Schedule K Form 990 Rev December Supplemental Information on Tax Exempt Bonds

Understanding the Schedule K Form 990 for Tax Exempt Bonds

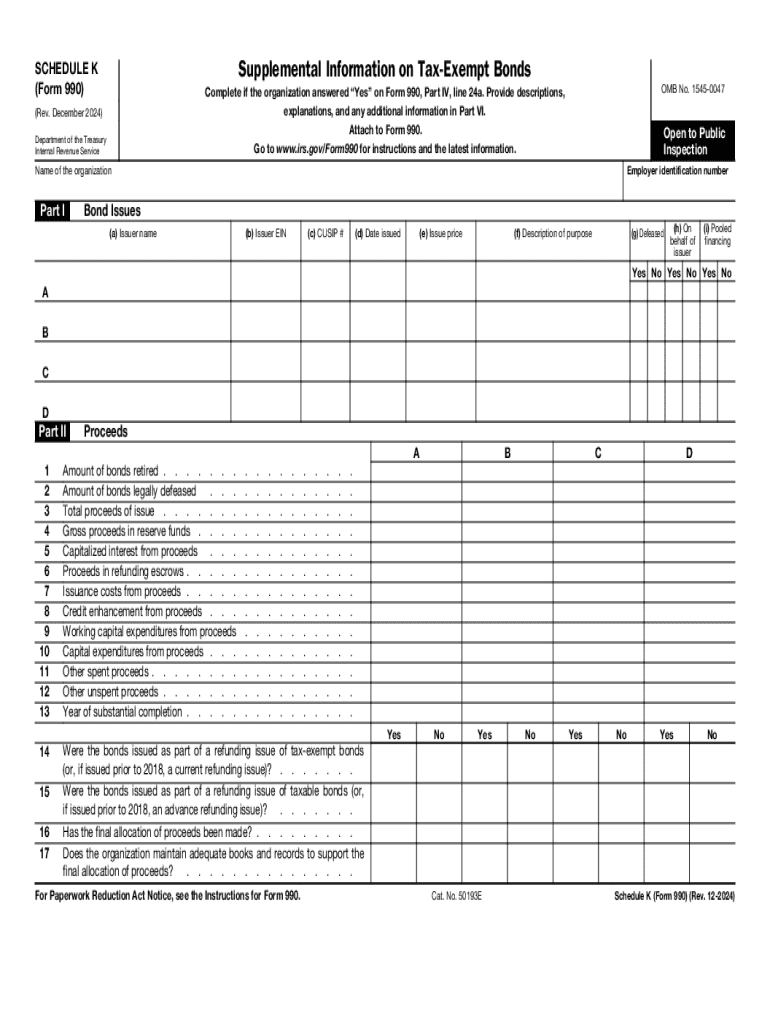

The Schedule K Form 990 provides supplemental information regarding tax-exempt bonds. This form is crucial for organizations that issue tax-exempt bonds, as it helps ensure compliance with IRS regulations. It includes detailed information about the bonds, such as the type of bonds issued, the purpose of the bonds, and the financial details associated with them. Understanding this form is essential for maintaining transparency and accountability in financial reporting.

Steps to Complete the Schedule K Form 990

Completing the Schedule K Form 990 involves several important steps:

- Gather necessary financial documents related to the tax-exempt bonds.

- Fill out the identification section, including the name and EIN of the organization.

- Provide detailed information about each bond issue, including the amount and purpose.

- Include financial data such as proceeds from the bond issue and any expenditures.

- Review the completed form for accuracy before submission.

Following these steps ensures that the form is filled out correctly, minimizing the risk of errors that could lead to compliance issues.

Legal Use of the Schedule K Form 990

The Schedule K Form 990 is legally required for organizations that have issued tax-exempt bonds. It serves as a means for the IRS to monitor compliance with tax laws and regulations surrounding these financial instruments. Proper use of this form helps organizations maintain their tax-exempt status and avoid penalties associated with non-compliance. It is important to understand the legal implications of the information provided on this form.

IRS Guidelines for Completing Schedule K

The IRS provides specific guidelines for completing the Schedule K Form 990. These guidelines include instructions on the information required, the format in which it should be presented, and deadlines for submission. Adhering to these guidelines is essential for ensuring that the form meets IRS standards. Organizations should regularly consult the IRS website or official publications for the most current instructions and requirements.

Filing Deadlines for Schedule K Form 990

Filing deadlines for the Schedule K Form 990 vary based on the organization's fiscal year. Generally, the form is due on the 15th day of the fifth month after the end of the fiscal year. Organizations that require additional time can file for an extension, but the form must still be submitted by the extended deadline. Being aware of these deadlines is crucial for maintaining compliance and avoiding late filing penalties.

Examples of Using the Schedule K Form 990

Organizations often use the Schedule K Form 990 to report various types of tax-exempt bonds. For instance, a municipality may issue bonds to finance public infrastructure projects. In this case, the Schedule K would detail the amount raised, the purpose of the bonds, and how the funds are being utilized. These examples illustrate the form's role in providing transparency to stakeholders and the public regarding the use of tax-exempt financing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule k form 990 rev december supplemental information on tax exempt bonds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does 'k tax exempt' mean in relation to airSlate SignNow?

'K tax exempt' refers to the tax-exempt status that certain organizations can claim. With airSlate SignNow, businesses can easily manage and eSign documents related to their tax-exempt status, ensuring compliance and efficiency in their operations.

-

How can airSlate SignNow help organizations with 'k tax exempt' documentation?

airSlate SignNow streamlines the process of handling 'k tax exempt' documentation by providing a user-friendly platform for eSigning and sending necessary forms. This helps organizations save time and reduce errors, ensuring that all tax-exempt documents are processed accurately and promptly.

-

Is there a cost associated with using airSlate SignNow for 'k tax exempt' forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those dealing with 'k tax exempt' forms. The cost-effective solution ensures that organizations can manage their documentation without breaking the bank, making it accessible for all types of businesses.

-

What features does airSlate SignNow offer for managing 'k tax exempt' documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically designed for 'k tax exempt' documents. These features enhance the efficiency of managing tax-exempt forms, allowing organizations to focus on their core activities.

-

Can airSlate SignNow integrate with other software for 'k tax exempt' processes?

Absolutely! airSlate SignNow offers integrations with various software applications that can assist in managing 'k tax exempt' processes. This ensures a seamless workflow, allowing organizations to connect their existing systems with airSlate SignNow for enhanced productivity.

-

What are the benefits of using airSlate SignNow for 'k tax exempt' organizations?

Using airSlate SignNow provides numerous benefits for 'k tax exempt' organizations, including improved efficiency, reduced paperwork, and enhanced compliance. The platform's ease of use allows teams to focus on their mission while ensuring that all tax-exempt documentation is handled correctly.

-

How secure is airSlate SignNow for handling 'k tax exempt' documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive 'k tax exempt' documents. The platform employs advanced encryption and security measures to protect all data, ensuring that organizations can trust airSlate SignNow with their important information.

Get more for Schedule K Form 990 Rev December Supplemental Information On Tax Exempt Bonds

- Iowa form ia 1041 instructions fiduciary tax return

- Rent reimbursement claim 54 130 form

- 2670000 common units raymond james jp morgan rbc form

- 2020 revenue regulations bureau of internal revenue form

- Mississippi resident individual income tax return form

- Solved 2848 power of attorney and declaration of form

- 2021 inventory of taxable property due on or before form

- 2020 bt ext new hampshire department of revenue form

Find out other Schedule K Form 990 Rev December Supplemental Information On Tax Exempt Bonds

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors