Louisville Metro Revenue Forms 2008

What are the Louisville Metro Revenue Forms?

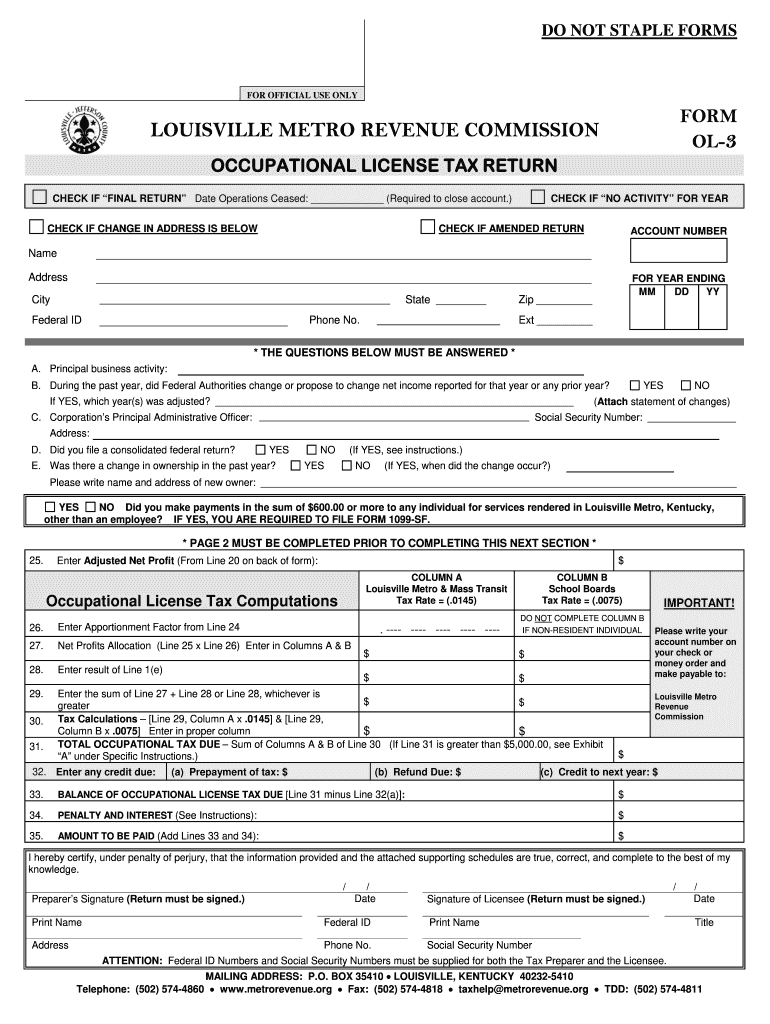

The Louisville Metro Revenue Forms are essential documents used for reporting and paying local taxes within the city of Louisville, Kentucky. These forms are primarily utilized by individuals and businesses to comply with local revenue regulations. The forms include various types, such as the form OL-3, which is specifically designed for reporting net profits for businesses operating in the area. Proper completion and submission of these forms ensure compliance with the city’s tax requirements and help avoid potential penalties.

Steps to Complete the Louisville Metro Revenue Forms

Completing the Louisville Metro Revenue Forms requires careful attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary documentation, including financial statements and previous tax returns.

- Obtain the appropriate form, such as the form OL-3, from the Louisville Metro Revenue Commission website or office.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the designated deadline, either online, by mail, or in person.

Legal Use of the Louisville Metro Revenue Forms

The legal use of the Louisville Metro Revenue Forms is governed by local tax laws and regulations. These forms must be filled out accurately and submitted on time to maintain compliance with the city’s revenue policies. Electronic signatures are accepted, provided they meet the legal standards set forth by the ESIGN Act and UETA. It is important to retain copies of submitted forms for your records, as they may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Louisville Metro Revenue Forms, including the form OL-3, are critical to avoid penalties. Typically, businesses must file their revenue forms annually, with specific due dates set by the Louisville Metro Revenue Commission. It is advisable to check the official commission website for the most current deadlines, as these dates may vary from year to year. Marking these dates on your calendar can help ensure timely submission and compliance.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Louisville Metro Revenue Forms can be done through multiple methods, providing flexibility for taxpayers. The available submission methods include:

- Online: Many forms can be completed and submitted electronically through the Louisville Metro Revenue Commission's online portal.

- Mail: Completed forms can be printed and mailed to the designated address provided by the commission.

- In-Person: Taxpayers may also choose to submit their forms in person at the Louisville Metro Revenue Commission office.

Key Elements of the Louisville Metro Revenue Forms

Key elements of the Louisville Metro Revenue Forms include specific information required for accurate tax reporting. Essential components typically include:

- Taxpayer identification information, such as name, address, and Social Security number or Employer Identification Number.

- Financial data, including gross receipts, deductions, and net profit calculations.

- Signature and date fields to validate the submission.

Quick guide on how to complete louisville metro revenue commission llc form ol 3

Complete Louisville Metro Revenue Forms effortlessly on any device

Online document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Louisville Metro Revenue Forms on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Louisville Metro Revenue Forms with ease

- Locate Louisville Metro Revenue Forms and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Louisville Metro Revenue Forms and ensure optimal communication at any point during your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisville metro revenue commission llc form ol 3

FAQs

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the louisville metro revenue commission llc form ol 3

How to make an electronic signature for the Louisville Metro Revenue Commission Llc Form Ol 3 online

How to generate an electronic signature for the Louisville Metro Revenue Commission Llc Form Ol 3 in Chrome

How to create an electronic signature for signing the Louisville Metro Revenue Commission Llc Form Ol 3 in Gmail

How to create an electronic signature for the Louisville Metro Revenue Commission Llc Form Ol 3 straight from your mobile device

How to create an eSignature for the Louisville Metro Revenue Commission Llc Form Ol 3 on iOS devices

How to generate an electronic signature for the Louisville Metro Revenue Commission Llc Form Ol 3 on Android OS

People also ask

-

What are Louisville Metro Revenue Forms?

Louisville Metro Revenue Forms are official documents required for filing taxes and other revenue-related submissions in the Louisville area. These forms ensure compliance with local regulations and help businesses accurately report their financial activities. By using airSlate SignNow, you can easily manage and eSign these forms, streamlining your filing process.

-

How can airSlate SignNow help with Louisville Metro Revenue Forms?

airSlate SignNow simplifies the process of completing and submitting Louisville Metro Revenue Forms by providing an intuitive platform for electronic signatures and document management. You can fill out, sign, and send your forms directly from your device, reducing the time spent on paperwork and minimizing errors. This efficiency is crucial for businesses looking to stay compliant and organized.

-

Is airSlate SignNow affordable for managing Louisville Metro Revenue Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing Louisville Metro Revenue Forms, with flexible pricing plans to suit businesses of all sizes. Our pricing structure ensures that you only pay for the features you need, making it a budget-friendly choice for efficient document management. Plus, the time saved can lead to signNow cost savings in the long run.

-

What features does airSlate SignNow provide for Louisville Metro Revenue Forms?

airSlate SignNow includes a variety of features tailored for managing Louisville Metro Revenue Forms, such as customizable templates, secure eSigning, and real-time tracking. These tools enable users to streamline their workflow, ensuring that forms are completed accurately and on time. Additionally, you can integrate with other applications to enhance your document management capabilities.

-

Can I integrate airSlate SignNow with other software for Louisville Metro Revenue Forms?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, allowing you to connect your existing tools for managing Louisville Metro Revenue Forms. Whether you use accounting software, CRM systems, or cloud storage, these integrations help create a cohesive workflow, making it easier to manage your documents and data.

-

Are Louisville Metro Revenue Forms secure when using airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. When you manage Louisville Metro Revenue Forms, your data is protected with advanced encryption and secure access protocols. This ensures that sensitive information remains confidential and complies with industry standards, giving you peace of mind when handling important documents.

-

How does airSlate SignNow improve the filing process for Louisville Metro Revenue Forms?

airSlate SignNow enhances the filing process for Louisville Metro Revenue Forms by allowing users to complete and eSign documents digitally, eliminating the need for paper forms. This not only accelerates the submission process but also reduces the risk of losing important documents. With easy access to your forms anytime, anywhere, you'll find managing your revenue filings more efficient.

Get more for Louisville Metro Revenue Forms

- External examiners claim form phd viva ucc

- Petplan claim form

- Form 1 f d dividends arising outside the republic of ireland and the united kingdom revenue

- Tax clearance certificatetcsipo form

- Form cg1 2003 capital gains tax return for revenue

- Tata aig proposal accident guard form

- Unpriced bidbjabalpurpdf hindustan petroleum corporation bb form

- Hdfc ergo health card form

Find out other Louisville Metro Revenue Forms

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer