Oklahoma Small Business Corporation Income Ta 2024-2026

Understanding the Oklahoma Small Business Corporation Income Tax

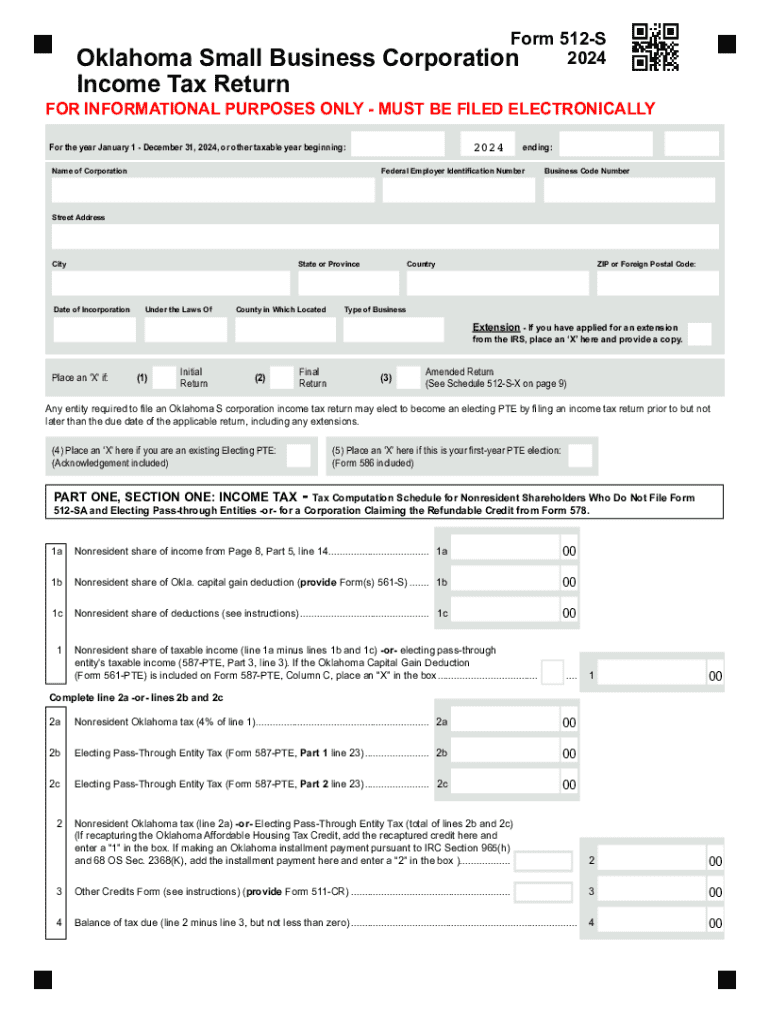

The Oklahoma Small Business Corporation Income Tax is a tax levied on the income generated by small business corporations operating within the state. This tax applies specifically to corporations that have elected to be taxed as S corporations under federal law. The income tax is calculated based on the corporation's taxable income, which is determined by federal tax regulations, with certain state-specific adjustments. Understanding this tax is crucial for small business owners to ensure compliance and proper financial planning.

Steps to Complete the Oklahoma Small Business Corporation Income Tax

Completing the Oklahoma Small Business Corporation Income Tax involves several key steps:

- Gather necessary financial records, including income statements and expense reports.

- Determine the corporation's taxable income by following federal guidelines and making any required state adjustments.

- Complete the Oklahoma return 512S form, ensuring all sections are filled out accurately.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates

It is essential for small business corporations to be aware of the filing deadlines for the Oklahoma Small Business Corporation Income Tax. Typically, the return is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the return is due on April 15. Keeping track of these dates helps prevent late filing penalties and interest charges.

Required Documents for Filing

When preparing to file the Oklahoma return 512S, several documents are essential:

- Financial statements, including profit and loss statements and balance sheets.

- Federal tax returns, particularly the IRS Form 1120S.

- Records of any adjustments made to federal taxable income.

- Documentation of any credits or deductions claimed on the state return.

Form Submission Methods

Small business corporations in Oklahoma have several options for submitting the Oklahoma return 512S. The form can be filed online through the Oklahoma Tax Commission's e-filing system, which offers a convenient and efficient way to submit tax returns. Alternatively, corporations may choose to mail the completed form to the appropriate address provided by the state tax authority. In-person submissions are also accepted at designated tax offices, allowing for direct interaction with tax officials if needed.

Penalties for Non-Compliance

Failure to comply with the Oklahoma Small Business Corporation Income Tax requirements can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal repercussions. It is crucial for corporations to file their returns accurately and on time to avoid these consequences. Understanding the implications of non-compliance helps ensure that small business owners remain in good standing with state tax authorities.

Create this form in 5 minutes or less

Find and fill out the correct oklahoma small business corporation income ta

Create this form in 5 minutes!

How to create an eSignature for the oklahoma small business corporation income ta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma return 512s form?

The Oklahoma return 512s form is a tax document used by businesses in Oklahoma to report income and calculate taxes owed. It is essential for ensuring compliance with state tax regulations. Understanding how to properly fill out the Oklahoma return 512s can help businesses avoid penalties and streamline their tax filing process.

-

How can airSlate SignNow help with the Oklahoma return 512s?

airSlate SignNow simplifies the process of preparing and submitting the Oklahoma return 512s by allowing users to eSign documents securely and efficiently. With its user-friendly interface, businesses can easily manage their tax documents and ensure timely submissions. This can signNowly reduce the stress associated with tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan includes features that can assist with the Oklahoma return 512s, ensuring that users have the tools they need at a cost-effective rate. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing its functionality for users dealing with the Oklahoma return 512s. These integrations allow for easy data transfer and document management, making it simpler to handle tax-related paperwork. Popular integrations include CRM systems and cloud storage services.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides robust document management features, including templates, automated workflows, and secure storage. These features are particularly beneficial for managing the Oklahoma return 512s, as they streamline the preparation and signing process. Users can easily track document status and ensure compliance with state requirements.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing users to manage their documents and eSign the Oklahoma return 512s on the go. This flexibility ensures that you can handle important tax documents anytime, anywhere, making it a convenient solution for busy professionals.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the Oklahoma return 512s. The platform employs advanced encryption and security protocols to protect your data. You can trust that your information is secure while using airSlate SignNow.

Get more for Oklahoma Small Business Corporation Income Ta

- Sf 85p applicant tips for successful e qip submission form

- 6627 form

- Expiration date 11302023 form

- Fillable online use this form to notify arise health plan

- Use this form to notify arise health plan and wps health insurance of any changes additions

- Va form 21 0960g 5 hepatitis cirrhosis and other liver conditions disability benefits questionnaire vba va

- Standardized recipe template form

- Request for release of fire medical andor marine safety records form

Find out other Oklahoma Small Business Corporation Income Ta

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form