Tennessee Schedule B 2018-2026

What is the Tennessee Schedule B

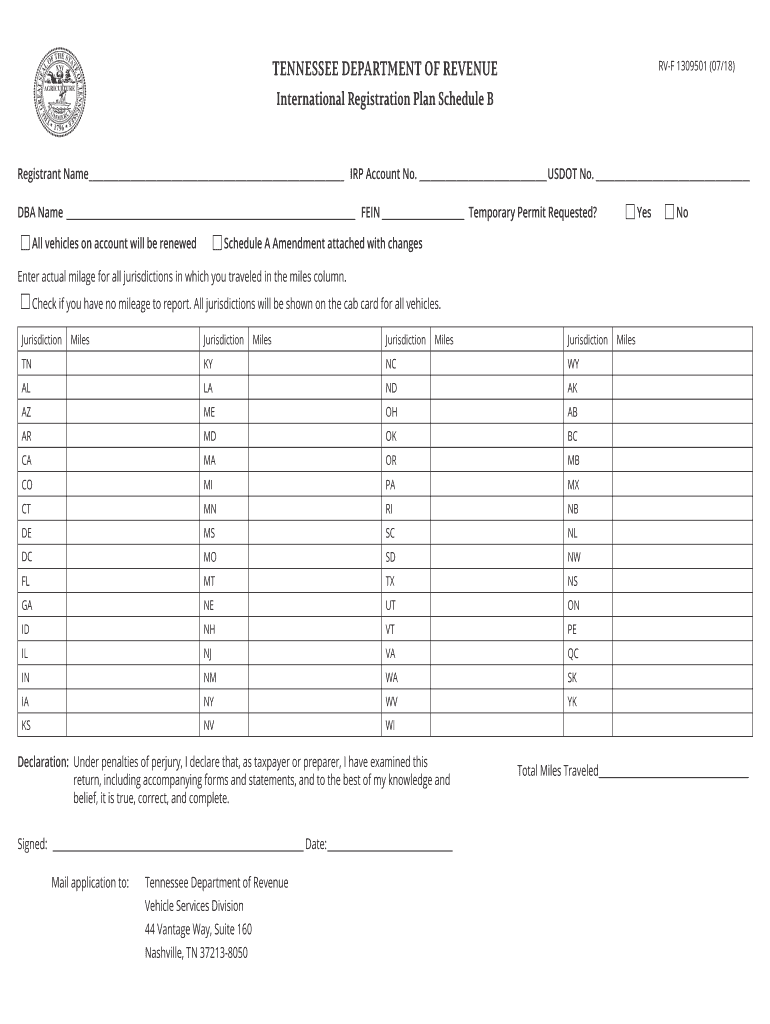

The Tennessee Schedule B is a tax form used by businesses and individuals to report specific types of income and deductions associated with their tax obligations in the state of Tennessee. This form is particularly relevant for entities that are subject to the International Registration Plan (IRP), which governs the registration of commercial vehicles in multiple jurisdictions. The Schedule B provides a detailed breakdown of the income derived from various sources, ensuring compliance with state tax regulations.

How to use the Tennessee Schedule B

Using the Tennessee Schedule B involves several steps to ensure accurate reporting of income and deductions. First, gather all necessary financial documents, including income statements and receipts for deductible expenses. Next, complete the form by entering the required information in the designated fields. It is crucial to follow the instructions carefully to avoid errors that could lead to penalties. Once completed, the form should be submitted along with your main tax return to the appropriate tax authority.

Steps to complete the Tennessee Schedule B

Completing the Tennessee Schedule B requires attention to detail. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductible expenses.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number or EIN.

- Report your income sources in the appropriate sections, ensuring accuracy in the amounts reported.

- List any deductions you are eligible for, providing necessary documentation to support your claims.

- Review the completed form for any errors or omissions before submission.

- Submit the form with your main tax return by the specified deadline.

Legal use of the Tennessee Schedule B

The legal use of the Tennessee Schedule B is governed by state tax laws and regulations. It is essential to ensure that the information reported is accurate and complete to avoid legal repercussions. The form serves as a formal declaration of income and deductions, and any discrepancies can lead to audits or penalties. Utilizing a reliable electronic signature platform can enhance the legal validity of the submitted form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee Schedule B align with the overall tax filing deadlines set by the state. Typically, individual tax returns are due on April 15 each year. It is important to stay informed about any changes in deadlines, especially for extensions or specific circumstances that may affect your filing date. Mark your calendar to ensure timely submission and avoid penalties.

Required Documents

To complete the Tennessee Schedule B, certain documents are required. These may include:

- Income statements such as W-2s and 1099s.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation required for specific deductions or credits.

Who Issues the Form

The Tennessee Schedule B is issued by the Tennessee Department of Revenue. This governmental body is responsible for the administration and enforcement of state tax laws, including the issuance of forms and guidelines for taxpayers. It is advisable to refer to the official website or contact the department for the most current versions of the form and related instructions.

Quick guide on how to complete tennessee schedule b

Complete Tennessee Schedule B effortlessly on any device

Digital document administration has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate format and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without complications. Handle Tennessee Schedule B on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Tennessee Schedule B with ease

- Locate Tennessee Schedule B and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important parts of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate reprinting documents. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign Tennessee Schedule B and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tennessee schedule b

Create this form in 5 minutes!

How to create an eSignature for the tennessee schedule b

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What is the Tennessee Schedule B and how does it relate to airSlate SignNow?

The Tennessee Schedule B is a form that must be filed with tax returns, providing additional income details. airSlate SignNow allows users to easily send and eSign these documents securely, streamlining the process of managing compliance with Tennessee Schedule B requirements.

-

How can airSlate SignNow help with filing the Tennessee Schedule B?

airSlate SignNow simplifies the process of preparing and submitting the Tennessee Schedule B by enabling users to create, edit, and eSign documents online. This efficient solution reduces the chances of errors and helps ensure timely submissions.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to various business needs. These plans include different features tailored to help manage documents like the Tennessee Schedule B effectively, ensuring a cost-effective solution for all users.

-

Can I integrate airSlate SignNow with other software for managing my Tennessee Schedule B?

Yes, airSlate SignNow offers integrations with popular software applications, allowing users to manage their Tennessee Schedule B alongside other financial tools. This feature enhances workflow efficiency and ensures all your documents are easily accessible in one place.

-

What features does airSlate SignNow offer that benefit users dealing with the Tennessee Schedule B?

airSlate SignNow includes features such as easy document sharing, real-time tracking, and secure eSigning, which are particularly beneficial for managing the Tennessee Schedule B. These functionalities help streamline the document process, ensuring users remain compliant and organized.

-

Is airSlate SignNow secure for handling sensitive documents like the Tennessee Schedule B?

Absolutely! airSlate SignNow employs advanced encryption and security measures, making it a safe platform for handling sensitive documents, including the Tennessee Schedule B. Users can trust that their information is protected throughout the eSigning process.

-

How long does it take to set up airSlate SignNow for filing the Tennessee Schedule B?

Setting up airSlate SignNow is quick and user-friendly, typically taking just a few minutes. Once registered, users can immediately start preparing and eSigning documents like the Tennessee Schedule B, enhancing their filing process.

Get more for Tennessee Schedule B

- Participant data form for sponsoring organizations of day care health ny

- Dd2813 24428600 form

- American specialty health ash patient progress po box form

- Im23 form

- Title 4 letter form

- Rem application form

- Cit 0010 f confirmation de la citoyennet canadienne du ou des cic gc form

- Domestic partnership agreement template form

Find out other Tennessee Schedule B

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT