Form 540x Fill Out & Sign Online

What is the Form 540x Fill Out & Sign Online

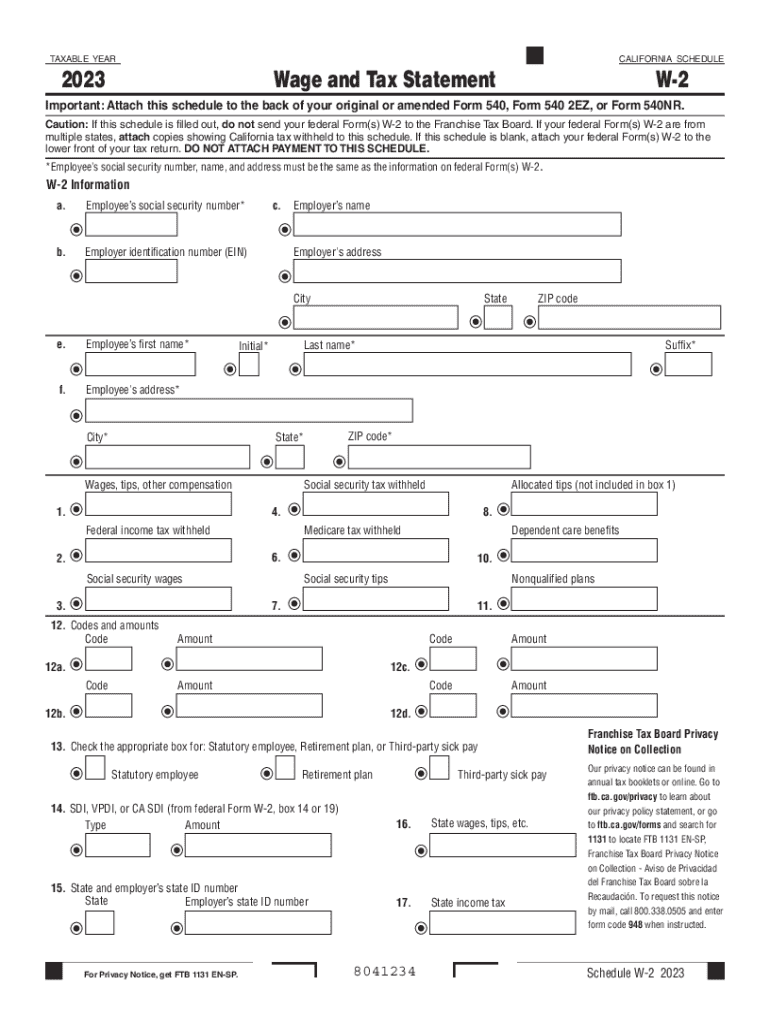

The Form 540x is a California tax form used to amend an individual income tax return. This form allows taxpayers to correct errors or make changes to their previously filed Form 540. Common reasons for filing Form 540x include changes in income, deductions, or credits. By filling out this form, taxpayers can ensure that their tax records are accurate and up to date, potentially leading to refunds or adjustments in tax liability.

Steps to complete the Form 540x Fill Out & Sign Online

Completing the Form 540x online involves several straightforward steps:

- Access the form through a secure online platform.

- Input your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and the original amount reported.

- Detail the changes you are making, including any new income or deductions.

- Calculate the new tax liability or refund amount based on the changes.

- Review the completed form for accuracy before submission.

How to obtain the Form 540x Fill Out & Sign Online

The Form 540x can be obtained easily through various online resources. Taxpayers can visit the California Franchise Tax Board website or utilize trusted e-signature platforms that offer the form for digital completion. Many platforms provide user-friendly interfaces, allowing individuals to fill out and sign the form online securely.

Legal use of the Form 540x Fill Out & Sign Online

The legal use of Form 540x is crucial for ensuring compliance with California tax laws. Taxpayers must file this form within the appropriate timeframe, typically within four years from the original filing date. It is essential to provide accurate information and documentation to avoid penalties or legal issues. Filing the form correctly can also lead to potential refunds if the changes result in a lower tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540x are critical to adhere to for compliance. Generally, amendments must be filed within four years from the original return's due date. For example, if the original return was due on April 15, the amended form should be submitted by April 15 of the fourth year following that date. Taxpayers should also be aware of specific deadlines for claiming refunds or making adjustments to their tax status.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Form 540x. The form can be filed online through authorized e-filing services, which often provide a streamlined process for completion and submission. Alternatively, taxpayers can print the completed form and mail it to the appropriate tax authority. In-person submissions are generally not required, but some individuals may choose to visit local tax offices for assistance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540x fill out amp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Form 540x Fill Out & Sign Online?

To Form 540x Fill Out & Sign Online, simply log into your airSlate SignNow account, upload your Form 540x, and use our intuitive editing tools to fill in the required fields. Once completed, you can easily sign the document electronically and send it to the necessary parties. This streamlined process saves time and ensures accuracy.

-

Is there a cost associated with using airSlate SignNow to Form 540x Fill Out & Sign Online?

Yes, airSlate SignNow offers various pricing plans to suit different needs. You can choose a plan that allows you to Form 540x Fill Out & Sign Online, with features that cater to both individuals and businesses. Our pricing is competitive and designed to provide value for the services offered.

-

What features does airSlate SignNow offer for Form 540x Fill Out & Sign Online?

airSlate SignNow provides a range of features for Form 540x Fill Out & Sign Online, including customizable templates, electronic signatures, and secure document storage. Additionally, our platform allows for real-time collaboration, making it easy to work with others on your tax forms. These features enhance efficiency and simplify the signing process.

-

Can I integrate airSlate SignNow with other applications for Form 540x Fill Out & Sign Online?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when you Form 540x Fill Out & Sign Online. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can connect seamlessly to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for Form 540x Fill Out & Sign Online?

Using airSlate SignNow to Form 540x Fill Out & Sign Online offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our electronic signature solution ensures that your documents are signed quickly and securely, while also providing a clear audit trail. This not only saves time but also helps you stay organized.

-

Is airSlate SignNow secure for filling out and signing Form 540x online?

Yes, airSlate SignNow prioritizes security when you Form 540x Fill Out & Sign Online. Our platform uses advanced encryption and complies with industry standards to protect your sensitive information. You can trust that your documents are safe and secure throughout the entire signing process.

-

How can I get support if I have issues with Form 540x Fill Out & Sign Online?

If you encounter any issues while using airSlate SignNow to Form 540x Fill Out & Sign Online, our customer support team is here to help. You can signNow out via live chat, email, or phone for assistance. We also provide a comprehensive knowledge base with tutorials and FAQs to help you navigate any challenges.

Get more for Form 540x Fill Out & Sign Online

Find out other Form 540x Fill Out & Sign Online

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document