CRSFATCA Entity Self Certification Form 2016

What is the CRSFATCA Entity Self Certification Form

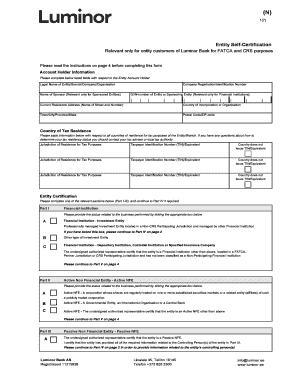

The CRSFATCA Entity Self Certification Form is a document required for entities to certify their status under the Foreign Account Tax Compliance Act (FATCA). This form is essential for financial institutions in the United States to identify foreign entities and ensure compliance with tax regulations. By completing this form, entities declare their tax residency status and provide necessary information to facilitate reporting obligations to the Internal Revenue Service (IRS).

How to Use the CRSFATCA Entity Self Certification Form

Using the CRSFATCA Entity Self Certification Form involves several straightforward steps. First, entities must gather relevant information, including their legal name, country of incorporation, and tax identification number. Next, they should accurately complete all sections of the form, ensuring that the information provided is truthful and complete. Once filled out, the form should be submitted to the financial institution requesting it, either electronically or in paper format, depending on the institution's requirements.

Steps to Complete the CRSFATCA Entity Self Certification Form

Completing the CRSFATCA Entity Self Certification Form requires attention to detail. Here are the steps to follow:

- Gather all necessary information about the entity, including its legal name and address.

- Identify the entity's tax classification and residency status.

- Fill in the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form to the requesting financial institution as per their instructions.

Key Elements of the CRSFATCA Entity Self Certification Form

The CRSFATCA Entity Self Certification Form includes several key elements that must be completed for it to be valid. These elements typically include:

- Entity name and address

- Country of incorporation

- Tax identification number

- Tax classification (e.g., corporation, partnership)

- Certification signature of an authorized representative

Legal Use of the CRSFATCA Entity Self Certification Form

The legal use of the CRSFATCA Entity Self Certification Form is crucial for compliance with U.S. tax laws. Financial institutions rely on this form to determine the tax status of foreign entities and fulfill reporting obligations to the IRS. Failure to provide accurate information can lead to penalties, including withholding taxes on certain payments. Therefore, it is essential for entities to understand the legal implications of the information they provide on this form.

Filing Deadlines / Important Dates

Entities must be aware of specific filing deadlines associated with the CRSFATCA Entity Self Certification Form. Generally, the form should be submitted whenever requested by a financial institution. However, it is advisable to keep track of any changes in IRS regulations that may affect reporting deadlines. Staying informed about these dates ensures compliance and helps avoid potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct crsfatca entity self certification form

Create this form in 5 minutes!

How to create an eSignature for the crsfatca entity self certification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CRSFATCA Entity Self certification Form?

The CRSFATCA Entity Self certification Form is a document required for entities to signNow their status under the Foreign Account Tax Compliance Act (FATCA). This form helps financial institutions determine the tax residency of their clients. By using airSlate SignNow, you can easily complete and eSign this form, ensuring compliance with FATCA regulations.

-

How does airSlate SignNow simplify the CRSFATCA Entity Self certification Form process?

airSlate SignNow streamlines the completion of the CRSFATCA Entity Self certification Form by providing an intuitive interface for filling out and signing documents. Users can quickly input their information and eSign the form, reducing the time spent on paperwork. This efficiency helps businesses stay compliant without the hassle of traditional methods.

-

Is there a cost associated with using airSlate SignNow for the CRSFATCA Entity Self certification Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost-effective solution allows you to manage multiple documents, including the CRSFATCA Entity Self certification Form, without breaking the bank. You can choose a plan that fits your budget while ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing the CRSFATCA Entity Self certification Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for the CRSFATCA Entity Self certification Form. These tools enhance the user experience by making it easy to manage and monitor the status of your documents. Additionally, you can integrate with other applications to streamline your workflow.

-

Can I integrate airSlate SignNow with other software for the CRSFATCA Entity Self certification Form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the CRSFATCA Entity Self certification Form alongside your existing tools. This integration capability enhances productivity and ensures that your document management processes are efficient and cohesive.

-

What are the benefits of using airSlate SignNow for the CRSFATCA Entity Self certification Form?

Using airSlate SignNow for the CRSFATCA Entity Self certification Form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's user-friendly design allows for quick completion and eSigning, saving time for businesses. Additionally, the secure environment ensures that your sensitive information is protected.

-

How secure is the CRSFATCA Entity Self certification Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security measures to protect your CRSFATCA Entity Self certification Form and other documents. You can trust that your data is safe while you complete and eSign important forms.

Get more for CRSFATCA Entity Self certification Form

- F3712 cfd pdf medical certificate for motor vehicle form

- Vehiclequeensland regulated ship cancellation of registration application form

- Apply for school transport assistance queensland government form

- Application for a new drivers licence number e126 form

- Power of attorney da form 5841 jul

- Guide 0174application guide for inland refugee claims form

- Employment application please print name form

- Ised isde 3591e changes regarding directors form 6 changes regarding directors

Find out other CRSFATCA Entity Self certification Form

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself