2024AR1000FSW PDF Form

Understanding the 2024 Arkansas State Tax Form

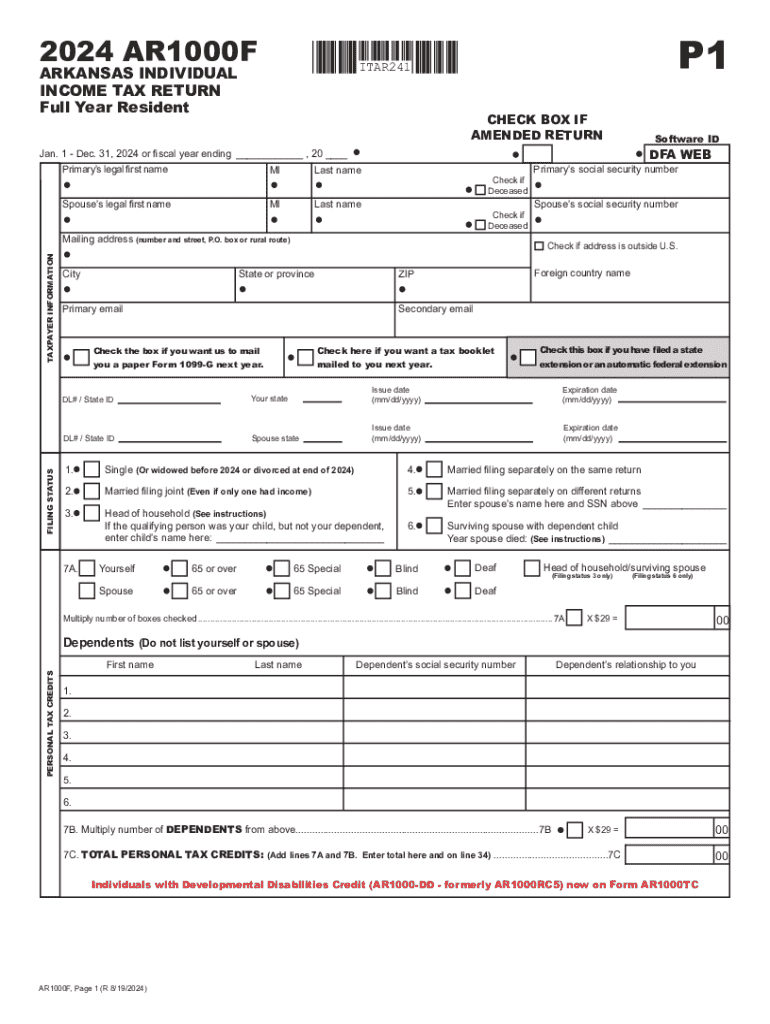

The 2024 Arkansas state tax form, commonly referred to as the AR1000F, is essential for individuals filing their income taxes in Arkansas. This form is used to report income, calculate tax liability, and determine eligibility for any credits or deductions. It is important for taxpayers to familiarize themselves with the specific requirements and sections of the form to ensure accurate filing.

Steps to Complete the 2024 Arkansas State Tax Form

Completing the 2024 Arkansas state tax form involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as name, address, and Social Security number.

- Report all sources of income in the designated sections of the form.

- Calculate deductions and credits applicable to your situation.

- Review the completed form for accuracy before submission.

Filing Deadlines and Important Dates

Taxpayers in Arkansas should be aware of the important deadlines associated with the 2024 AR1000F form. Typically, the deadline for filing state income tax returns is April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates from the Arkansas Department of Finance and Administration for specific dates and any potential extensions.

Required Documents for Filing

To successfully complete the 2024 Arkansas state tax form, individuals will need to provide several key documents, including:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income, such as dividends or rental income

- Documentation for deductions, including receipts for medical expenses or charitable contributions

Form Submission Methods

The 2024 Arkansas state tax form can be submitted through various methods. Taxpayers have the option to file online using the Arkansas Department of Finance and Administration's e-file system, which is a convenient and secure way to submit forms. Alternatively, individuals can mail their completed forms to the appropriate address or deliver them in person at local tax offices. Each method has its own processing times and requirements.

Key Elements of the 2024 Arkansas State Tax Form

The AR1000F includes several critical sections that taxpayers must complete:

- Personal information section for identification

- Income section to report all earnings

- Deductions section for eligible expenses

- Tax calculation section to determine total tax owed

- Signature section to certify the accuracy of the information provided

Eligibility Criteria for Using the 2024 Arkansas State Tax Form

Eligibility to use the 2024 Arkansas state tax form generally applies to residents who earn income in Arkansas. Specific criteria may include income thresholds, filing status (single, married, etc.), and age. It is important for taxpayers to review the eligibility requirements to ensure they are using the correct form and filing appropriately.

Handy tips for filling out 2024AR1000FSW pdf online

Quick steps to complete and e-sign 2024AR1000FSW pdf online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant solution for optimum simplicity. Use signNow to electronically sign and send out 2024AR1000FSW pdf for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2024ar1000fsw pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Arkansas state tax form and why is it important?

The 2024 Arkansas state tax form is a document required for filing state income taxes in Arkansas. It is important because it ensures compliance with state tax laws and helps you accurately report your income and deductions. Using the correct form can also expedite your tax refund process.

-

How can airSlate SignNow help with the 2024 Arkansas state tax form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the 2024 Arkansas state tax form. This streamlines the process, allowing you to complete your tax filing quickly and securely. With our solution, you can manage all your tax documents in one place.

-

Is there a cost associated with using airSlate SignNow for the 2024 Arkansas state tax form?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our features, such as document management and eSigning capabilities for the 2024 Arkansas state tax form. You can choose a plan that best fits your budget.

-

What features does airSlate SignNow offer for the 2024 Arkansas state tax form?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking specifically for the 2024 Arkansas state tax form. These features enhance efficiency and ensure that your documents are handled securely. Additionally, you can collaborate with others easily through our platform.

-

Can I integrate airSlate SignNow with other software for the 2024 Arkansas state tax form?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easier to manage the 2024 Arkansas state tax form alongside your other business tools. This integration helps streamline your workflow and ensures that all your documents are accessible in one place. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for the 2024 Arkansas state tax form?

Using airSlate SignNow for the 2024 Arkansas state tax form offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the signing process, allowing you to focus on other important tasks. Additionally, you can access your documents anytime, anywhere, which adds convenience.

-

How secure is airSlate SignNow when handling the 2024 Arkansas state tax form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when handling the 2024 Arkansas state tax form. We ensure that your sensitive information remains confidential and secure throughout the signing process. Trust us to keep your documents safe.

Get more for 2024AR1000FSW pdf

Find out other 2024AR1000FSW pdf

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free