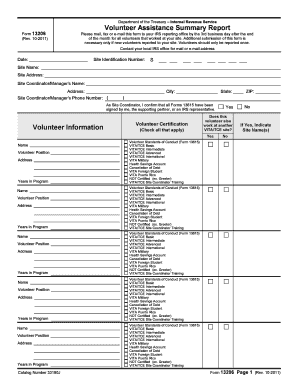

Volunteer Assistance Summary Report Volunteer Information Irs 2024

What is the Volunteer Assistance Summary Report Volunteer Information Irs

The Volunteer Assistance Summary Report is a crucial document used by organizations and individuals involved in volunteer work. This report provides detailed information about volunteer activities, including hours worked, services provided, and any related expenses. It is essential for ensuring compliance with IRS regulations, particularly for organizations that rely on volunteers for charitable purposes. By accurately completing this report, organizations can effectively demonstrate their commitment to community service and maintain their tax-exempt status.

How to use the Volunteer Assistance Summary Report Volunteer Information Irs

Using the Volunteer Assistance Summary Report involves several key steps. First, gather all necessary information regarding the volunteers, including their names, contact details, and the specific activities they participated in. Next, document the total hours each volunteer contributed, along with any expenses incurred during their service. This information should be organized clearly to facilitate easy reporting. Finally, submit the completed report to the appropriate IRS office or include it with your organization's annual tax filings to ensure compliance with federal regulations.

Key elements of the Volunteer Assistance Summary Report Volunteer Information Irs

Several key elements must be included in the Volunteer Assistance Summary Report to ensure it meets IRS requirements. These elements include:

- Volunteer Information: Names, addresses, and contact information of all volunteers.

- Activity Details: Description of the volunteer activities undertaken and the dates they occurred.

- Hours Worked: Total hours contributed by each volunteer during the reporting period.

- Expenses Incurred: Any out-of-pocket expenses that volunteers may have incurred while performing their duties.

- Signature: A signature from an authorized representative of the organization verifying the accuracy of the report.

Steps to complete the Volunteer Assistance Summary Report Volunteer Information Irs

Completing the Volunteer Assistance Summary Report involves a systematic approach:

- Collect volunteer information, including names and contact details.

- Document the specific activities each volunteer participated in.

- Calculate the total hours worked by each volunteer.

- List any expenses incurred by volunteers during their service.

- Review the report for accuracy and completeness.

- Obtain the necessary signatures from authorized personnel.

- Submit the report to the IRS or include it with your tax filings.

Legal use of the Volunteer Assistance Summary Report Volunteer Information Irs

The legal use of the Volunteer Assistance Summary Report is vital for maintaining compliance with IRS regulations. Organizations must ensure that the information reported is accurate and complete, as discrepancies can lead to penalties or loss of tax-exempt status. Additionally, this report can serve as a record for audits, demonstrating the organization’s commitment to transparency and accountability in its volunteer efforts.

Filing Deadlines / Important Dates

Filing deadlines for the Volunteer Assistance Summary Report align with the annual tax filing deadlines for organizations. Typically, tax-exempt organizations must submit their annual returns by the fifteenth day of the fifth month after the end of their fiscal year. It is essential to keep track of these dates to ensure timely submission and avoid potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct volunteer assistance summary report volunteer information irs

Create this form in 5 minutes!

How to create an eSignature for the volunteer assistance summary report volunteer information irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Volunteer Assistance Summary Report Volunteer Information Irs?

The Volunteer Assistance Summary Report Volunteer Information Irs is a comprehensive document that outlines the details of volunteer activities and contributions for IRS reporting. It helps organizations maintain accurate records and ensures compliance with tax regulations. This report is essential for nonprofits and businesses that engage volunteers.

-

How can airSlate SignNow help with the Volunteer Assistance Summary Report Volunteer Information Irs?

airSlate SignNow streamlines the process of creating and signing the Volunteer Assistance Summary Report Volunteer Information Irs. With our easy-to-use platform, you can quickly generate, send, and eSign documents, ensuring that all necessary information is captured accurately and efficiently.

-

What are the pricing options for using airSlate SignNow for volunteer reporting?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various organizations. Whether you are a small nonprofit or a large corporation, you can find a plan that fits your budget while providing access to features that simplify the Volunteer Assistance Summary Report Volunteer Information Irs process.

-

What features does airSlate SignNow offer for managing volunteer information?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools make it easier to manage volunteer information and generate the Volunteer Assistance Summary Report Volunteer Information Irs efficiently, saving time and reducing errors.

-

Can I integrate airSlate SignNow with other software for volunteer management?

Yes, airSlate SignNow offers integrations with various software solutions, enhancing your volunteer management capabilities. By connecting with platforms like CRM systems and project management tools, you can streamline the process of collecting and reporting volunteer information, including the Volunteer Assistance Summary Report Volunteer Information Irs.

-

What are the benefits of using airSlate SignNow for volunteer documentation?

Using airSlate SignNow for volunteer documentation provides numerous benefits, including increased efficiency, reduced paperwork, and improved compliance with IRS requirements. The platform simplifies the creation of the Volunteer Assistance Summary Report Volunteer Information Irs, allowing organizations to focus more on their mission and less on administrative tasks.

-

Is airSlate SignNow secure for handling sensitive volunteer information?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all volunteer information, including the Volunteer Assistance Summary Report Volunteer Information Irs, is protected. Our platform uses advanced encryption and security protocols to safeguard your data against unauthorized access.

Get more for Volunteer Assistance Summary Report Volunteer Information Irs

- 4118 feds form

- Furniture specification sheet template form

- How to apply for privilege licenses in chicago illinois form

- Passenger arrival card new zealand customs service form

- New york criminal history record check form

- Attendant form 23647842

- Anything form 100095924

- Oregon metal detecting permit form

Find out other Volunteer Assistance Summary Report Volunteer Information Irs

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online