Income Tax Individuals Change of Details TX210 Onward CPA 2014-2026

What is the Income Tax – Individuals – Change Of Details TX210 Onward CPA

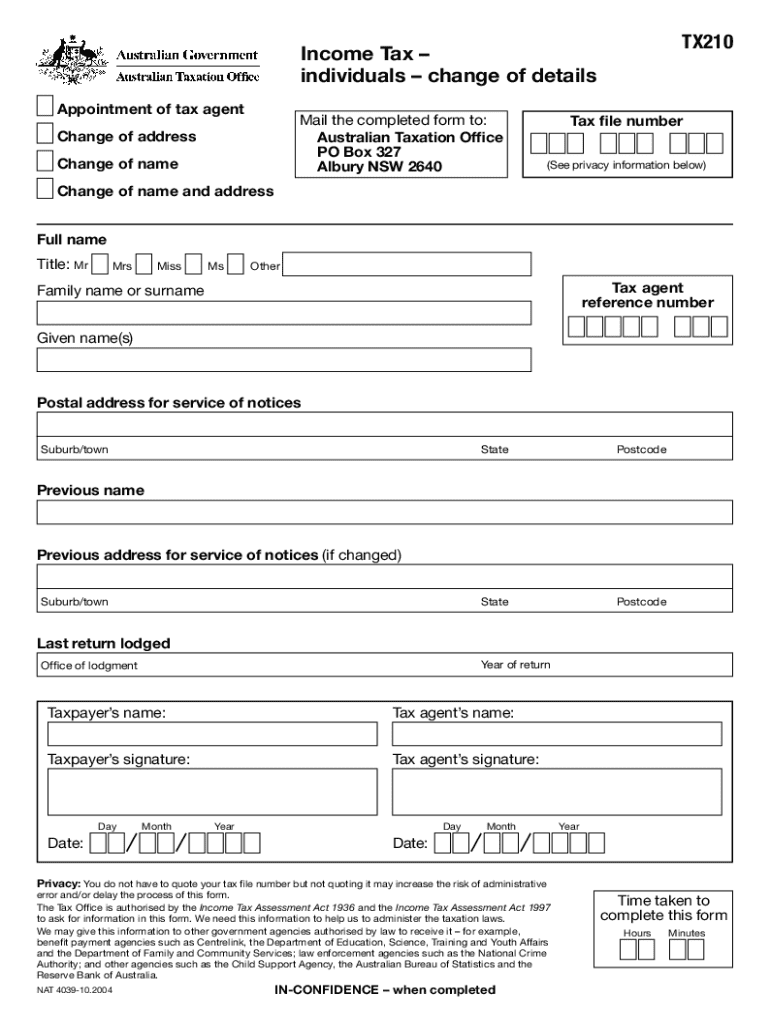

The Income Tax – Individuals – Change Of Details TX210 Onward CPA is a specific form used by individuals to update their personal information related to income tax filings. This form is essential for ensuring that the Internal Revenue Service (IRS) has accurate and current information about taxpayers. It is particularly important for those who have experienced changes such as a change of address, name, or marital status, which can affect tax obligations and communications with the IRS.

How to use the Income Tax – Individuals – Change Of Details TX210 Onward CPA

Using the Income Tax – Individuals – Change Of Details TX210 Onward CPA involves filling out the form with the necessary updated details. Taxpayers should ensure that all information is accurate to avoid delays or issues with their tax records. The form can typically be completed online or printed for manual submission. After filling out the form, individuals should follow the submission guidelines provided by the IRS to ensure proper processing.

Steps to complete the Income Tax – Individuals – Change Of Details TX210 Onward CPA

Completing the Income Tax – Individuals – Change Of Details TX210 Onward CPA involves several key steps:

- Gather necessary personal information, such as Social Security numbers and previous tax details.

- Access the form through the IRS website or a trusted tax software.

- Fill in the required fields with updated information, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or via mail.

Required Documents

To effectively complete the Income Tax – Individuals – Change Of Details TX210 Onward CPA, individuals may need to provide certain documents. These can include:

- Proof of identity, such as a driver’s license or passport.

- Documentation of the change, like a marriage certificate for name changes.

- Previous tax returns for reference.

Form Submission Methods

The Income Tax – Individuals – Change Of Details TX210 Onward CPA can be submitted through various methods, ensuring convenience for taxpayers. Options include:

- Online submission via the IRS e-file system.

- Mailing the completed form to the appropriate IRS address based on the taxpayer’s location.

- In-person submission at designated IRS offices, if needed.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Income Tax – Individuals – Change Of Details TX210 Onward CPA. These guidelines include:

- Timelines for submission to ensure updates are processed before the next tax filing season.

- Instructions on how to correct any errors after submission.

- Information on tracking the status of the submitted form.

Create this form in 5 minutes or less

Find and fill out the correct income tax individuals change of details tx210 onward cpa

Create this form in 5 minutes!

How to create an eSignature for the income tax individuals change of details tx210 onward cpa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Income Tax – Individuals – Change Of Details TX210 Onward CPA?

The Income Tax – Individuals – Change Of Details TX210 Onward CPA is a form used to update personal information for tax purposes. It ensures that the tax authorities have the most current details about your income and personal circumstances. Completing this form accurately is crucial for compliance and to avoid potential issues with your tax filings.

-

How can airSlate SignNow help with the Income Tax – Individuals – Change Of Details TX210 Onward CPA?

airSlate SignNow simplifies the process of completing and submitting the Income Tax – Individuals – Change Of Details TX210 Onward CPA. With our platform, you can easily fill out the form, eSign it, and send it securely to the relevant authorities. This streamlines your tax update process, saving you time and reducing stress.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans tailored to meet various needs, including individual users and businesses. Our plans provide access to essential features for managing documents like the Income Tax – Individuals – Change Of Details TX210 Onward CPA. You can choose a plan that fits your budget while ensuring you have the tools necessary for efficient document management.

-

Are there any features specifically designed for tax document management?

Yes, airSlate SignNow includes features specifically designed for tax document management, such as templates for the Income Tax – Individuals – Change Of Details TX210 Onward CPA. You can also track document status, set reminders for deadlines, and securely store your completed forms. These features enhance your efficiency and help ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows you to manage the Income Tax – Individuals – Change Of Details TX210 Onward CPA alongside your other financial documents. Integration enhances your workflow, making it easier to keep all your tax-related information organized.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents like the Income Tax – Individuals – Change Of Details TX210 Onward CPA offers numerous benefits. It provides a user-friendly interface, secure eSigning capabilities, and efficient document management. These features help you save time, reduce errors, and ensure that your tax documents are handled professionally.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax information. We use advanced encryption and security protocols to protect your data, including documents like the Income Tax – Individuals – Change Of Details TX210 Onward CPA. You can trust that your information is secure while using our platform.

Get more for Income Tax Individuals Change Of Details TX210 Onward CPA

Find out other Income Tax Individuals Change Of Details TX210 Onward CPA

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe