State and Local Tax Filing and Payment Extensions Due to 2020

Understanding the Oklahoma 512 S Form

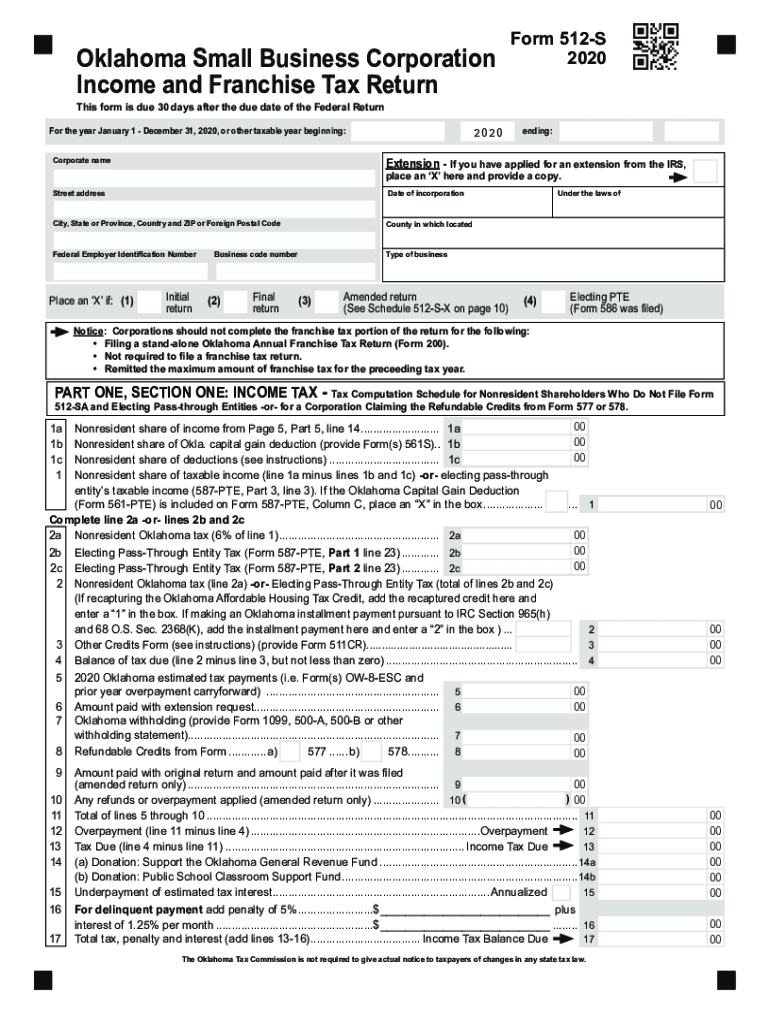

The Oklahoma 512 S form is a crucial document for corporations and small businesses in Oklahoma, specifically designed for income and franchise tax reporting. This form allows businesses to report their income, deductions, and credits to the state. It is essential for ensuring compliance with Oklahoma tax laws and for determining the amount of tax owed or any potential refunds. The 512 S form is typically used by corporations, including S corporations, and is integral to maintaining good standing with the state.

Filing Deadlines for the Oklahoma 512 S Form

Timely filing of the Oklahoma 512 S form is critical to avoid penalties and interest. Generally, the due date for filing is the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important to be aware of these deadlines to ensure compliance and avoid unnecessary fees.

Required Documents for Filing the Oklahoma 512 S Form

To successfully complete the Oklahoma 512 S form, several documents are necessary. These typically include:

- Financial statements, including income statements and balance sheets

- Records of income, deductions, and credits

- Previous year’s tax return, if applicable

- Any supporting documentation for claimed deductions or credits

Gathering these documents in advance can streamline the filing process and help ensure accuracy.

Steps to Complete the Oklahoma 512 S Form

Completing the Oklahoma 512 S form involves several steps:

- Gather all necessary financial documentation.

- Fill out the form with accurate income and deduction figures.

- Calculate the tax owed or refund due based on the provided information.

- Review the completed form for accuracy and completeness.

- Submit the form by the due date, either electronically or by mail.

Following these steps can help ensure that the filing process is efficient and compliant with state regulations.

Penalties for Non-Compliance with the Oklahoma 512 S Form

Failing to file the Oklahoma 512 S form on time can result in significant penalties. The state imposes fines for late filings, which can accumulate over time. Additionally, interest may accrue on any unpaid taxes. It is advisable to file the form even if payment cannot be made in full to mitigate potential penalties. Understanding the implications of non-compliance can encourage timely and accurate filing.

Who Issues the Oklahoma 512 S Form

The Oklahoma 512 S form is issued by the Oklahoma Tax Commission. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Oklahoma. The Tax Commission provides resources and guidance for completing the form, making it easier for businesses to navigate the filing process.

Quick guide on how to complete state and local tax filing and payment extensions due to

Finalize State And Local Tax Filing And Payment Extensions Due To effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle State And Local Tax Filing And Payment Extensions Due To on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign State And Local Tax Filing And Payment Extensions Due To with ease

- Locate State And Local Tax Filing And Payment Extensions Due To and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you would like to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from a device of your choice. Modify and electronically sign State And Local Tax Filing And Payment Extensions Due To to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state and local tax filing and payment extensions due to

Create this form in 5 minutes!

How to create an eSignature for the state and local tax filing and payment extensions due to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Oklahoma return 512s?

The Oklahoma return 512s is a specific tax form used by businesses operating in Oklahoma to report various types of income. It is essential for ensuring compliance with state tax regulations. By accurately completing the Oklahoma return 512s, businesses can avoid penalties and ensure they are meeting their tax obligations.

-

How do I complete the Oklahoma return 512s using airSlate SignNow?

Completing the Oklahoma return 512s with airSlate SignNow is straightforward. Simply upload your documents, fill in the required fields, and add electronic signatures as needed. The platform provides templates and tools to streamline the process, making it easy to submit your Oklahoma return 512s accurately and on time.

-

What are the pricing options for using airSlate SignNow for Oklahoma return 512s?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for businesses preparing the Oklahoma return 512s. Plans typically include features like unlimited document signing and customizable workflows, ensuring you have the tools necessary to manage your tax responsibilities effectively.

-

What features does airSlate SignNow offer that benefit the Oklahoma return 512s process?

airSlate SignNow provides features tailored for the Oklahoma return 512s process, such as document templates, workflow automation, and real-time tracking of your submissions. These features help streamline your documentation process, enhance collaboration, and ensure that your forms are filled out accurately before submission.

-

Can airSlate SignNow integrate with accounting software for the Oklahoma return 512s?

Yes, airSlate SignNow can integrate seamlessly with various accounting software solutions to assist with the Oklahoma return 512s. This integration allows for easier data transfer, ensuring that your financial information is accurate and readily available when preparing your tax forms.

-

What are the benefits of using airSlate SignNow for my Oklahoma return 512s?

Using airSlate SignNow for your Oklahoma return 512s provides multiple benefits including speed, accuracy, and a paperless workflow. The electronic signing capability reduces turnaround times and streamlines the entire process, saving you both time and resources while ensuring compliance with state regulations.

-

Is there support available for businesses using airSlate SignNow for Oklahoma return 512s?

Absolutely! airSlate SignNow offers dedicated customer support to assist businesses in navigating the Oklahoma return 512s process. Whether you have questions about features, integrations, or best practices, our support team is ready to help you maximize the platform's capabilities.

Get more for State And Local Tax Filing And Payment Extensions Due To

- Practicum form application for sports training certification sotx

- Antrag auf beurkundung einer auslandsgeburt im geburtenregister form

- Download rental application delta wave communications inc form

- Wisconsin dept of revenue wage assignment reduction request 2017 form

- Residential contract for sale and purchase fill any pdf form

- Bcc lic 013 rev form

- New customer request form university bursar virginia tech bursar vt

- Lab 1 bienvenido a paloaltounileones paloalto unileon form

Find out other State And Local Tax Filing And Payment Extensions Due To

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online