PROPERTY TAX APPEAL PETITION FORM PRINCIPAL Michigan

Understanding the Michigan Property Tax Appeal Form

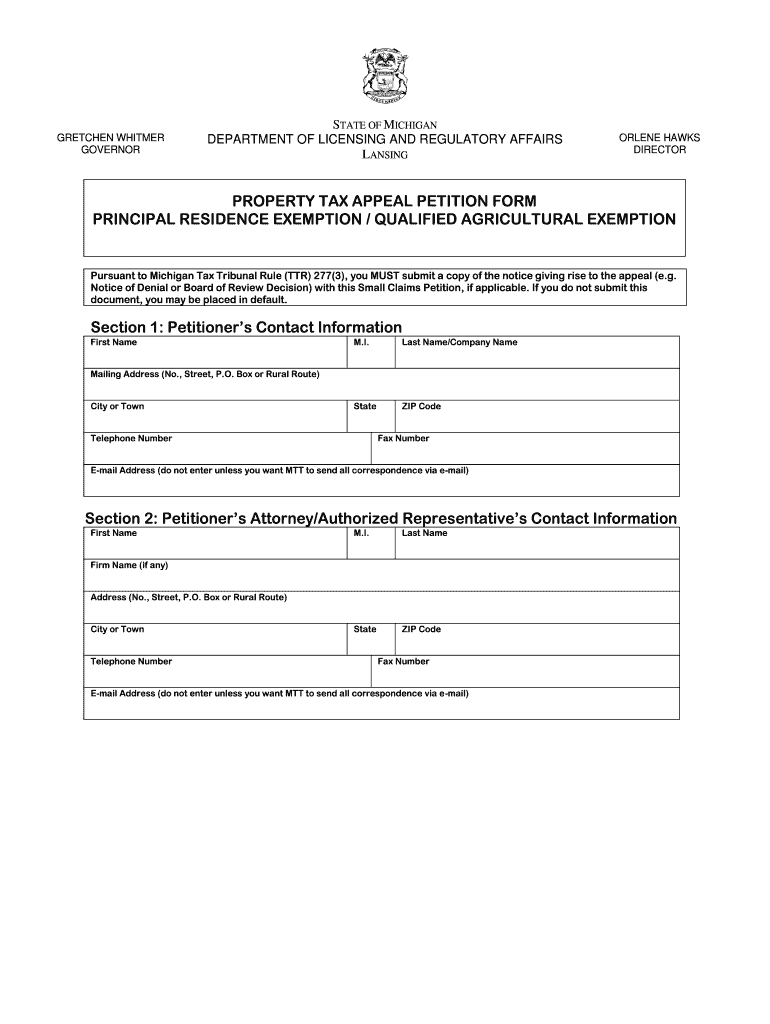

The Michigan property tax appeal form, often referred to as the property tax appeal petition form, is a crucial document for property owners who believe their property has been overvalued by local tax assessors. This form allows taxpayers to formally contest their property tax assessments, providing a structured process to seek a fair evaluation of their property’s value. Understanding the purpose and function of this form is essential for anyone looking to navigate the property tax appeal process effectively.

Steps to Complete the Michigan Property Tax Appeal Form

Completing the Michigan property tax appeal form involves several key steps:

- Gather necessary information, including your property details and the current assessed value.

- Clearly state the reasons for your appeal, providing evidence to support your claims, such as recent sales data of comparable properties.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline, ensuring it reaches the appropriate local tax authority.

Obtaining the Michigan Property Tax Appeal Form

The Michigan property tax appeal form can be obtained through various channels. It is typically available on the official website of your local tax assessor's office. Additionally, many county websites provide downloadable versions of the form. If you prefer a physical copy, you can visit your local tax office to request one directly. Ensuring you have the correct and most recent version of the form is important for a successful appeal process.

Key Elements of the Michigan Property Tax Appeal Form

When filling out the Michigan property tax appeal form, several key elements must be included:

- Property Identification: Include the property address and parcel number.

- Assessed Value: State the current assessed value as determined by the local tax assessor.

- Reason for Appeal: Clearly articulate the basis for your appeal, supported by relevant documentation.

- Signature: Ensure the form is signed and dated to validate the appeal.

Filing Deadlines for the Michigan Property Tax Appeal

Filing deadlines for the Michigan property tax appeal form are critical to adhere to for a successful appeal. Generally, property owners must file their appeals within a specific timeframe after receiving their property tax assessment notice. This period typically falls within the first few months of the year, but exact dates may vary by locality. It is advisable to check with your local tax authority for the precise deadlines applicable to your area.

Legal Use of the Michigan Property Tax Appeal Form

The Michigan property tax appeal form serves a legal purpose, allowing property owners to formally contest their property tax assessments. Utilizing this form ensures that the appeal process is documented and recognized by local tax authorities. The legal framework surrounding property tax appeals in Michigan provides taxpayers with the right to challenge assessments that they believe are inaccurate, ensuring fairness in property taxation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax appeal petition form principal michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan property tax appeal form?

The Michigan property tax appeal form is a document that allows property owners to contest their property tax assessments. By submitting this form, you can request a review of your property's assessed value, potentially leading to a reduction in your tax bill.

-

How can I obtain the Michigan property tax appeal form?

You can easily obtain the Michigan property tax appeal form from your local county assessor's office or download it from the Michigan Department of Treasury's website. airSlate SignNow also provides a convenient way to access and eSign this form online.

-

What are the benefits of using airSlate SignNow for the Michigan property tax appeal form?

Using airSlate SignNow for the Michigan property tax appeal form streamlines the process of filling out and submitting your appeal. Our platform allows you to eSign documents securely and efficiently, ensuring that your appeal is submitted on time.

-

Is there a fee associated with filing the Michigan property tax appeal form?

While there is typically no fee to file the Michigan property tax appeal form itself, some counties may charge a small processing fee. It's best to check with your local assessor's office for specific details regarding any potential fees.

-

Can I track the status of my Michigan property tax appeal form?

Yes, once you submit your Michigan property tax appeal form through airSlate SignNow, you can track its status online. Our platform provides updates and notifications to keep you informed throughout the appeal process.

-

What features does airSlate SignNow offer for managing the Michigan property tax appeal form?

airSlate SignNow offers features such as document templates, eSigning, and secure storage for your Michigan property tax appeal form. These tools make it easy to manage your documents and ensure that your appeal is handled efficiently.

-

Are there integrations available for the Michigan property tax appeal form?

Yes, airSlate SignNow integrates with various applications to enhance your workflow when handling the Michigan property tax appeal form. You can connect with tools like Google Drive, Dropbox, and more to streamline document management.

Get more for PROPERTY TAX APPEAL PETITION FORM PRINCIPAL Michigan

Find out other PROPERTY TAX APPEAL PETITION FORM PRINCIPAL Michigan

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form