Injured Spouse Claims Vermont Department of Taxes 2022

Understanding the m 8379 Form

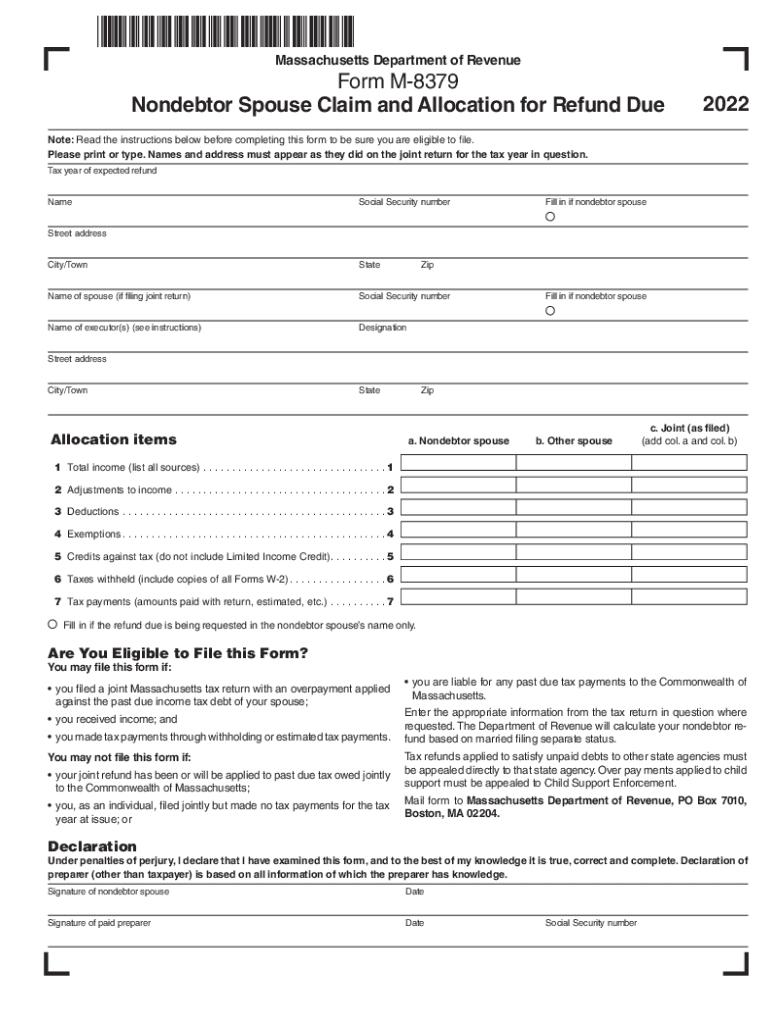

The m 8379 form, also known as the Massachusetts Injured Spouse Claim, is designed for individuals who wish to claim their share of a tax refund that may have been intercepted due to a spouse's debts. This form allows a nondebtor spouse to assert their right to a portion of the tax refund, ensuring that they are not unfairly penalized for their partner's financial obligations. It is essential for individuals in this situation to understand the purpose and implications of the m 8379 form to protect their financial interests.

Steps to Complete the m 8379 Form

Completing the m 8379 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including your tax returns and any relevant financial information. Next, fill out the form carefully, providing accurate details about your income, your spouse's income, and any debts that may affect the refund. It is crucial to sign and date the form before submission. Once completed, you can submit the form electronically or via mail, depending on your preference and the guidelines provided by the Massachusetts Department of Revenue.

Eligibility Criteria for the m 8379 Form

To qualify for the m 8379 form, certain eligibility criteria must be met. First, you must be a nondebtor spouse who is filing a joint tax return with a spouse who has outstanding debts. Additionally, you must have reported income on the joint return and have a valid claim to the refund being intercepted. Understanding these criteria is vital to ensure that you can successfully file the form and receive your rightful share of the tax refund.

Required Documents for Filing the m 8379 Form

When preparing to file the m 8379 form, it is important to gather all required documents. This typically includes copies of your joint tax return, any notices from the Massachusetts Department of Revenue regarding the interception of your refund, and documentation that supports your claim as a nondebtor spouse. Having these documents ready will streamline the filing process and help substantiate your claim.

Form Submission Methods

The m 8379 form can be submitted through various methods, providing flexibility for users. You can choose to file the form electronically, which is often faster and more efficient. Alternatively, you may opt to mail a paper version of the form to the appropriate address provided by the Massachusetts Department of Revenue. Ensure that you follow the submission guidelines carefully to avoid any delays in processing your claim.

IRS Guidelines for the m 8379 Form

While the m 8379 form is specific to Massachusetts, it is important to be aware of the IRS guidelines that may apply. The IRS provides general rules regarding injured spouse claims, which can help inform your understanding of how the m 8379 form operates within the broader context of federal tax regulations. Familiarizing yourself with these guidelines can enhance your ability to navigate the filing process effectively.

Quick guide on how to complete injured spouse claims vermont department of taxes

Effortlessly prepare Injured Spouse Claims Vermont Department Of Taxes on any device

Online document management has gained increased popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Injured Spouse Claims Vermont Department Of Taxes on any device using the airSlate SignNow apps available for Android or iOS, and simplify any document-related task today.

How to edit and electronically sign Injured Spouse Claims Vermont Department Of Taxes with ease

- Locate Injured Spouse Claims Vermont Department Of Taxes and click on Get Form to begin.

- Use the tools provided to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Injured Spouse Claims Vermont Department Of Taxes and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct injured spouse claims vermont department of taxes

Create this form in 5 minutes!

How to create an eSignature for the injured spouse claims vermont department of taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the m 8379 form and its purpose?

The m 8379 form, also known as the Injured Spouse Allocation form, is used to request the division of a tax refund when one spouse has outstanding legal obligations. Businesses often need to empower employees to handle such forms efficiently, which is where airSlate SignNow comes into play.

-

How can airSlate SignNow help with the m 8379 form?

airSlate SignNow simplifies the process of completing and signing the m 8379 form electronically. With user-friendly features, businesses can streamline document management, making it easier for employees to fill out and submit the form securely.

-

Is there a cost associated with using airSlate SignNow for the m 8379 form?

airSlate SignNow offers various pricing plans tailored to business needs, including options that cover the eSigning of important documents like the m 8379 form. You can choose a plan that best fits your budget while ensuring a smooth document workflow.

-

Can I integrate airSlate SignNow with other applications while handling the m 8379 form?

Yes, airSlate SignNow offers integrations with various applications and platforms, allowing you to manage the m 8379 form alongside your existing document processes. This integration helps enhance productivity and ensures a seamless workflow.

-

What are the key features of airSlate SignNow for managing the m 8379 form?

Key features of airSlate SignNow include eSigning, document tracking, and secure storage, which are crucial for effective management of the m 8379 form. These features ensure that your documents are handled efficiently and remain compliant with regulations.

-

Is airSlate SignNow secure for signing the m 8379 form?

Absolutely! airSlate SignNow prioritizes security, implementing end-to-end encryption to protect documents like the m 8379 form. You can trust that your sensitive information and signed documents are secure throughout the signing process.

-

How can I get started with airSlate SignNow for the m 8379 form?

Getting started with airSlate SignNow for the m 8379 form is easy. Simply sign up for an account, choose your pricing plan, and start uploading your documents to send for eSigning right away. The intuitive interface makes it accessible for everyone.

Get more for Injured Spouse Claims Vermont Department Of Taxes

Find out other Injured Spouse Claims Vermont Department Of Taxes

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template