Massachusetts Form MA NRCR Nonresident Compos 2024-2026

What is the Massachusetts Form MA NRCR Nonresident Compos

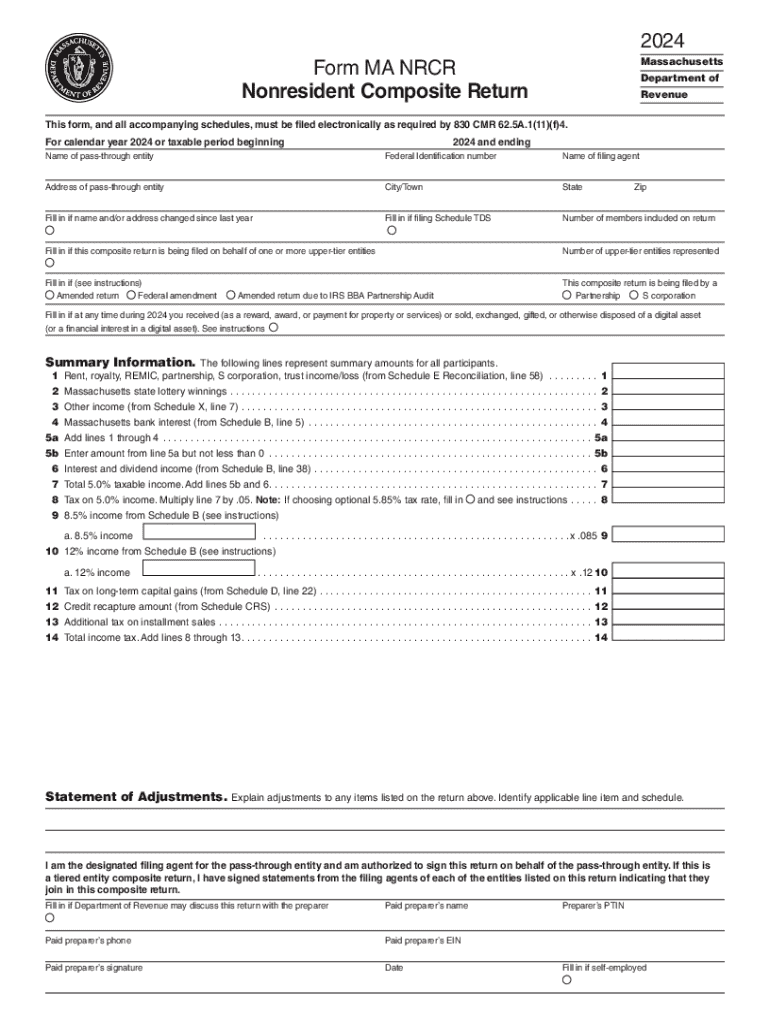

The Massachusetts Form MA NRCR, also known as the Nonresident Composite Return, is a tax form specifically designed for nonresident individuals and entities that earn income in Massachusetts. This form allows nonresidents to report their income derived from Massachusetts sources, ensuring compliance with state tax laws. It is particularly relevant for individuals who may not be residents of Massachusetts but have income from rental properties, investments, or business activities within the state.

How to use the Massachusetts Form MA NRCR Nonresident Compos

To effectively use the Massachusetts Form MA NRCR, nonresidents must first gather all relevant income documentation. This includes W-2 forms, 1099 forms, and any other income statements related to Massachusetts sources. Once the necessary documents are collected, taxpayers should accurately fill out the form by reporting their income, deductions, and any applicable credits. It is essential to follow the instructions provided with the form closely to ensure all information is correctly submitted.

Steps to complete the Massachusetts Form MA NRCR Nonresident Compos

Completing the Massachusetts Form MA NRCR involves several key steps:

- Gather all relevant income documentation from Massachusetts sources.

- Obtain a copy of the MA NRCR form, which can be downloaded or accessed online.

- Fill out the form, ensuring all income and deductions are accurately reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline, either electronically or by mail.

Filing Deadlines / Important Dates

It is crucial for nonresidents to be aware of the filing deadlines for the Massachusetts Form MA NRCR. Typically, the form must be filed by April fifteenth of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any specific deadlines related to estimated tax payments if applicable.

Required Documents

When preparing to file the Massachusetts Form MA NRCR, nonresidents must compile several key documents:

- W-2 forms from employers for income earned in Massachusetts.

- 1099 forms for any freelance or contract work conducted in the state.

- Records of any business income derived from Massachusetts sources.

- Documentation of any deductions or credits claimed on the return.

Eligibility Criteria

Eligibility to file the Massachusetts Form MA NRCR is generally limited to individuals and entities that are not residents of Massachusetts but have earned income from Massachusetts sources. This includes nonresident individuals, partnerships, and corporations. To qualify, taxpayers must ensure that their income meets the thresholds set by the state for nonresident taxation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts form ma nrcr nonresident compos

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the ma nrcr instructions 2024 for using airSlate SignNow?

The ma nrcr instructions 2024 provide a comprehensive guide on how to effectively utilize airSlate SignNow for document signing. This includes step-by-step processes for sending, signing, and managing documents electronically. Following these instructions ensures a smooth and efficient experience for all users.

-

How much does airSlate SignNow cost in 2024?

In 2024, airSlate SignNow offers various pricing plans tailored to meet different business needs. The plans are designed to be cost-effective, ensuring that you get the best value for your investment. For detailed pricing information, please visit our pricing page.

-

What features does airSlate SignNow offer in relation to ma nrcr instructions 2024?

airSlate SignNow includes features that align with the ma nrcr instructions 2024, such as customizable templates, secure eSigning, and document tracking. These features enhance the user experience by simplifying the signing process and ensuring compliance with regulatory standards. Users can easily navigate through these features to maximize efficiency.

-

How can airSlate SignNow benefit my business in 2024?

Using airSlate SignNow in 2024 can signNowly streamline your document management processes. The platform allows for quick and secure eSigning, reducing turnaround times and improving productivity. By following the ma nrcr instructions 2024, businesses can ensure they are leveraging the full potential of the software.

-

Does airSlate SignNow integrate with other software in 2024?

Yes, airSlate SignNow offers integrations with various software applications in 2024, enhancing its functionality. These integrations allow users to connect their existing tools with airSlate SignNow, making document management seamless. This is particularly useful for businesses looking to optimize their workflows while adhering to the ma nrcr instructions 2024.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents are handled with the utmost care. The platform complies with industry standards and regulations, making it a safe choice for sensitive documents. Following the ma nrcr instructions 2024 will help users understand the security measures in place.

-

Can I customize my documents using airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of documents to meet your specific needs. Users can create templates, add fields, and personalize their documents easily. This feature is particularly beneficial when following the ma nrcr instructions 2024 to ensure compliance and accuracy.

Get more for Massachusetts Form MA NRCR Nonresident Compos

Find out other Massachusetts Form MA NRCR Nonresident Compos

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure