PRINTCLEARST8 Rev 06Department of Revenue 1 Form

What is the PRINTCLEARST8 rev 06Department Of Revenue 1

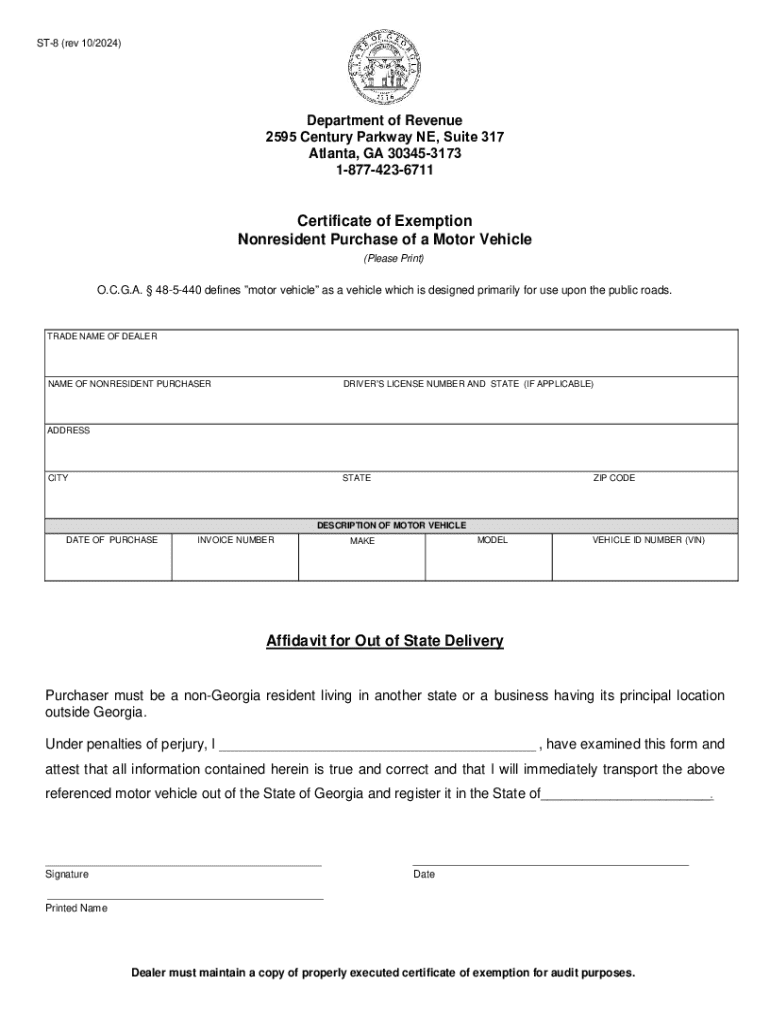

The PRINTCLEARST8 rev 06Department Of Revenue 1 is a specific form used by the Department of Revenue for various administrative purposes. This form is essential for taxpayers and businesses to report information accurately and comply with state regulations. It may involve data related to income, deductions, or other financial aspects relevant to tax obligations. Understanding the purpose of this form is crucial for ensuring proper filing and compliance with tax laws.

How to use the PRINTCLEARST8 rev 06Department Of Revenue 1

Using the PRINTCLEARST8 rev 06Department Of Revenue 1 involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents and information required to fill out the form. Next, carefully follow the instructions provided on the form to enter your data accurately. It is important to review the completed form for any errors before submission. Finally, submit the form through the designated method, which may include online submission, mailing, or in-person delivery to the appropriate Department of Revenue office.

Steps to complete the PRINTCLEARST8 rev 06Department Of Revenue 1

Completing the PRINTCLEARST8 rev 06Department Of Revenue 1 requires a systematic approach. Start by downloading the form from the official Department of Revenue website or obtaining a physical copy. Fill in your personal or business information as required, ensuring all fields are completed accurately. Include any necessary financial details, such as income amounts or deductions. After filling out the form, double-check for accuracy and completeness. Once verified, submit the form according to the guidelines provided, ensuring you meet any deadlines specified by the Department of Revenue.

Legal use of the PRINTCLEARST8 rev 06Department Of Revenue 1

The PRINTCLEARST8 rev 06Department Of Revenue 1 serves a legal purpose within the framework of state tax regulations. It is a formal document that must be completed accurately to avoid penalties or legal issues. The information provided on this form is used by the Department of Revenue to assess tax liabilities and ensure compliance with state laws. Therefore, it is essential to understand the legal implications of submitting this form and to ensure that all information is truthful and complete.

Required Documents

When preparing to complete the PRINTCLEARST8 rev 06Department Of Revenue 1, certain documents are typically required. These may include:

- Proof of income, such as W-2 forms or 1099 statements

- Receipts for deductions or credits claimed

- Identification information for individuals or businesses

- Previous tax returns for reference

Gathering these documents in advance can streamline the process and ensure that all necessary information is included in the form.

Form Submission Methods

The PRINTCLEARST8 rev 06Department Of Revenue 1 can be submitted through various methods, depending on the guidelines set by the Department of Revenue. Common submission methods include:

- Online submission through the Department of Revenue's official website

- Mailing the completed form to the designated office address

- In-person submission at local Department of Revenue offices

Choosing the appropriate submission method is important to ensure timely processing and compliance with state regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printclearst8 rev 06department of revenue 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PRINTCLEARST8 rev 06Department Of Revenue 1?

PRINTCLEARST8 rev 06Department Of Revenue 1 is a specific document format used for submitting forms to the Department of Revenue. This format ensures compliance with state regulations and facilitates efficient processing of tax-related documents. Utilizing airSlate SignNow, you can easily eSign and send this document securely.

-

How does airSlate SignNow support PRINTCLEARST8 rev 06Department Of Revenue 1?

airSlate SignNow provides a user-friendly platform for managing PRINTCLEARST8 rev 06Department Of Revenue 1 documents. You can create, edit, and eSign these forms seamlessly, ensuring that all necessary information is accurately captured. This streamlines the submission process to the Department of Revenue.

-

What are the pricing options for using airSlate SignNow with PRINTCLEARST8 rev 06Department Of Revenue 1?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those requiring PRINTCLEARST8 rev 06Department Of Revenue 1. You can choose from monthly or annual subscriptions, which provide access to all features necessary for efficient document management and eSigning. Check our website for the latest pricing details.

-

Can I integrate airSlate SignNow with other software for handling PRINTCLEARST8 rev 06Department Of Revenue 1?

Yes, airSlate SignNow supports various integrations with popular software applications, making it easy to manage PRINTCLEARST8 rev 06Department Of Revenue 1 documents alongside your existing tools. This allows for a seamless workflow, enhancing productivity and ensuring that all documents are handled efficiently.

-

What are the benefits of using airSlate SignNow for PRINTCLEARST8 rev 06Department Of Revenue 1?

Using airSlate SignNow for PRINTCLEARST8 rev 06Department Of Revenue 1 offers numerous benefits, including time savings, enhanced security, and improved compliance. The platform simplifies the eSigning process, allowing you to complete and submit documents quickly. Additionally, it provides a secure environment for sensitive information.

-

Is airSlate SignNow user-friendly for managing PRINTCLEARST8 rev 06Department Of Revenue 1?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage PRINTCLEARST8 rev 06Department Of Revenue 1 documents. The intuitive interface allows users to navigate through the eSigning process effortlessly, ensuring that even those with minimal technical skills can utilize the platform effectively.

-

What security measures does airSlate SignNow implement for PRINTCLEARST8 rev 06Department Of Revenue 1?

airSlate SignNow prioritizes security, implementing robust measures to protect your PRINTCLEARST8 rev 06Department Of Revenue 1 documents. This includes encryption, secure access controls, and compliance with industry standards. You can trust that your sensitive information is safe while using our platform.

Get more for PRINTCLEARST8 rev 06Department Of Revenue 1

- 13 1040 schedule nrhindd maine form

- Nonresident or safe harbor resident spouses with no maine source income maine form

- Form 1040ext me maine

- Govrevenue and eliminate the necessity of ling form maine

- Auditor forms lexington county sc gov

- Medical consent form to return to work

- Student employee break waiver university of southern maine usm maine form

- Ohio state renew of dental hygienist form

Find out other PRINTCLEARST8 rev 06Department Of Revenue 1

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation