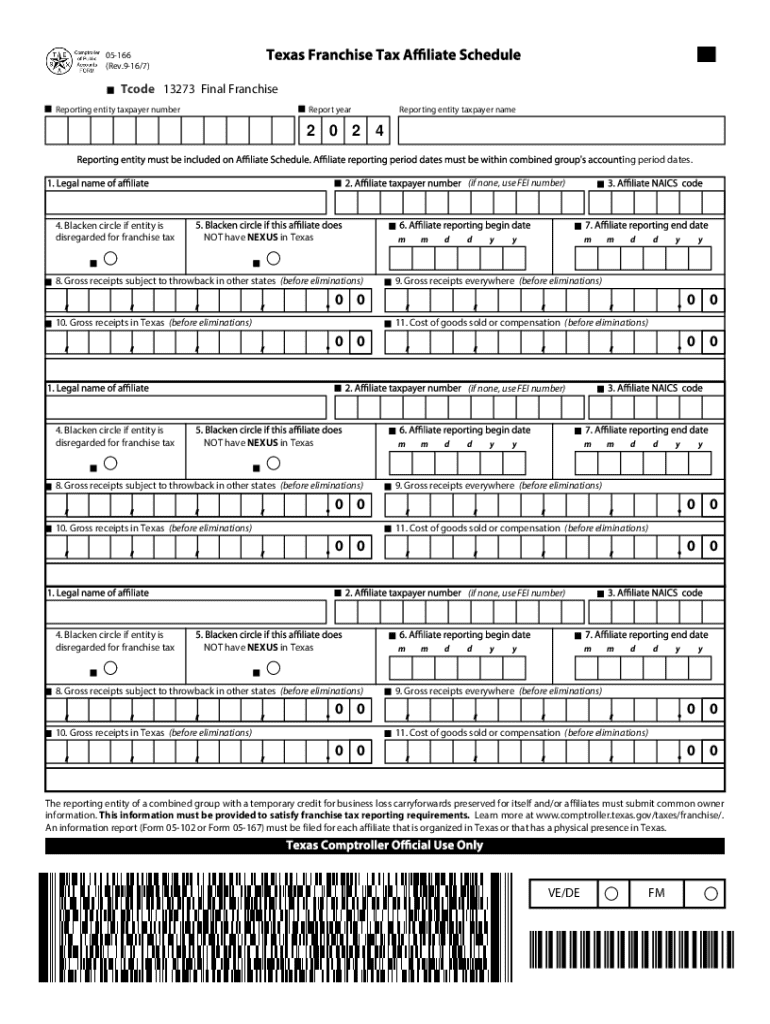

Form 05 166, Texas Franchise Tax Affiliate Schedule for Final Report

Understanding the Texas Franchise Tax Affiliate Schedule (Form 05-166)

The Texas Franchise Tax Affiliate Schedule, officially known as Form 05-166, is a critical document for businesses operating in Texas that are required to file a franchise tax report. This form is specifically designed for entities that have affiliates and need to report their income and expenses accurately. The Texas Franchise Tax is a privilege tax imposed on businesses operating in the state, and the affiliate schedule helps in determining the tax liability based on the combined income of the affiliates.

How to Complete Form 05-166

Filling out Form 05-166 involves several key steps. First, gather all necessary financial information from your affiliates, including their income, deductions, and other relevant financial data. Next, ensure that you accurately report each affiliate's details in the sections provided on the form. Pay close attention to the calculations, as errors can lead to penalties. Once completed, review the form for accuracy before submission. It is advisable to consult a tax professional if you have questions about specific entries or calculations.

Obtaining Form 05-166

Form 05-166 can be easily obtained from the Texas Comptroller of Public Accounts website. The form is available in a downloadable PDF format, which you can print and fill out manually. Additionally, some tax software programs may include the form, allowing for electronic completion and submission. Ensure you have the latest version of the form to comply with current tax regulations.

Key Elements of Form 05-166

The key elements of Form 05-166 include sections for reporting the names and addresses of the affiliates, their respective income, deductions, and the overall tax liability. It also requires detailed information about the relationship between the primary business and its affiliates. Understanding these elements is crucial for accurate reporting and compliance with Texas tax laws.

Filing Deadlines for Form 05-166

Filing deadlines for Form 05-166 typically align with the franchise tax report deadlines. Generally, the form must be submitted by May 15 for most businesses. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these deadlines to avoid late filing penalties.

Legal Considerations for Using Form 05-166

Using Form 05-166 carries legal responsibilities. Businesses must ensure that all information provided is accurate and complete, as false reporting can lead to severe penalties, including fines and interest on unpaid taxes. It is essential to maintain proper documentation to support the entries made on the form, as the Texas Comptroller may request this information during audits.

Examples of Form 05-166 Usage

Form 05-166 is commonly used by various business entities, including limited liability companies (LLCs), corporations, and partnerships that have affiliates. For example, a corporation with multiple subsidiaries would use this form to consolidate its financial data and determine its overall tax liability. Similarly, an LLC with several related businesses would report the income and expenses of each affiliate to comply with Texas tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 05 166 texas franchise tax affiliate schedule for final report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas affiliate schedule and how does it work?

The Texas affiliate schedule is a structured timeline that outlines the key dates and deadlines for affiliate program activities in Texas. It helps businesses manage their affiliate partnerships effectively by providing clarity on when to expect commissions, promotions, and reporting. Understanding this schedule is crucial for maximizing your affiliate marketing efforts.

-

How can airSlate SignNow help with managing the Texas affiliate schedule?

airSlate SignNow offers a streamlined solution for managing documents related to the Texas affiliate schedule. With features like eSigning and document tracking, businesses can ensure that all agreements and schedules are executed promptly. This efficiency helps maintain strong relationships with affiliates and keeps your program running smoothly.

-

What are the pricing options for using airSlate SignNow with the Texas affiliate schedule?

airSlate SignNow provides flexible pricing plans that cater to different business needs, including those managing a Texas affiliate schedule. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while offering essential features for document management and eSigning. Check our website for the latest pricing details.

-

What features does airSlate SignNow offer for the Texas affiliate schedule?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking, all of which are beneficial for managing the Texas affiliate schedule. These tools simplify the process of sending and signing documents, ensuring that all parties are aligned with the schedule. This enhances productivity and reduces the risk of errors.

-

How does airSlate SignNow ensure compliance with the Texas affiliate schedule?

Compliance with the Texas affiliate schedule is crucial for businesses, and airSlate SignNow helps ensure this through secure document management and eSigning capabilities. Our platform adheres to legal standards, providing a reliable way to handle contracts and agreements. This compliance helps protect your business and maintain trust with your affiliates.

-

Can airSlate SignNow integrate with other tools for managing the Texas affiliate schedule?

Yes, airSlate SignNow offers integrations with various tools that can enhance your management of the Texas affiliate schedule. Whether you use CRM systems, marketing platforms, or project management tools, our integrations allow for seamless data flow and improved efficiency. This connectivity helps streamline your affiliate operations.

-

What are the benefits of using airSlate SignNow for the Texas affiliate schedule?

Using airSlate SignNow for the Texas affiliate schedule provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. The platform's user-friendly interface makes it easy for all stakeholders to access and sign documents quickly. This leads to faster turnaround times and a more organized affiliate program.

Get more for Form 05 166, Texas Franchise Tax Affiliate Schedule For Final Report

- Dear clerk form

- Sample letter change of service provider webcams ip form

- We have enclosed a summons for n a m e and our check in the amount of form

- Medicare prescription drug benefit manual cmsgov form

- Enclosed herewith please find the original and one copy of the following form

- Us environmental protection agency correspondence manual 1320 form

- Enclosed herewith please find the originals and one copy of plaintiffs motion for protective form

- Name u form

Find out other Form 05 166, Texas Franchise Tax Affiliate Schedule For Final Report

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement