N 35 Form

What is the N-35?

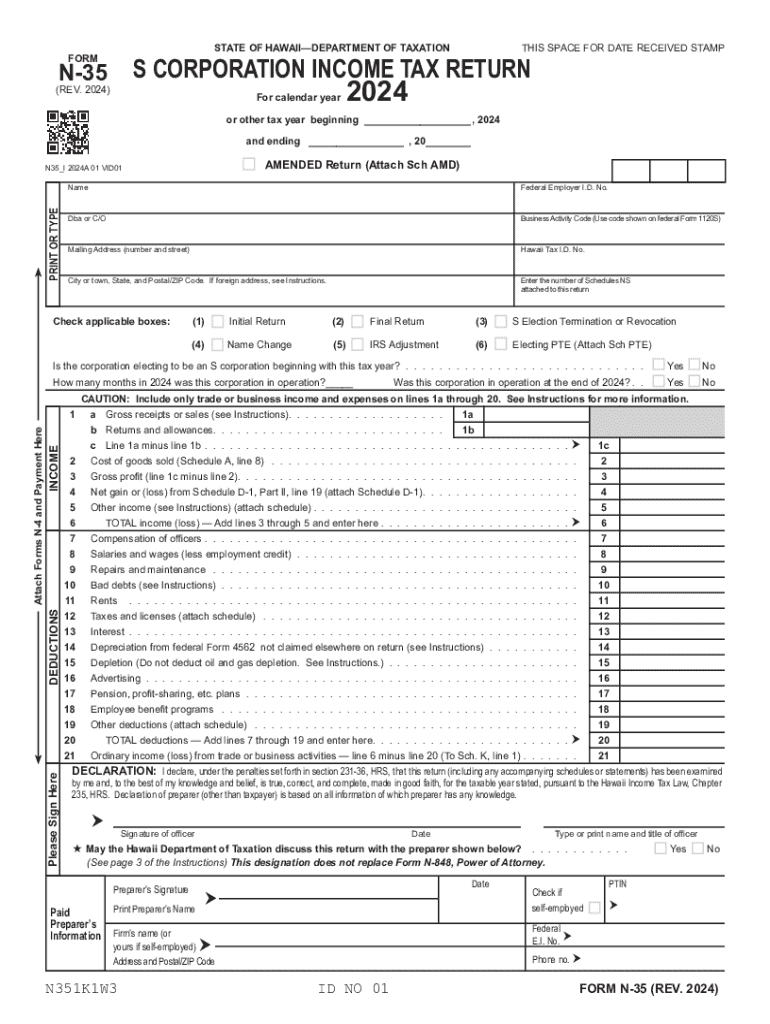

The N-35 form, also known as the Hawaii Corporation Income Tax Return, is a tax document used by corporations operating in Hawaii. This form is specifically designed for corporations to report their income, deductions, and credits to the Hawaii Department of Taxation. It is essential for ensuring compliance with state tax laws and for calculating the corporation's tax liability accurately. Understanding the N-35 is crucial for businesses to maintain good standing and avoid penalties.

How to use the N-35

To use the N-35 form effectively, corporations must gather all necessary financial information, including income, expenses, and any applicable deductions. The form requires detailed reporting of various financial aspects, such as gross income, cost of goods sold, and other deductions. Once completed, the N-35 must be submitted to the Hawaii Department of Taxation by the specified deadline to ensure compliance with state tax regulations.

Steps to complete the N-35

Completing the N-35 form involves several key steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements, balance sheets, and expense records.

- Fill Out the Form: Carefully enter all required information, ensuring accuracy in reporting income, deductions, and credits.

- Review for Errors: Double-check all entries for accuracy and completeness to avoid mistakes that could lead to penalties.

- Submit the Form: File the completed N-35 with the Hawaii Department of Taxation either online or via mail, depending on your preference.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the N-35 form to avoid late fees and penalties. Typically, the N-35 is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April fifteenth. It is advisable to file as early as possible to ensure compliance and allow time for any necessary corrections.

Legal use of the N-35

The N-35 form is legally required for corporations operating within Hawaii. Failing to file this form can result in significant penalties, including fines and interest on unpaid taxes. It is essential for corporations to understand their legal obligations regarding the N-35 to maintain compliance with state tax laws and to avoid potential legal issues.

Who Issues the Form

The N-35 form is issued by the Hawaii Department of Taxation. This state agency is responsible for administering tax laws in Hawaii, including the collection of corporate income taxes. Corporations can obtain the N-35 form directly from the Department of Taxation's website or through authorized tax professionals who assist with corporate tax filings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the n 35

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 'hi n 35 s'?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents efficiently. The term 'hi n 35 s' refers to the quick and seamless process of signing documents in just 35 seconds, making it an ideal choice for those looking to streamline their workflows.

-

How much does airSlate SignNow cost?

airSlate SignNow offers various pricing plans to cater to different business needs. With options starting at an affordable rate, you can experience the benefits of 'hi n 35 s' without breaking the bank, ensuring a cost-effective solution for eSigning documents.

-

What features does airSlate SignNow provide?

airSlate SignNow includes a range of features such as document templates, real-time tracking, and secure cloud storage. These features enhance the 'hi n 35 s' experience by allowing users to manage their documents efficiently and securely.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document management. The 'hi n 35 s' process ensures that your team can focus on what matters most, while still maintaining a professional and efficient workflow.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Salesforce, and more. This flexibility supports the 'hi n 35 s' approach, allowing you to incorporate eSigning into your existing workflows effortlessly.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, enabling users to send and sign documents on the go. This aligns perfectly with the 'hi n 35 s' concept, ensuring that you can complete transactions quickly, no matter where you are.

-

What security measures does airSlate SignNow have in place?

airSlate SignNow prioritizes security with features like encryption and secure access controls. This commitment to safety ensures that your documents are protected while you enjoy the 'hi n 35 s' experience of fast and reliable eSigning.

Get more for N 35

Find out other N 35

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online