Form 8038 Rev February Information Return for Tax Exempt Private Activity Bond Issues 2022-2026

Understanding Form 8038: Information Return for Tax-Exempt Private Activity Bond Issues

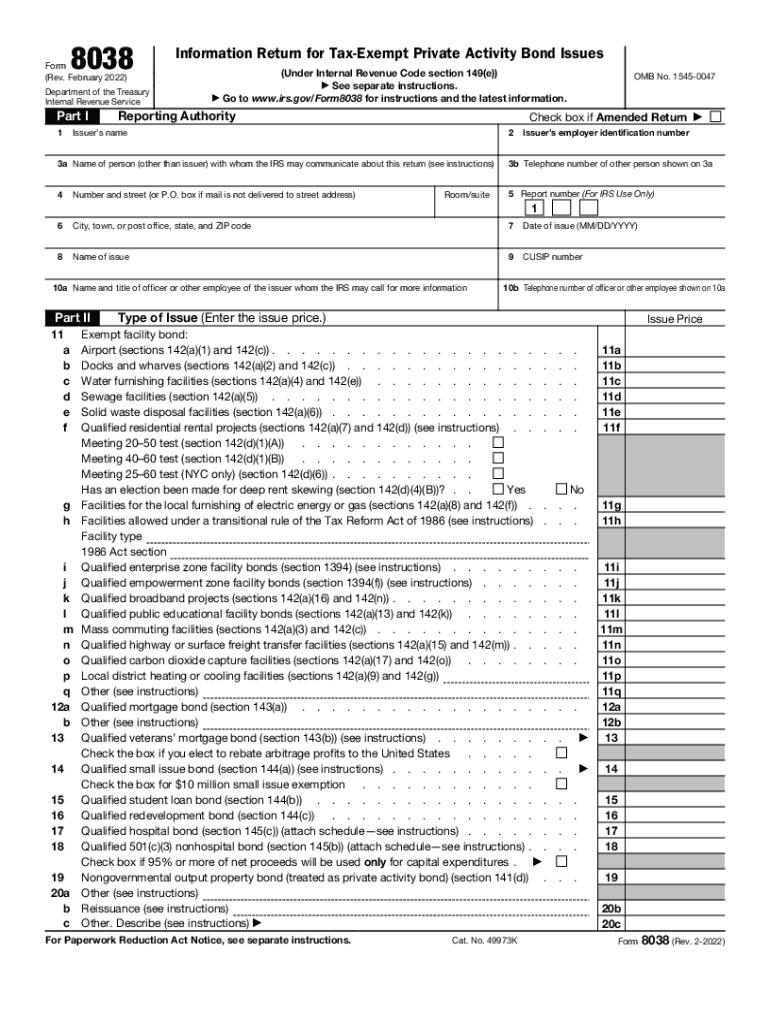

The Form 8038 is an essential document used by issuers of tax-exempt private activity bonds. This form serves as an information return, providing the Internal Revenue Service (IRS) with critical details about the bonds issued. It ensures compliance with federal tax regulations, allowing for the proper tracking of tax-exempt financing. The form includes information such as the issuer's name, the type of bond, and the purpose of the financing. Understanding the nuances of this form is vital for any entity involved in issuing tax-exempt bonds.

Steps to Complete Form 8038

Completing Form 8038 requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the bond issue, including the issuer's name, address, and the type of bond being issued.

- Fill in the details regarding the purpose of the bond, ensuring that it aligns with IRS guidelines for tax-exempt financing.

- Provide financial information, including the amount of bonds issued and the date of issuance.

- Review the completed form for accuracy, checking all entries against supporting documentation.

- Submit the form to the IRS by the required deadline, ensuring compliance with federal regulations.

Legal Use of Form 8038

Form 8038 must be used in accordance with IRS regulations governing tax-exempt private activity bonds. It is crucial for issuers to understand the legal implications of the information provided. Incorrect or incomplete submissions can lead to penalties and loss of tax-exempt status for the bonds. The form must be filed for each bond issue, and it is advisable to consult with a tax professional to ensure compliance with all legal requirements.

Filing Deadlines for Form 8038

Timely filing of Form 8038 is essential to maintain compliance with IRS regulations. The form must be submitted within a specific timeframe following the bond issuance. Generally, the deadline is 90 days after the date of issuance. Missing this deadline can result in penalties and complications regarding the tax-exempt status of the bonds. It is advisable to keep track of filing dates and set reminders to avoid any issues.

Obtaining Form 8038

Form 8038 can be obtained directly from the IRS website. It is available as a downloadable PDF, which can be filled out electronically or printed for manual completion. Additionally, tax professionals and financial institutions involved in bond issuance often have copies available. Ensuring that you have the most current version of the form is important, as updates may occur that affect filing requirements.

Examples of Using Form 8038

Form 8038 is typically used in various scenarios involving tax-exempt private activity bonds. For instance, a municipality may issue bonds to finance a new transportation project. In this case, the municipality would complete Form 8038 to report the details of the bond issue to the IRS. Another example includes a nonprofit organization issuing bonds to fund a new facility. Each example highlights the importance of accurately reporting the bond issuance to maintain tax-exempt status.

Quick guide on how to complete form 8038 rev february information return for tax exempt private activity bond issues

Complete Form 8038 Rev February Information Return For Tax Exempt Private Activity Bond Issues with ease on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form 8038 Rev February Information Return For Tax Exempt Private Activity Bond Issues on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and eSign Form 8038 Rev February Information Return For Tax Exempt Private Activity Bond Issues effortlessly

- Find Form 8038 Rev February Information Return For Tax Exempt Private Activity Bond Issues and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, time-consuming form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8038 Rev February Information Return For Tax Exempt Private Activity Bond Issues to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8038 rev february information return for tax exempt private activity bond issues

Create this form in 5 minutes!

How to create an eSignature for the form 8038 rev february information return for tax exempt private activity bond issues

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 8038 form in airSlate SignNow?

The 8038 form is crucial for businesses that need to report tax-exempt bond issues. airSlate SignNow allows users to easily fill out, send, and eSign the 8038 form digitally, streamlining the process and ensuring compliance.

-

How does airSlate SignNow handle the pricing for the 8038 submissions?

AirSlate SignNow offers competitive pricing for eSigning services, including those for the 8038 form. Customers can choose from several subscription plans, ensuring they find one that fits their budget and needs.

-

What features does airSlate SignNow provide for managing the 8038 form?

With airSlate SignNow, you can easily upload, edit, and track the 8038 form through a user-friendly interface. Additional features like reminders and auto-fill make managing this form efficient and straightforward.

-

Can I integrate airSlate SignNow with other applications for 8038 processing?

Yes, airSlate SignNow integrates seamlessly with many popular applications like CRM systems and accounting software, enhancing the management of the 8038 forms. This ensures a smooth workflow and better data synchronization.

-

What benefits does eSigning the 8038 form with airSlate SignNow offer?

eSigning the 8038 form with airSlate SignNow provides benefits such as time savings and improved security. Digital signatures are legally binding and ensure that your documents are safe and processed quickly.

-

Is airSlate SignNow compliant with regulations regarding the 8038 form?

Absolutely! airSlate SignNow adheres to all relevant regulations for eSigning, ensuring that your 8038 submissions are compliant with legal standards. This helps reduce the risk of audits and penalties.

-

What kind of support is available for users dealing with 8038 forms in airSlate SignNow?

Users can access comprehensive support through airSlate SignNow's resources, including tutorials and customer service for 8038 forms. Whether you have technical questions or need assistance, help is readily available.

Get more for Form 8038 Rev February Information Return For Tax Exempt Private Activity Bond Issues

Find out other Form 8038 Rev February Information Return For Tax Exempt Private Activity Bond Issues

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors