Form L 80 Rev Tracer Request for Tax Year 2024-2026

What is the Form L 80 Rev Tracer Request For Tax Year

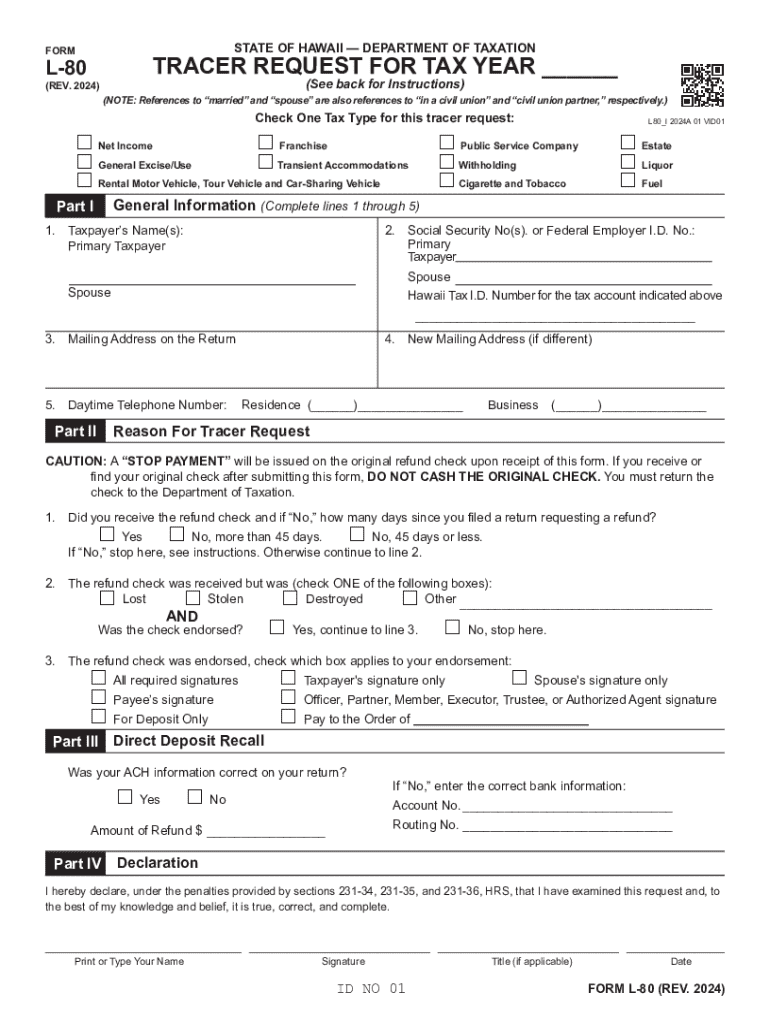

The Form L 80 Rev Tracer Request is a specific document used in Hawaii for taxpayers who need to request a tracer for their tax returns. This form is essential for individuals or businesses that have not received their tax refund or need to verify the status of their tax filings. By submitting this form, taxpayers can track their refund status or confirm that their tax return was processed correctly. It is particularly useful for those who may have experienced delays or issues with their tax submissions.

How to use the Form L 80 Rev Tracer Request For Tax Year

Using the Form L 80 Rev Tracer Request involves a straightforward process. First, you must fill out the required fields, including your personal information, tax year in question, and details regarding your original tax return. Ensure that all information is accurate to avoid delays. Once completed, the form can be submitted either online or via mail, depending on your preference. It is advisable to keep a copy of the submitted form for your records, as it may be needed for future reference.

Steps to complete the Form L 80 Rev Tracer Request For Tax Year

Completing the Form L 80 Rev Tracer Request requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary information, including your Social Security number, filing status, and details of the tax return in question.

- Access the form from the appropriate state tax authority website or office.

- Fill in all required fields, ensuring accuracy in your personal and tax-related information.

- Review the form for any errors or omissions before submission.

- Submit the form online or mail it to the designated address provided by the tax authority.

Legal use of the Form L 80 Rev Tracer Request For Tax Year

The Form L 80 Rev Tracer Request is legally recognized for tracking tax refunds and verifying tax filings in Hawaii. Taxpayers are entitled to request this tracer under state tax laws, which protect their rights to receive timely refunds and ensure proper processing of their returns. It is important to use this form only for legitimate purposes related to tax inquiries to avoid any potential legal issues.

Key elements of the Form L 80 Rev Tracer Request For Tax Year

Several key elements must be included in the Form L 80 Rev Tracer Request for it to be valid:

- Taxpayer Identification: Your name, address, and Social Security number.

- Tax Year: The specific year for which you are requesting the tracer.

- Details of the Original Return: Information regarding the tax return you are inquiring about.

- Signature: Your signature is required to validate the request.

Form Submission Methods

The Form L 80 Rev Tracer Request can be submitted through various methods to accommodate different preferences. Taxpayers may choose to submit the form online through the state tax authority's website, which often provides a quicker response. Alternatively, the form can be mailed to the designated office, ensuring that you retain a copy for your records. In-person submissions may also be possible at certain tax offices, depending on local regulations.

Create this form in 5 minutes or less

Find and fill out the correct form l 80 rev tracer request for tax year

Create this form in 5 minutes!

How to create an eSignature for the form l 80 rev tracer request for tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the l 80 form and how can airSlate SignNow help?

The l 80 form is a document used for various business purposes, including compliance and reporting. airSlate SignNow simplifies the process of filling out and signing the l 80 form by providing an intuitive platform that allows users to easily create, send, and eSign documents securely.

-

Is there a cost associated with using airSlate SignNow for the l 80 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion of the l 80 form, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the l 80 form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all of which enhance the management of the l 80 form. These tools help ensure that your documents are completed accurately and efficiently.

-

How does airSlate SignNow ensure the security of the l 80 form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and authentication measures to protect your l 80 form and other sensitive documents, ensuring that your data remains confidential and secure.

-

Can I integrate airSlate SignNow with other applications for the l 80 form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow when handling the l 80 form. This means you can connect with tools you already use, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the l 80 form?

Using airSlate SignNow for the l 80 form provides numerous benefits, including faster turnaround times, reduced paperwork, and improved accuracy. The platform's user-friendly interface makes it easy for anyone to manage their documents effectively.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with the l 80 form?

Yes, airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a small startup or a large corporation, the platform can help you efficiently manage the l 80 form and other documents, adapting to your specific needs.

Get more for Form L 80 Rev Tracer Request For Tax Year

- Get the doe ohr 200 005 form

- Ohio dic 3016 form

- Rp1 form download

- New zealand grant application form

- Imaging request form pdf centre for health centreforhealth org

- Case report form malaria public health surveillance surv esr cri

- Taylor fire department form

- Alameda county birth certificate application form

Find out other Form L 80 Rev Tracer Request For Tax Year

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo