Massachusetts Department of Revenue Form M 8379 No 2024-2026

Understanding the Massachusetts Department Of Revenue Form M-8379

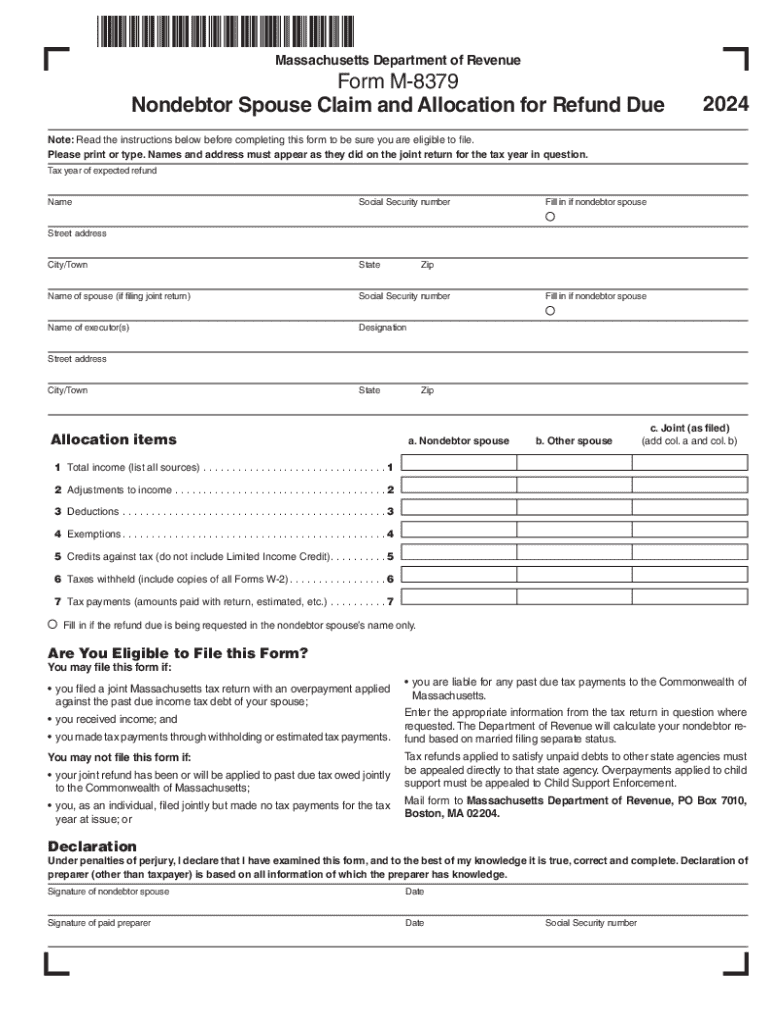

The Massachusetts Department of Revenue Form M-8379 is specifically designed for non-debtor spouses who wish to allocate their share of a tax refund when filing jointly with a debtor spouse. This form is essential for ensuring that the non-debtor spouse receives their rightful portion of the refund, especially in cases where the debtor spouse has tax liabilities that may affect the refund. Understanding the purpose and function of this form is crucial for taxpayers navigating financial obligations and tax refunds.

Steps to Complete the Massachusetts Department Of Revenue Form M-8379

Completing the Massachusetts M-8379 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including tax returns and any relevant financial information. Next, clearly fill out the form, providing details such as the names of both spouses, Social Security numbers, and the allocation of the refund. It is important to double-check all entries for accuracy. After completing the form, sign and date it before submission. Properly following these steps can prevent delays in processing and ensure that the non-debtor spouse receives their entitled refund.

Obtaining the Massachusetts Department Of Revenue Form M-8379

The Massachusetts M-8379 form can be obtained directly from the Massachusetts Department of Revenue's official website. It is available for download in a printable format, allowing taxpayers to fill it out manually. Additionally, the form may be available at local tax offices or through tax preparation services. Ensuring that you have the most current version of the form is essential for compliance and accurate filing.

Legal Use of the Massachusetts Department Of Revenue Form M-8379

The legal use of the Massachusetts M-8379 form is primarily for non-debtor spouses who need to claim their share of a tax refund when filing jointly. This form is recognized by the Massachusetts Department of Revenue as a legitimate means to protect the rights of the non-debtor spouse. It is crucial to use this form correctly to avoid complications with tax liabilities and to ensure that the allocation of the refund is processed according to state laws.

Required Documents for the Massachusetts Department Of Revenue Form M-8379

When completing the Massachusetts M-8379 form, certain documents are required to support the allocation claim. These include the most recent tax returns for both spouses, documentation of any debts or liabilities of the debtor spouse, and any other financial statements that may be relevant. Having these documents ready will facilitate the completion of the form and ensure that all necessary information is provided for processing.

Filing Deadlines for the Massachusetts Department Of Revenue Form M-8379

Filing deadlines for the Massachusetts M-8379 form align with the general tax filing deadlines set by the Massachusetts Department of Revenue. Typically, this form should be submitted along with the tax return by the April fifteenth deadline for most taxpayers. However, it is important to check for any specific deadlines related to extensions or changes in tax law that may affect the filing of this form. Timely submission is crucial to avoid penalties and ensure prompt processing of the refund allocation.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form m 8379 no

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form m 8379 no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Massachusetts M Allocation?

Massachusetts M Allocation refers to the distribution of funds or resources within the state of Massachusetts. Understanding this allocation is crucial for businesses looking to optimize their operations and ensure compliance with state regulations.

-

How can airSlate SignNow assist with Massachusetts M Allocation?

airSlate SignNow provides a streamlined platform for managing documents related to Massachusetts M Allocation. With our eSigning capabilities, businesses can quickly send, sign, and store important documents, ensuring a smooth allocation process.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses dealing with Massachusetts M Allocation. Our cost-effective solutions ensure that you only pay for the features you need, making it accessible for all business sizes.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to enhance your experience with Massachusetts M Allocation. These tools help streamline your document management process, saving you time and resources.

-

Can airSlate SignNow integrate with other software for Massachusetts M Allocation?

Yes, airSlate SignNow seamlessly integrates with various software applications to support your Massachusetts M Allocation needs. This integration capability allows for better data management and enhances collaboration across different platforms.

-

What are the benefits of using airSlate SignNow for Massachusetts M Allocation?

Using airSlate SignNow for Massachusetts M Allocation provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your core business activities.

-

Is airSlate SignNow secure for handling Massachusetts M Allocation documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents related to Massachusetts M Allocation are protected with advanced encryption and compliance measures. You can trust us to keep your sensitive information safe.

Get more for Massachusetts Department Of Revenue Form M 8379 No

- Employment bapplicationb atlantic bpestb solutions atlanticpestsolutions form

- Extension request for life raft inspection certificate form

- Template declaration of form

- Application for a medical doctor limited medical clinical academic limited or educational limited license medicine form michigan

- Missing marks uon form

- Printable dog grooming forms

- Advance notice of intent to exercise lockout form

- Client intake form kids therapy made simple

Find out other Massachusetts Department Of Revenue Form M 8379 No

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word