1125 a Form 2012

What is the 1125 A Form

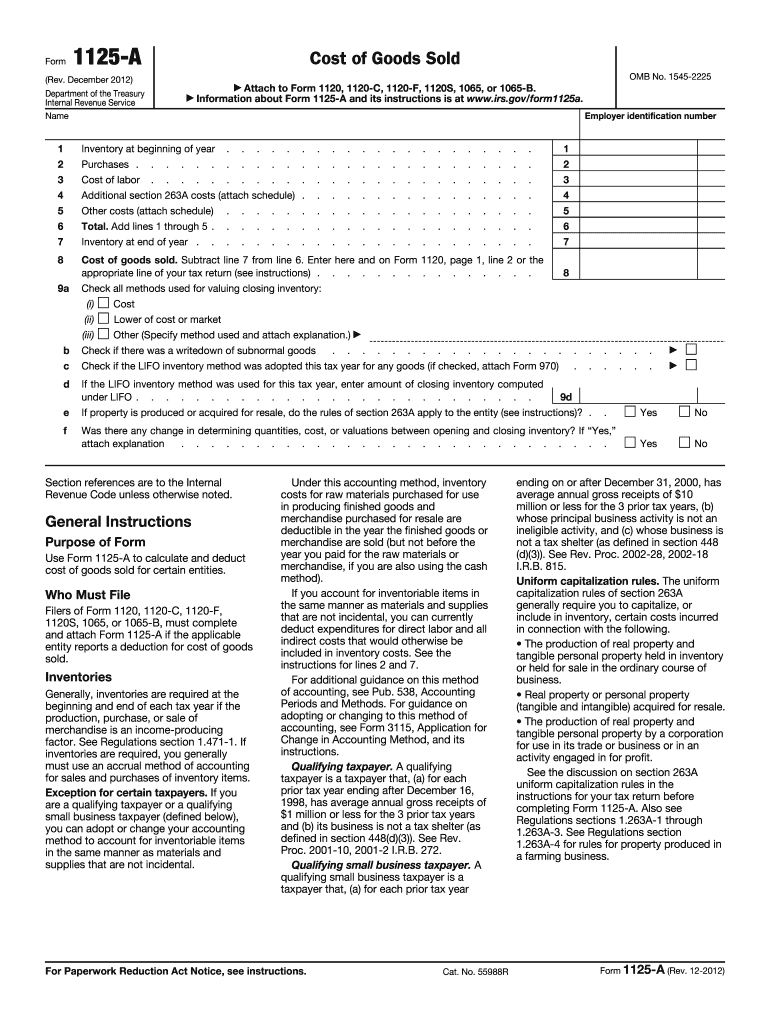

The 1125 A Form is a tax document used primarily by businesses to report certain types of income and expenses. It is essential for accurately detailing the financial activities of a business entity, ensuring compliance with Internal Revenue Service (IRS) regulations. This form is particularly relevant for entities such as corporations and partnerships, as it provides a structured format for reporting various financial transactions.

How to use the 1125 A Form

Using the 1125 A Form involves several key steps. First, gather all necessary financial records, including income statements, expense reports, and any relevant documentation that supports the figures you will report. Next, fill out the form accurately, ensuring that all entries reflect your financial activities for the reporting period. Once completed, review the form for any errors or omissions before submission. This careful approach helps to avoid potential issues with the IRS.

Steps to complete the 1125 A Form

Completing the 1125 A Form requires a methodical approach:

- Collect all relevant financial documents, including receipts and bank statements.

- Begin filling out the form by entering your business name and identification number.

- Report your income in the designated sections, ensuring accuracy.

- Detail your expenses, categorizing them appropriately to reflect your business operations.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the 1125 A Form

The legal use of the 1125 A Form is crucial for maintaining compliance with federal tax laws. When completed correctly, this form serves as a binding document that accurately reflects a business's financial activities. It is important to ensure that all information is truthful and complete, as inaccuracies can lead to penalties or audits by the IRS. Understanding the legal implications of this form can help businesses navigate their tax responsibilities more effectively.

Filing Deadlines / Important Dates

Filing deadlines for the 1125 A Form are critical for compliance. Typically, businesses must submit this form along with their annual tax return. The exact deadline may vary depending on the type of business entity and the fiscal year-end. Generally, for most corporations, the deadline falls on the fifteenth day of the fourth month after the end of the tax year. Staying informed about these dates is essential to avoid late filing penalties.

Who Issues the Form

The 1125 A Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. This form is part of the IRS's efforts to ensure that businesses report their income and expenses accurately, contributing to the overall integrity of the tax system.

Quick guide on how to complete 2012 1125 a form

Complete 1125 A Form easily on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the required forms and securely save them online. airSlate SignNow provides all the necessary tools for you to create, alter, and electronically sign your documents rapidly without delays. Manage 1125 A Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign 1125 A Form effortlessly

- Obtain 1125 A Form and click Get Form to begin.

- Utilize our provided tools to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and eSign 1125 A Form and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1125 a form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1125 a form

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the 1125 A Form and why do I need it?

The 1125 A Form is a tax form used for reporting certain types of income. It is essential for businesses looking to remain compliant with tax regulations. Utilizing airSlate SignNow can streamline the process of signing and sending your 1125 A Form securely and efficiently.

-

How does airSlate SignNow support the completion of a 1125 A Form?

airSlate SignNow provides an easy-to-use platform that allows users to fill out and eSign the 1125 A Form online. With customizable templates and a user-friendly interface, you can complete your form quickly and accurately, ensuring timely submission.

-

Is there a cost associated with using airSlate SignNow for the 1125 A Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on the features you require for managing documents, including the 1125 A Form, you can choose a plan that fits your budget while benefiting from cost-effective solutions.

-

Can I integrate airSlate SignNow with other software for managing the 1125 A Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, enhancing your workflow for managing the 1125 A Form. Whether it's CRM systems or cloud storage services, our platform ensures you can easily access and send your documents.

-

What features does airSlate SignNow offer for the 1125 A Form?

airSlate SignNow includes features such as eSignature capabilities, document templates, and real-time tracking for the 1125 A Form. These tools help you manage your documents efficiently, ensuring you can send, sign, and store forms securely.

-

How secure is the airSlate SignNow platform when handling the 1125 A Form?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect sensitive information, including your 1125 A Form, ensuring that your documents are safe during transmission and storage.

-

Can I access the 1125 A Form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile use, allowing you to access and manage your 1125 A Form on the go. This flexibility ensures that you can send and eSign documents anytime, anywhere, directly from your smartphone or tablet.

Get more for 1125 A Form

- Sample personal invitation letter for china tourist visa form

- Pakistani passport application form

- Libya visa application form

- Eft request form template

- Trust agreement fampampa federal credit union form

- Sellers representation letter form

- I declare that to the best of my knowledge and belief the information entered

- Energy right program heat pump form

Find out other 1125 A Form

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form