Rev 72 2017-2026

What is the Rev 72?

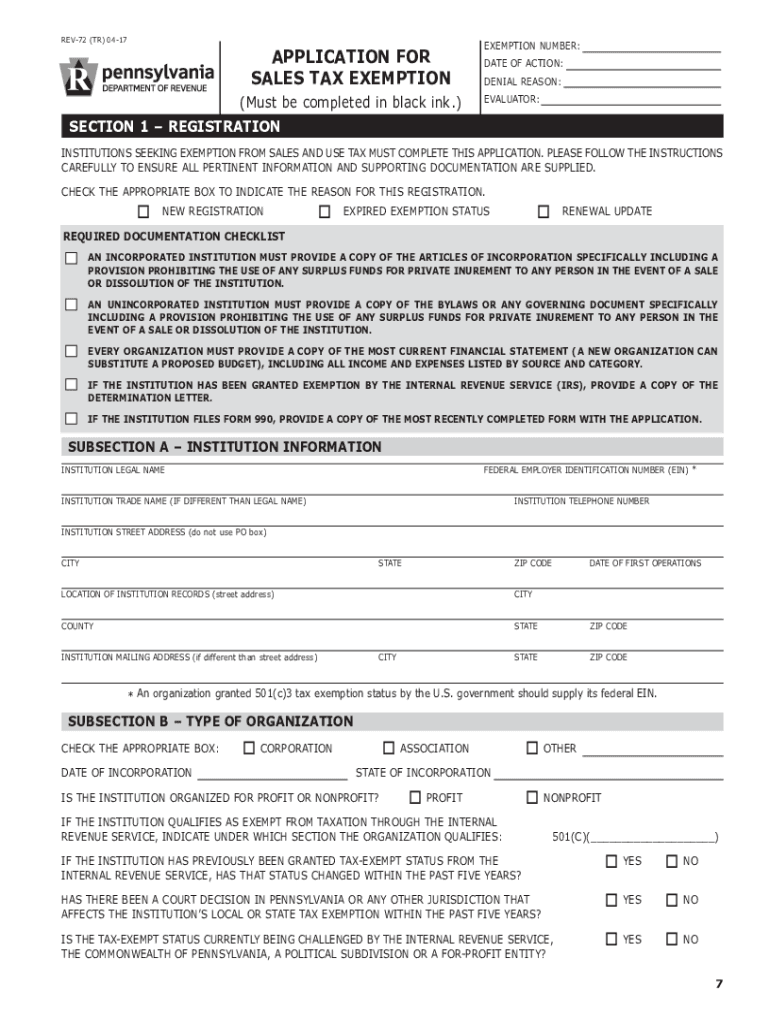

The Rev 72 form, also known as the Pennsylvania Sales Tax Exemption Form, is a crucial document for businesses and organizations in Pennsylvania seeking to claim exemption from sales tax on certain purchases. This form is primarily used by entities that qualify under specific categories, such as non-profit organizations, government agencies, and educational institutions, allowing them to make tax-exempt purchases for their operations. Understanding the Rev 72 is essential for ensuring compliance with Pennsylvania tax regulations while maximizing potential savings on eligible purchases.

How to obtain the Rev 72

Obtaining the Rev 72 form is a straightforward process. Businesses and organizations can access the form online through the Pennsylvania Department of Revenue’s website. It is available in a fillable PDF format, making it easy to complete electronically. Additionally, organizations may request a physical copy by contacting the Pennsylvania Department of Revenue directly. Ensuring that you have the most current version of the Rev 72 is important, as outdated forms may not be accepted for tax exemption purposes.

Steps to complete the Rev 72

Completing the Rev 72 form involves a few key steps to ensure accuracy and compliance. Start by gathering necessary information, such as the organization's name, address, and tax identification number. Next, indicate the reason for the exemption by selecting the appropriate category that applies to your organization. After filling out the required fields, review the form for completeness and accuracy. Finally, the form must be signed by an authorized representative of the organization to validate the exemption claim. Once completed, the form can be submitted to vendors when making tax-exempt purchases.

Legal use of the Rev 72

The legal use of the Rev 72 form is governed by Pennsylvania tax laws, which outline specific criteria for tax exemption eligibility. Organizations must ensure they meet these criteria to avoid potential penalties or audits. The completed Rev 72 serves as proof of eligibility for sales tax exemption when presented to vendors. Misuse of the form, such as using it for non-eligible purchases, can lead to legal repercussions, including fines or back taxes owed. Therefore, it is vital to understand the legal implications of using the Rev 72 correctly.

Eligibility Criteria

To qualify for a sales tax exemption using the Rev 72 form, organizations must meet certain eligibility criteria established by the Pennsylvania Department of Revenue. Generally, eligible entities include non-profit organizations, government agencies, and educational institutions. Additionally, the purchases must be made for specific exempt purposes, such as for use in the organization’s operations or for resale. It is important to review the detailed eligibility requirements to ensure compliance and avoid any issues during the exemption process.

Form Submission Methods

The Rev 72 form can be submitted through various methods, depending on the preferences of the organization and the vendor. Organizations can present the completed form directly to vendors at the time of purchase, ensuring that the vendor accepts it for tax exemption. Additionally, some vendors may require a copy of the form to be kept on file for their records. It is essential to confirm the submission method preferred by each vendor to ensure that the exemption is applied correctly.

Quick guide on how to complete rev 72

Complete Rev 72 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Manage Rev 72 on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Rev 72 without stress

- Locate Rev 72 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Rev 72 while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rev 72

Create this form in 5 minutes!

How to create an eSignature for the rev 72

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is a PA sales tax exemption form?

A PA sales tax exemption form is a document that allows eligible businesses to make tax-exempt purchases in Pennsylvania. This form is crucial for organizations that frequently purchase goods and services without incurring sales tax. By using the PA sales tax exemption form, businesses can streamline their purchasing process and ensure compliance with state regulations.

-

How can airSlate SignNow help me with the PA sales tax exemption form?

AirSlate SignNow offers an easy-to-use platform for creating, sending, and eSigning your PA sales tax exemption form. With our cost-effective solution, you can manage your documents efficiently and track their status in real-time. This will save you time and simplify your workflow, ensuring your tax exemption processes are handled promptly.

-

Is there a cost associated with using the airSlate SignNow service for PA sales tax exemption forms?

Yes, airSlate SignNow offers flexible pricing plans to accommodate different business needs. You can choose the plan that best suits your requirements and budget, whether you are a small business or a large enterprise. Our services provide exceptional value for managing your PA sales tax exemption form and other documents efficiently.

-

Can I integrate airSlate SignNow with other software for handling my PA sales tax exemption form?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of software applications and tools. This allows you to automate your workflows, including those related to the PA sales tax exemption form, making your processes more efficient and interconnected.

-

What are the benefits of using airSlate SignNow for my PA sales tax exemption form needs?

Using airSlate SignNow for your PA sales tax exemption form provides several benefits, including ease of use, time savings, and document security. You can handle all your signing needs online, reducing the paperwork and improving turnaround times. Additionally, our platform ensures that your documents remain secure and compliant with state regulations.

-

How does eSigning the PA sales tax exemption form work?

eSigning the PA sales tax exemption form with airSlate SignNow is a simple and straightforward process. You upload your document, add the necessary fields, and invite other parties to sign electronically. Once signed, the document is stored securely and can be accessed anytime, making it convenient for your business needs.

-

What should I do if my PA sales tax exemption form is denied?

If your PA sales tax exemption form is denied, it's essential to review the reasons for denial provided by the authority. Ensure all information is accurate and meets the requirements set by the Pennsylvania Department of Revenue. You can also consult our support team for assistance in rectifying any issues with the document.

Get more for Rev 72

- When is war justified lesson 2 answers form

- Big book awakening pdf form

- Wr form

- Mba suppelmentary statement of continueing disability form

- Wow burger application form

- 01fast final interventioncentralmysdhcorg form

- Monthly report ministry of social development form

- Sawgrass springs middle school form

Find out other Rev 72

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document