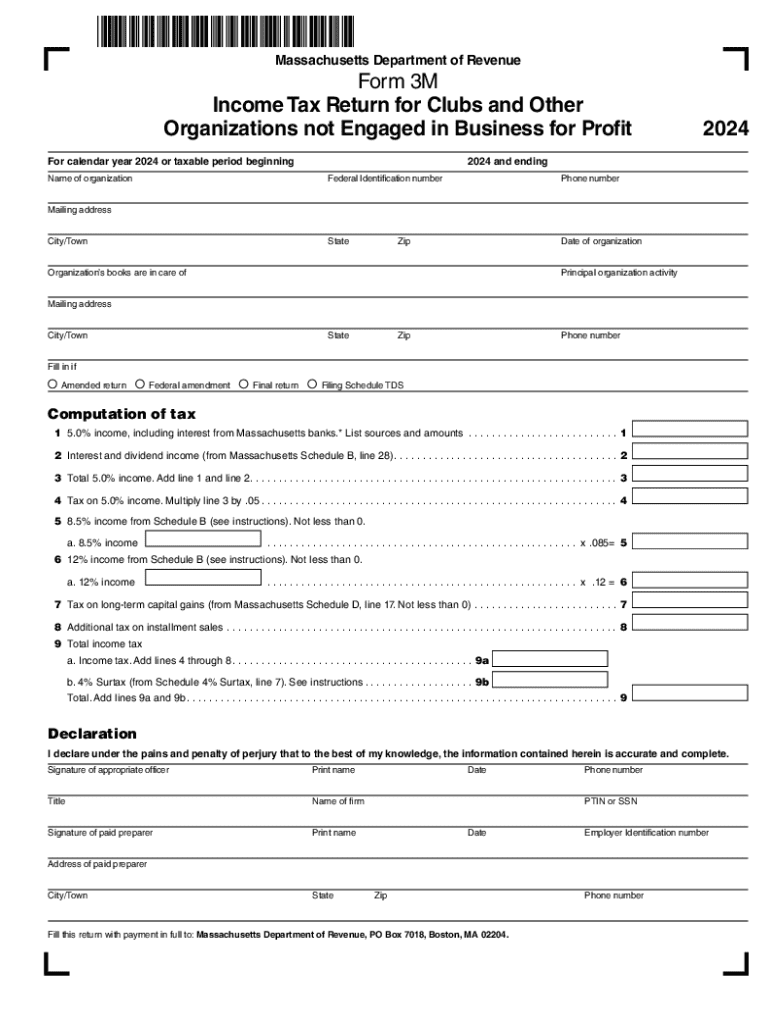

Massachusetts Department of Revenue Form 3M Income

What is the Massachusetts Department Of Revenue Form 3M Income

The Massachusetts Department of Revenue Form 3M is specifically designed for reporting income from mutual funds, partnerships, and other entities that pass through income to individual taxpayers. This form is essential for individuals who receive income from these sources and need to report it accurately for state tax purposes. The form helps ensure compliance with Massachusetts tax laws and provides the necessary information for the state to assess tax liabilities appropriately.

How to use the Massachusetts Department Of Revenue Form 3M Income

To use the Massachusetts Form 3M, individuals must first gather all relevant income documentation from mutual funds or partnerships. This includes any K-1 forms or statements detailing income distributions. Once the necessary documents are collected, taxpayers can fill out the form by entering their personal information and the income amounts received. It is crucial to follow the instructions provided with the form to ensure accurate reporting and avoid potential delays in processing.

Steps to complete the Massachusetts Department Of Revenue Form 3M Income

Completing the Massachusetts Form 3M involves several steps:

- Gather all income documentation, including K-1 forms and statements from mutual funds.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number.

- Report the income received from each source in the designated sections of the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Massachusetts Form 3M. Typically, the form is due on or before the fifteenth day of the fourth month following the end of the tax year. For most taxpayers, this means the deadline falls on April fifteenth. However, if this date falls on a weekend or holiday, the due date may be adjusted accordingly. Staying informed of these deadlines helps avoid penalties and ensures timely compliance with state tax regulations.

Required Documents

When preparing to file the Massachusetts Form 3M, certain documents are required to ensure accurate reporting. These include:

- K-1 forms from partnerships or S corporations, detailing income distributions.

- Statements from mutual funds indicating income received.

- Any other relevant financial documents that report income from pass-through entities.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the Massachusetts Form 3M on time or inaccuracies in reporting can result in penalties. The Massachusetts Department of Revenue may impose fines for late submissions, which can accumulate over time. Additionally, taxpayers may face interest charges on any unpaid tax liabilities. It is essential to file the form accurately and on time to avoid these potential penalties and maintain compliance with state tax regulations.

Handy tips for filling out Massachusetts Department Of Revenue Form 3M Income online

Quick steps to complete and e-sign Massachusetts Department Of Revenue Form 3M Income online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant solution for optimum straightforwardness. Use signNow to e-sign and send Massachusetts Department Of Revenue Form 3M Income for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form 3m income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts Form 3M?

The Massachusetts Form 3M is a tax form used for reporting income and calculating tax liabilities for businesses in Massachusetts. It is essential for ensuring compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and submit your Massachusetts Form 3M securely.

-

How can airSlate SignNow help with the Massachusetts Form 3M?

airSlate SignNow streamlines the process of completing and eSigning the Massachusetts Form 3M. Our platform allows you to fill out the form digitally, ensuring accuracy and saving time. With our user-friendly interface, you can manage your documents efficiently.

-

Is there a cost associated with using airSlate SignNow for the Massachusetts Form 3M?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are cost-effective and designed to provide value, especially for those frequently handling documents like the Massachusetts Form 3M. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Massachusetts Form 3M?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage for the Massachusetts Form 3M. These features enhance productivity and ensure that your documents are always accessible and compliant with state regulations.

-

Can I integrate airSlate SignNow with other software for the Massachusetts Form 3M?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your Massachusetts Form 3M alongside your existing tools. This integration capability helps streamline your workflow and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for the Massachusetts Form 3M?

Using airSlate SignNow for the Massachusetts Form 3M provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and submitted efficiently, allowing you to focus on your business operations.

-

Is airSlate SignNow secure for handling the Massachusetts Form 3M?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the Massachusetts Form 3M. We utilize advanced encryption and security protocols to protect your sensitive information throughout the signing process.

Get more for Massachusetts Department Of Revenue Form 3M Income

- 2014 michigan homestead property tax credit claim mi 1040cr michigan form

- Form m1x

- Form m1w

- Buy american certification maryland form

- Electrician apprentice monthly progress report month of cjatc form

- Certificate to accompany involuntary admission pdf form

- 18th street financial services llp private wealth consultants form

- Closing instructions 8 8 10 9 1 10 pdf real estate attorneys form

Find out other Massachusetts Department Of Revenue Form 3M Income

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation