Appointment of Tax Agent Form Ato 2003

What is the Appointment of Tax Agent Form ATO?

The Appointment of Tax Agent Form ATO is a crucial document used by taxpayers in the United States to designate a tax agent to manage their tax affairs. This form allows individuals or businesses to authorize a tax professional to act on their behalf in dealings with the Internal Revenue Service (IRS) and state tax authorities. By completing this form, taxpayers can ensure that their tax agent has the authority to access their tax information, file returns, and communicate with tax offices regarding any issues that may arise.

How to Use the Appointment of Tax Agent Form ATO

Using the Appointment of Tax Agent Form ATO involves a few straightforward steps. First, obtain the form from the IRS or your tax professional. Next, fill out the required fields, including your personal information and the details of the tax agent you are appointing. It is essential to provide accurate information to avoid delays. After completing the form, sign and date it to validate your authorization. Finally, submit the form to the appropriate tax authority, ensuring you keep a copy for your records.

Steps to Complete the Appointment of Tax Agent Form ATO

Completing the Appointment of Tax Agent Form ATO requires careful attention to detail. Follow these steps for successful completion:

- Download the form from the IRS website or request it from your tax agent.

- Fill in your name, address, and taxpayer identification number (TIN).

- Provide the name and contact information of your appointed tax agent.

- Specify the type of tax matters the agent is authorized to handle.

- Sign and date the form to confirm your authorization.

- Submit the completed form to the IRS or relevant state tax authority.

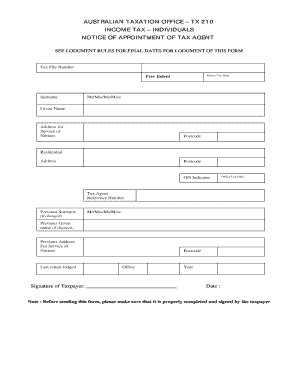

Key Elements of the Appointment of Tax Agent Form ATO

The Appointment of Tax Agent Form ATO includes several key elements that are essential for its validity. These elements typically consist of:

- Taxpayer Information: Full name, address, and TIN of the taxpayer.

- Agent Information: Name, address, and phone number of the appointed tax agent.

- Scope of Authority: Specific tax matters the agent is authorized to manage.

- Signature: The taxpayer's signature and date, confirming the appointment.

Legal Use of the Appointment of Tax Agent Form ATO

The Appointment of Tax Agent Form ATO is legally binding, provided it is completed correctly and submitted to the appropriate tax authority. This form complies with federal and state regulations governing the appointment of tax representatives. It allows the appointed agent to perform tasks on behalf of the taxpayer, ensuring that the taxpayer's rights and responsibilities are upheld. It is important to ensure that the form is filled out accurately to avoid any legal complications.

Form Submission Methods

The Appointment of Tax Agent Form ATO can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online Submission: Some tax authorities allow for electronic submission through their online portals.

- Mail: The completed form can be mailed to the appropriate IRS or state tax office.

- In-Person: Taxpayers may also choose to deliver the form in person at designated tax offices.

Quick guide on how to complete appointment of tax agent form ato

Effortlessly Prepare Appointment Of Tax Agent Form Ato on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents since you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Appointment Of Tax Agent Form Ato on any device with the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

How to Modify and Electronically Sign Appointment Of Tax Agent Form Ato with Ease

- Find Appointment Of Tax Agent Form Ato and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and possesses the same legal validity as a traditional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Appointment Of Tax Agent Form Ato and guarantee seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct appointment of tax agent form ato

Create this form in 5 minutes!

How to create an eSignature for the appointment of tax agent form ato

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ato tx220 form and how can I use it with airSlate SignNow?

The ato tx220 form is a document required in certain tax situations. With airSlate SignNow, you can easily upload, eSign, and send your ato tx220 form securely. Our platform simplifies the process, ensuring your documents are handled efficiently and legally.

-

Can I track the status of my ato tx220 form after sending it?

Yes, airSlate SignNow allows you to track the status of your ato tx220 form in real time. You will receive notifications as your document is viewed, signed, or completed. This feature enhances accountability and helps you stay organized.

-

What are the pricing options for using airSlate SignNow with the ato tx220 form?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you’re a small startup or a large enterprise, you can select a package that meets your needs for managing the ato tx220 form and other documents at competitive rates.

-

Is airSlate SignNow compliant with legal standards for signing the ato tx220 form?

Absolutely! AirSlate SignNow complies with industry-standard security protocols and legal regulations for electronic signatures. This means that your ato tx220 form will be legally binding and secure, providing peace of mind for all parties involved.

-

What features does airSlate SignNow offer for managing the ato tx220 form?

AirSlate SignNow provides a range of features tailored for managing the ato tx220 form, including customizable templates, automated workflows, and the ability to collect payments. These features streamline the document signing process, making it quicker and more efficient.

-

Can I integrate airSlate SignNow with other applications to manage the ato tx220 form?

Yes, airSlate SignNow supports seamless integrations with a variety of applications, enabling you to manage the ato tx220 form within your existing workflows. Connect with tools like Google Drive, Salesforce, and more to enhance your overall productivity.

-

How does airSlate SignNow enhance the signing experience for the ato tx220 form?

AirSlate SignNow enhances the signing experience for the ato tx220 form by providing an intuitive interface and mobile compatibility. Users can easily access, review, and sign documents from anywhere, ensuring a hassle-free experience regardless of their location.

Get more for Appointment Of Tax Agent Form Ato

- D 407 nc k 1 web 7 22 for use only beneficia form

- Des doj ca govformsdrosworksheetbof 929bof 929 dealers record of sale dros worksheet california

- F3712 medical certificate for motor vehicle driver form

- Cigarette inventory count sheet 397232636 form

- Mobile home and travel trailer register ars 42 19154 co santa cruz az form

- Workers compensation standard intake form

- Replacement dl389 formall sections must be complet

- Goodwill donation receipt 180210 form

Find out other Appointment Of Tax Agent Form Ato

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast