Puerto Rico Corporation Tax Return 2018

What is the Puerto Rico Corporation Tax Return

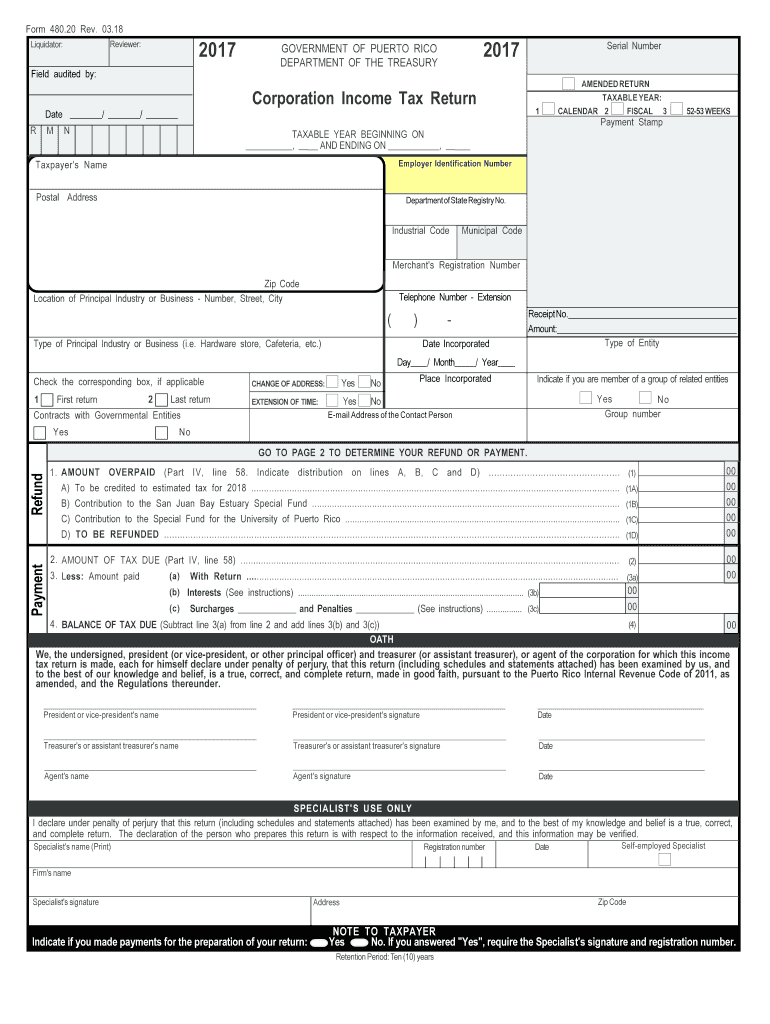

The Puerto Rico Corporation Tax Return, commonly referred to as Form 480.20, is a crucial document for businesses operating in Puerto Rico. This form is used to report the income, deductions, and credits of corporations, partnerships, and other business entities. It allows the Puerto Rico Department of Treasury to assess the tax liability of the entity based on its financial activities during the tax year. Understanding this form is essential for compliance with local tax laws and ensuring that businesses fulfill their fiscal responsibilities.

Steps to complete the Puerto Rico Corporation Tax Return

Completing the Puerto Rico Corporation Tax Return involves several key steps that ensure accuracy and compliance. Here is a simplified process:

- Gather financial records: Collect all necessary documentation, including income statements, expense reports, and prior tax returns.

- Fill out the form: Enter the required information on Form 480.20, ensuring that all figures are accurate and reflect the business's financial status.

- Review for accuracy: Double-check all entries for errors or omissions to avoid potential penalties.

- Submit the form: File the completed return with the Puerto Rico Department of Treasury by the specified deadline.

Legal use of the Puerto Rico Corporation Tax Return

The legal use of the Puerto Rico Corporation Tax Return is governed by regulations set forth by the Puerto Rico Department of Treasury. To ensure that the return is considered valid, it must be completed accurately and submitted on time. Additionally, businesses must retain copies of their filings and supporting documents for a minimum of three years, as these may be requested during audits or reviews. Compliance with these legal requirements helps protect businesses from penalties and ensures their standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Puerto Rico Corporation Tax Return are critical for compliance. Typically, the return is due on the fifteenth day of the fourth month following the end of the tax year. For example, if the tax year ends on December 31, the return would be due by April 15 of the following year. It is important for businesses to mark these dates on their calendars to avoid late filing fees and penalties. Additionally, extensions may be available, but they must be formally requested and approved by the Puerto Rico Department of Treasury.

Required Documents

To complete the Puerto Rico Corporation Tax Return, several documents are required to support the information reported on the form. These typically include:

- Income statements: Detailed records of all income earned during the tax year.

- Expense documentation: Receipts and invoices for all business-related expenses.

- Prior year tax returns: Copies of previous filings can provide useful context and assist in completing the current return.

- Financial statements: Balance sheets and profit and loss statements to provide a comprehensive view of the business's financial health.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit the Puerto Rico Corporation Tax Return through various methods, ensuring flexibility and convenience. The primary submission options include:

- Online filing: Many businesses opt to file electronically through the Puerto Rico Department of Treasury's online portal, which can streamline the process and reduce processing times.

- Mail: Completed forms can be printed and mailed to the appropriate tax office, ensuring they are sent well before the deadline.

- In-person submission: Businesses may also choose to deliver their returns directly to a local tax office for immediate processing.

Quick guide on how to complete puerto rico corporation tax return

Complete Puerto Rico Corporation Tax Return effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to find the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Puerto Rico Corporation Tax Return on any platform using the airSlate SignNow Android or iOS applications and streamline any document-focused process today.

How to modify and eSign Puerto Rico Corporation Tax Return with ease

- Locate Puerto Rico Corporation Tax Return and click Get Form to initiate.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Modify and eSign Puerto Rico Corporation Tax Return and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct puerto rico corporation tax return

Create this form in 5 minutes!

How to create an eSignature for the puerto rico corporation tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

Can a US company do business in Puerto Rico?

A foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary.

-

Is it worth moving to Puerto Rico to avoid taxes?

Another huge tax advantage to living in Puerto Rico is that you do not have to pay any taxes on capital gains. If you remain living in the United States, you would have to pay 20 percent on capital gains. If you do decide to move to Puerto Rico, make note of the value of shares you own.

-

How are US corporations taxed in Puerto Rico?

If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%. However, under the Puerto Rico Incentives Code (Act 60), businesses based in Puerto Rico only need to pay a 4% corporate income tax on goods and services exported from the commonwealth.

-

Is Puerto Rico a corporate tax haven?

Puerto Rico's Act 60 promotes investment in Puerto Rico through tax incentives. These tax benefits include zero tax on passive income, including capital gains, dividends, and interest. Other tax benefits from Act 60 include: 2-4% corporate tax.

-

Is Puerto Rico a tax haven for the US?

For some individuals and businesses, Puerto Rico could be the crypto tax haven you've been searching for. A law known as Act 60 makes Puerto Rico taxes very favorable to crypto investors. This tax haven can easily save taxpayers hundreds of thousands of dollars per year (or more) in federal taxes!

-

Do I have to file a Puerto Rico tax return?

Yes, since you are a Puerto Rico resident, you must file the Puerto Rico income tax return reporting all your earnings, and you may claim a credit in such return for any income taxes paid to the United States.

-

Does Puerto Rico have corporate tax?

Puerto Rico Income Tax If your LLC is taxed as a Puerto Rico corporation, you'll need to pay corporate income tax. Puerto Rico's corporate tax rate is 37.5%.

-

What are the tax advantages of Puerto Rico?

4% corporate tax rate. 100% tax-exempt dividends. 60% exemption on municipal taxes. No federal taxes on Puerto Rico source income.

Get more for Puerto Rico Corporation Tax Return

- Medical record addendum template 239611842 form

- Marriage license application form

- Durham public schools student accident injury reporting form

- Egghead book pdf form

- Schwab simple ira elective deferral agreement form

- Pru 100 dui advisement of rights waiver and plea form first offense

- Answer limited up to 10k form

- Service partnership agreement template form

Find out other Puerto Rico Corporation Tax Return

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors