Tax Year of Expected Refund 2020

What is the tax year of expected refund

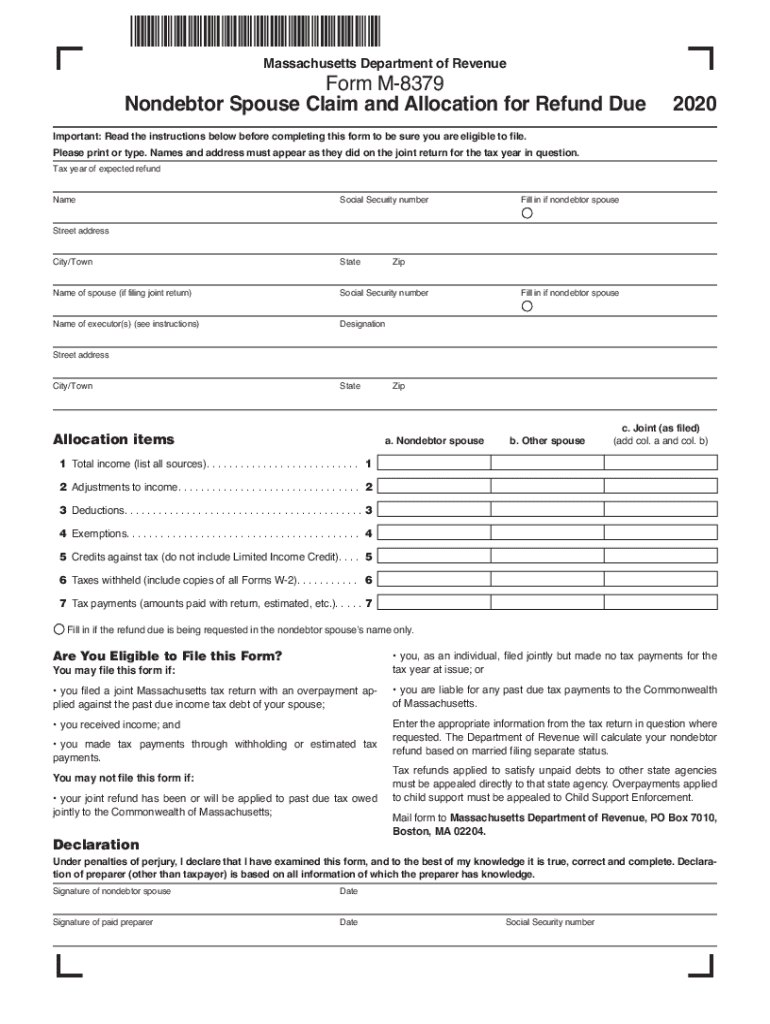

The tax year of expected refund refers to the specific year for which taxpayers anticipate receiving a refund after filing their taxes. For example, if you filed your taxes for the year 2022, your expected refund would be associated with that tax year. Understanding the tax year is crucial for accurately completing forms like the mass dor form m8379, as it directly impacts the calculations and information required for the refund process.

Steps to complete the tax year of expected refund

Completing the tax year of expected refund on the mass dor form m8379 involves several key steps:

- Identify the correct tax year for which you are claiming a refund. This is typically the year for which you filed your tax return.

- Gather all relevant tax documents, including your original tax return and any supporting documentation related to your refund claim.

- Accurately fill out the mass dor form m8379, ensuring that you indicate the correct tax year in the designated section.

- Review the form for accuracy and completeness before submission.

Required documents

When filing the mass dor form m8379, several documents are necessary to support your claim for a refund. These documents may include:

- Your original tax return for the relevant tax year.

- Any W-2 forms or 1099s that report income for that year.

- Documentation related to any deductions or credits you are claiming.

- Proof of identity, such as a driver's license or Social Security card, if required.

Filing deadlines / important dates

Understanding the filing deadlines for the mass dor form m8379 is essential to ensure your claim is processed in a timely manner. Typically, the form must be submitted within three years from the original tax return due date. Important dates may vary based on the tax year, so it is advisable to check the Massachusetts Department of Revenue's official guidelines for the specific deadlines applicable to your situation.

IRS guidelines

The Internal Revenue Service (IRS) provides guidelines that govern the filing of tax forms, including the mass dor form m8379. These guidelines outline the eligibility criteria, documentation requirements, and procedures for claiming a refund. Familiarizing yourself with these guidelines can help ensure that your form is completed correctly and that you meet all necessary requirements for a successful refund claim.

Eligibility criteria

To qualify for a refund using the mass dor form m8379, certain eligibility criteria must be met. Generally, you must have filed a joint tax return and experienced a situation where you are entitled to a refund due to your spouse's tax liability. Specific conditions may apply based on your individual circumstances, so it is important to review the eligibility requirements carefully before proceeding with the form.

Quick guide on how to complete tax year of expected refund

Prepare Tax Year Of Expected Refund effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Tax Year Of Expected Refund on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Tax Year Of Expected Refund with ease

- Obtain Tax Year Of Expected Refund and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tax Year Of Expected Refund to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax year of expected refund

Create this form in 5 minutes!

How to create an eSignature for the tax year of expected refund

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is the mass dor form m8379 and what is its purpose?

The mass dor form m8379 is a Massachusetts Department of Revenue form used for income tax purposes. It is specifically designed for individuals who are applying for a refund related to their Massachusetts tax filings. This form ensures that taxpayers can claim the appropriate credits and refunds they are eligible for.

-

How can airSlate SignNow help with the mass dor form m8379?

airSlate SignNow provides an efficient platform for electronically signing and sending the mass dor form m8379. This streamlines the process, making it faster and more convenient for users, and ensures that the form is submitted on time without the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow for the mass dor form m8379?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and reflects the value of a user-friendly platform that simplifies processes like completing and submitting the mass dor form m8379. Consider the pricing options to find one that fits your budget.

-

What features does airSlate SignNow offer for managing the mass dor form m8379?

airSlate SignNow offers a variety of features such as secure eSigning, document tracking, and customizable templates specifically for the mass dor form m8379. Additionally, the platform allows users to store and organize their forms efficiently, ensuring easy access whenever needed.

-

Are there any integrations available with airSlate SignNow for the mass dor form m8379?

Yes, airSlate SignNow integrates seamlessly with various business applications, which enhances the workflow related to the mass dor form m8379. These integrations allow users to connect their existing tools for more streamlined document management, improving overall efficiency.

-

Can I edit the mass dor form m8379 within airSlate SignNow?

Absolutely! airSlate SignNow allows users to edit the mass dor form m8379, making it easier to complete and update information before sending it for eSignature. This flexibility helps ensure that all necessary information is captured accurately and promptly.

-

What are the benefits of using airSlate SignNow for the mass dor form m8379?

Using airSlate SignNow for the mass dor form m8379 provides numerous benefits including time savings, enhanced security, and ease of use. The platform's intuitive interface allows users to navigate the process effortlessly, reducing the stress often associated with tax forms and documentation.

Get more for Tax Year Of Expected Refund

Find out other Tax Year Of Expected Refund

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer