Business Tax Forms and Publications for Tax Filing 2019

Understanding the Oklahoma Form 512-S

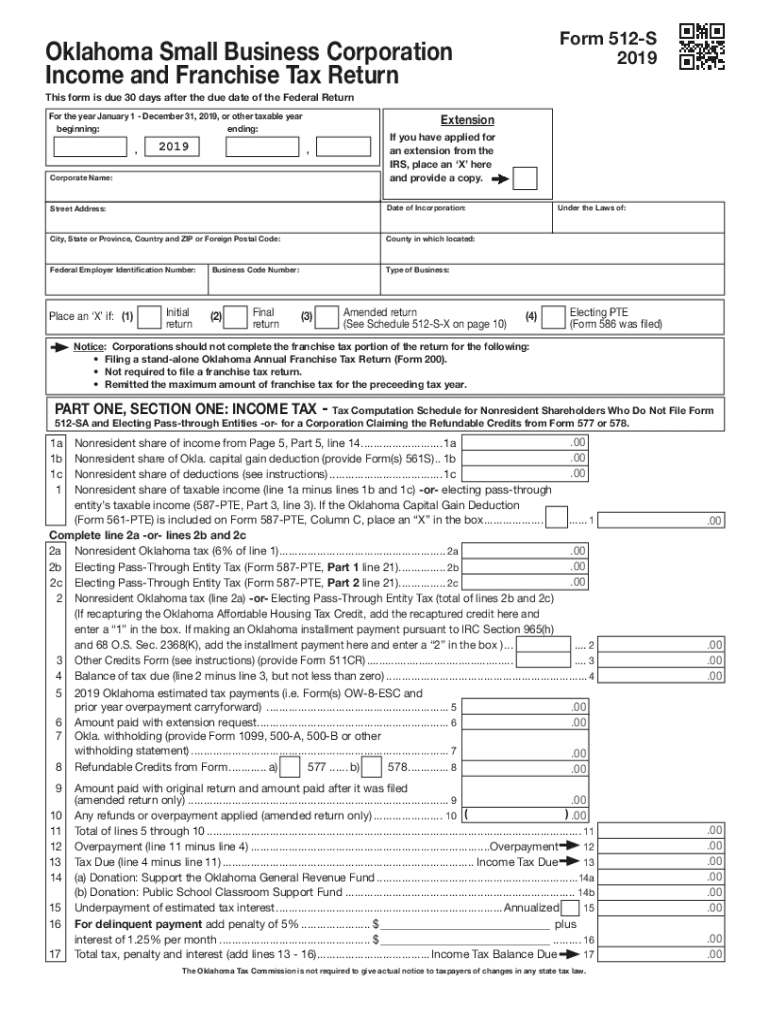

The Oklahoma Form 512-S is a crucial document used for reporting income from S corporations in the state of Oklahoma. This form is essential for ensuring that S corporations comply with state tax requirements. It captures various financial details, including income, deductions, and credits that the corporation may claim. Properly completing this form is vital for accurate tax reporting and to avoid potential penalties.

Steps to Complete the Oklahoma Form 512-S

Filling out the Oklahoma Form 512-S involves several key steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including income statements and expense records.

- Input the corporation's total income, including any distributions to shareholders.

- Detail allowable deductions, such as business expenses and losses.

- Calculate the total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Oklahoma Form 512-S

It is important to be aware of the filing deadlines associated with the Oklahoma Form 512-S. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. Missing this deadline may result in penalties, so timely submission is essential.

Who Issues the Oklahoma Form 512-S

The Oklahoma Form 512-S is issued by the Oklahoma Tax Commission. This agency is responsible for administering state tax laws and ensuring compliance among businesses operating within Oklahoma. For any specific inquiries regarding the form or its requirements, businesses can contact the Oklahoma Tax Commission directly.

Required Documents for Filing the Oklahoma Form 512-S

To successfully file the Oklahoma Form 512-S, certain documents are required. These typically include:

- Financial statements that outline the corporation's income and expenses.

- Records of any distributions made to shareholders during the tax year.

- Documentation supporting any deductions claimed on the form.

Having these documents ready can streamline the filing process and help ensure compliance with state regulations.

Penalties for Non-Compliance with the Oklahoma Form 512-S

Failure to file the Oklahoma Form 512-S on time or inaccuracies in the form can lead to significant penalties. These may include fines and interest on any unpaid taxes. Additionally, non-compliance can result in further scrutiny from the Oklahoma Tax Commission, which may lead to audits or additional legal consequences. It is crucial for S corporations to adhere to filing requirements to avoid these risks.

Quick guide on how to complete business tax forms and publications for tax filing

Prepare Business Tax Forms And Publications For Tax Filing effortlessly on any device

Virtual document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your paperwork promptly without delays. Manage Business Tax Forms And Publications For Tax Filing on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign Business Tax Forms And Publications For Tax Filing without hassle

- Locate Business Tax Forms And Publications For Tax Filing and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Modify and eSign Business Tax Forms And Publications For Tax Filing and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tax forms and publications for tax filing

Create this form in 5 minutes!

How to create an eSignature for the business tax forms and publications for tax filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Form 512 S?

The Oklahoma Form 512 S is a tax form used for reporting the income of partnerships and S corporations in the state of Oklahoma. It enables businesses to correctly calculate tax liabilities and ensures compliance with Oklahoma tax regulations. By using airSlate SignNow, businesses can efficiently fill out and sign this form electronically.

-

How can airSlate SignNow help me with Oklahoma Form 512 S?

airSlate SignNow simplifies the process of completing and submitting the Oklahoma Form 512 S by allowing users to eSign documents securely and quickly. With intuitive tools for form filling and an organized document workflow, you can easily manage this tax form and ensure timely submissions. The user-friendly platform reduces the hassle associated with traditional methods.

-

Is there a cost associated with using airSlate SignNow for Oklahoma Form 512 S?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. Depending on your requirements, you can choose a plan that provides access to features necessary for efficiently managing the Oklahoma Form 512 S. It’s a cost-effective solution that saves time and resources.

-

What features does airSlate SignNow provide for managing Oklahoma Form 512 S?

airSlate SignNow offers a wide range of features for managing Oklahoma Form 512 S, including eSigning, automated reminders, and document storage. You can collaborate with team members, track the signing status, and securely share the completed forms. These tools make it easier to maintain compliance and organization.

-

Can I integrate airSlate SignNow with other software for the Oklahoma Form 512 S?

Absolutely! airSlate SignNow integrates seamlessly with various business software solutions, allowing you to streamline your workflow when managing the Oklahoma Form 512 S. Whether it's accounting software or other productivity tools, these integrations enhance efficiency and eliminate redundancy in your document management process.

-

What are the benefits of using airSlate SignNow for Oklahoma Form 512 S?

Using airSlate SignNow for the Oklahoma Form 512 S provides numerous benefits, including increased efficiency, improved accuracy, and reduced paperwork. The electronic signing process minimizes the chances of errors and delays, helping you meet deadlines with ease. Moreover, you can access your documents anytime, anywhere, adding flexibility to your operations.

-

Is airSlate SignNow secure for handling sensitive Oklahoma Form 512 S data?

Yes, airSlate SignNow uses industry-standard security protocols to protect sensitive data associated with the Oklahoma Form 512 S. Features like encryption, secure user authentication, and compliance with legal regulations ensure that your documents remain safe. You can trust airSlate SignNow to handle your tax documents securely.

Get more for Business Tax Forms And Publications For Tax Filing

Find out other Business Tax Forms And Publications For Tax Filing

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word