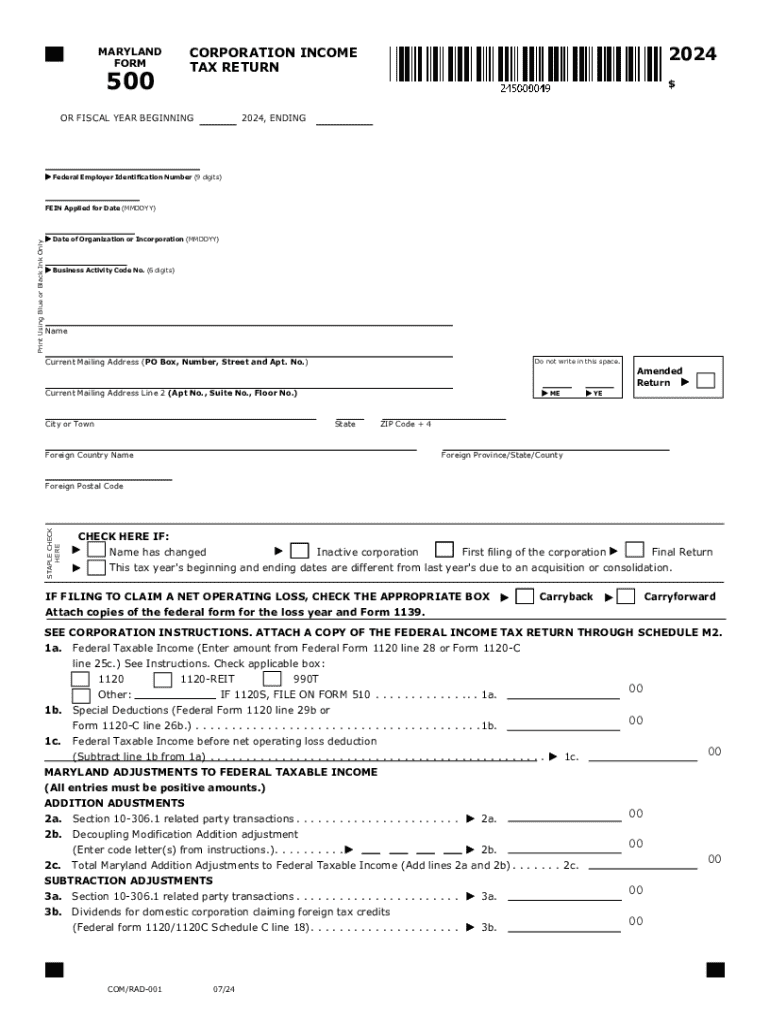

Maryland Form 500 Corporation Income Tax Return

What is the Maryland Form 500 Corporation Income Tax Return

The Maryland Form 500 is the official document used by corporations to report their income and calculate their state tax obligations. This form is essential for all corporations operating in Maryland, including C corporations and S corporations that have elected to be taxed as a corporation. The Maryland Form 500 serves to ensure compliance with state tax laws and provides a comprehensive overview of a corporation's financial activities over the tax year.

Steps to complete the Maryland Form 500 Corporation Income Tax Return

Completing the Maryland Form 500 involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and records of deductions.

- Begin filling out the form by entering the corporation's identifying information, such as name, address, and federal employer identification number (EIN).

- Report total income and calculate the taxable income by subtracting allowable deductions.

- Determine the tax liability using the applicable Maryland tax rates.

- Review the form for accuracy and completeness before submission.

How to obtain the Maryland Form 500 Corporation Income Tax Return

The Maryland Form 500 can be obtained through the Maryland Comptroller's website or by visiting their local office. The form is available in both digital and printable formats, allowing businesses to choose their preferred method of completion. For those who prefer to file online, the form can also be accessed through approved e-filing software that supports Maryland tax submissions.

Filing Deadlines / Important Dates

It is crucial for corporations to be aware of the filing deadlines for the Maryland Form 500. Typically, the form must be filed by the 15th day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. Extensions may be available, but they must be requested in advance to avoid penalties.

Required Documents

To accurately complete the Maryland Form 500, corporations should prepare several key documents:

- Financial statements, including income and expense reports.

- Records of any deductions claimed, such as business expenses and credits.

- Previous year’s tax return for reference.

- Documentation supporting any special tax treatments or elections made by the corporation.

Penalties for Non-Compliance

Failure to file the Maryland Form 500 on time can result in significant penalties. Corporations may face late filing fees, which can accumulate over time, as well as interest on any unpaid taxes. It is essential for businesses to adhere to filing requirements to avoid these financial repercussions and maintain good standing with state tax authorities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 500 corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MD 500 tax form?

The MD 500 tax form is a specific document used for reporting certain tax information in Maryland. It is essential for individuals and businesses to understand its requirements to ensure compliance with state tax laws. airSlate SignNow can help you eSign and send this form efficiently.

-

How can airSlate SignNow assist with the MD 500 tax form?

airSlate SignNow provides a user-friendly platform to easily eSign and send the MD 500 tax form. Our solution streamlines the process, allowing you to complete your tax documentation quickly and securely. This ensures that you meet all deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for the MD 500 tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your MD 500 tax form and other documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the MD 500 tax form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the MD 500 tax form. These tools enhance your workflow and ensure that your documents are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other software for the MD 500 tax form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your MD 500 tax form alongside your existing tools. This flexibility allows you to streamline your processes and improve overall productivity.

-

What are the benefits of using airSlate SignNow for the MD 500 tax form?

Using airSlate SignNow for the MD 500 tax form provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, ensuring that you can focus on your business while we handle your documentation needs.

-

Is airSlate SignNow secure for handling the MD 500 tax form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your MD 500 tax form and other documents are protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for Maryland Form 500 Corporation Income Tax Return

- Ny civ 194 mold form

- Ny hybrid entity status pursuant to hipaa form

- Nm word of life christian academy parentstudent handbook form

- Nh air registration form

- Wa annual vacation rental permit application chelan county form

- Wa federal way public schools form 32071

- Il village of lisle newsletter form

- Co dpd 241b form

Find out other Maryland Form 500 Corporation Income Tax Return

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer