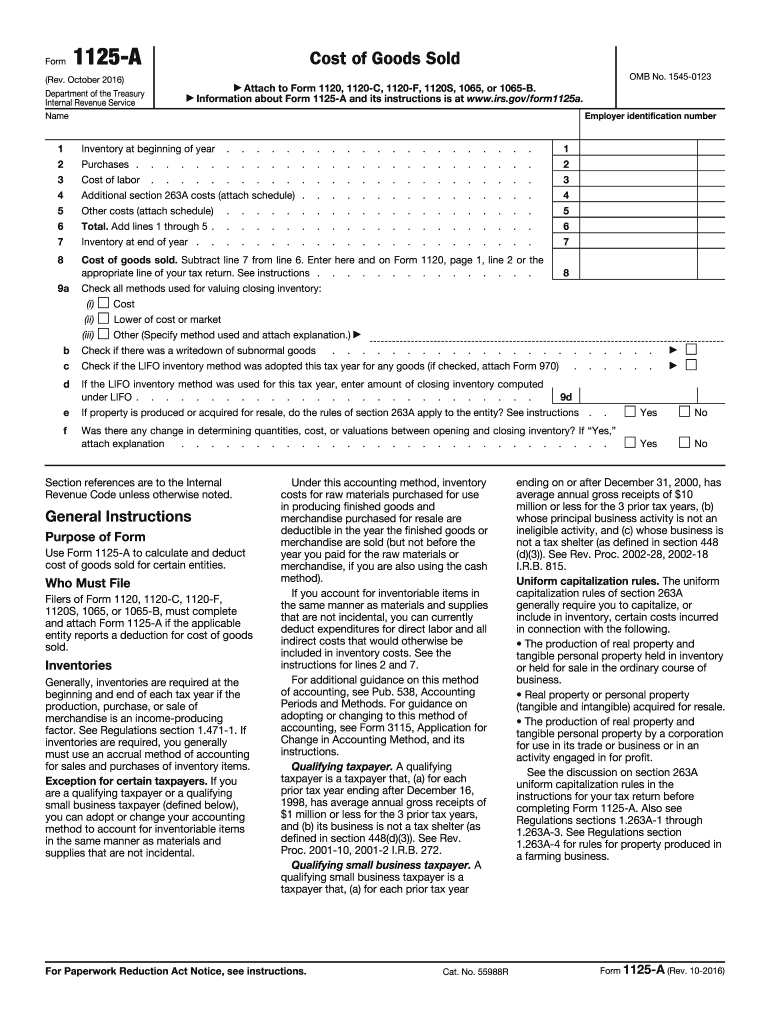

The Form 1125 A is a tax form used by businesses to report the cost of goods sold (COGS) for the Internal Revenue Service (IRS). This form is essential for corporations and partnerships that need to calculate their gross income accurately. By detailing the costs associated with inventory and production, the Form 1125 A helps ensure compliance with federal tax regulations. It is particularly relevant for businesses involved in manufacturing, retail, or any sector where inventory management is crucial.

How to use the Form 1125 A

To effectively use the Form 1125 A, businesses must first gather all necessary financial records related to their inventory and production costs. This includes purchase invoices, production costs, and any other relevant documentation. The form requires detailed entries for beginning inventory, purchases, direct labor, and other costs that contribute to the total cost of goods sold. Accurate completion of the form is vital, as it directly impacts the business's taxable income.

Steps to complete the Form 1125 A

Completing the Form 1125 A involves several key steps:

- Gather documentation: Collect all relevant financial records, including invoices and production costs.

- Calculate beginning inventory: Determine the value of inventory at the start of the tax year.

- List purchases: Document all purchases made during the tax year that contribute to inventory.

- Account for direct labor: Include costs associated with labor directly involved in production.

- Complete the form: Fill in the required fields accurately, ensuring all calculations are correct.

- Review and submit: Double-check the form for accuracy before submitting it to the IRS.

Legal use of the Form 1125 A

The legal use of the Form 1125 A is governed by IRS regulations. Businesses must ensure that the form is filled out correctly and submitted on time to avoid penalties. The information provided must be accurate and reflect the true financial status of the business. Misrepresentation or errors in the form can lead to audits, fines, or other legal repercussions. Therefore, it is advisable for businesses to consult with tax professionals when preparing this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1125 A typically align with the tax return deadlines for the business entity. For most corporations, the form is due on the fifteenth day of the fourth month following the end of the tax year. For partnerships, the deadline is the fifteenth day of the third month after the end of the tax year. It is crucial for businesses to be aware of these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 1125 A can be submitted to the IRS through various methods. Businesses may choose to file electronically using approved tax software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address, depending on the business's location and filing status. In-person submissions are generally not common for this form, as electronic filing is encouraged for efficiency and accuracy.

Quick guide on how to complete form 1125 a 2016

Discover the easiest method to complete and endorse your Form 1125 A

Are you still spending time preparing your formal documents on paper instead of doing it online? airSlate SignNow offers a more efficient way to finalize and endorse your Form 1125 A and associated forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to work on documents swiftly and in compliance with official standards - comprehensive PDF editing, managing, securing, signing, and sharing capabilities are all readily accessible through an intuitive interface.

Only a few steps are needed to complete and endorse your Form 1125 A:

- Upload the editable template to the editor using the Get Form button.

- Verify the information you need to include in your Form 1125 A.

- Move between the fields using the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the sections with your details.

- Enhance the content with Text boxes or Images from the top toolbar.

- Highlight items of significance or Blackout sections that are no longer relevant.

- Click on Sign to generate a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed Form 1125 A in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our solution also offers flexible form sharing options. There's no need to print your forms when you can send them directly to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct form 1125 a 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

Create this form in 5 minutes!

How to create an eSignature for the form 1125 a 2016

How to generate an electronic signature for your Form 1125 A 2016 online

How to create an eSignature for the Form 1125 A 2016 in Chrome

How to make an eSignature for signing the Form 1125 A 2016 in Gmail

How to create an eSignature for the Form 1125 A 2016 straight from your mobile device

How to generate an eSignature for the Form 1125 A 2016 on iOS devices

How to generate an eSignature for the Form 1125 A 2016 on Android

People also ask

-

What is Form 1125 A and why do I need it?

Form 1125 A is a tax form used by businesses to report the cost of goods sold. This form is essential for accurately calculating your business income tax obligations. By using airSlate SignNow, you can easily prepare and eSign Form 1125 A, ensuring compliance and efficiency in your tax filing process.

-

How can airSlate SignNow help me with Form 1125 A?

airSlate SignNow offers a streamlined solution for preparing, signing, and managing Form 1125 A. With our intuitive platform, you can fill out the form quickly, collect eSignatures, and store your documents securely. This saves you time and reduces the stress of tax season.

-

Is there a cost to use airSlate SignNow for Form 1125 A?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who require assistance with Form 1125 A. Our cost-effective solutions provide great value, especially for companies looking to simplify their document management and eSigning processes.

-

Can I integrate airSlate SignNow with other software when working on Form 1125 A?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management software. This allows you to efficiently manage Form 1125 A alongside your other financial documents, enhancing productivity and streamlining your workflow.

-

What features does airSlate SignNow offer for managing Form 1125 A?

airSlate SignNow includes features such as customizable templates, eSigning, document tracking, and secure storage, all tailored for managing Form 1125 A. These features ensure that you can prepare the form correctly and keep track of your submissions effectively.

-

Is airSlate SignNow user-friendly for preparing Form 1125 A?

Yes, airSlate SignNow is designed with user-friendliness in mind. Our platform provides an easy-to-navigate interface that simplifies the process of filling out and eSigning Form 1125 A, making it accessible for users of all skill levels.

-

What support options are available for using airSlate SignNow with Form 1125 A?

We offer comprehensive support for airSlate SignNow users, including tutorials, FAQs, and customer service assistance. If you have questions about preparing or eSigning Form 1125 A, our team is here to help you navigate the process smoothly.

Get more for Form 1125 A

- Sfe residency form

- Bmo harris 401k form

- Michigan power of attorney form 151

- School district of hillsborough county medical release form

- Synonyms for kindergarten worksheets form

- Cillit bang limescale remover safety data sheet form

- Notice of rent increasen1disposable en francisr form

- Resignation employment deutschland contract template form

Find out other Form 1125 A

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement