New York Credit Application Form

What is the New York Credit Application

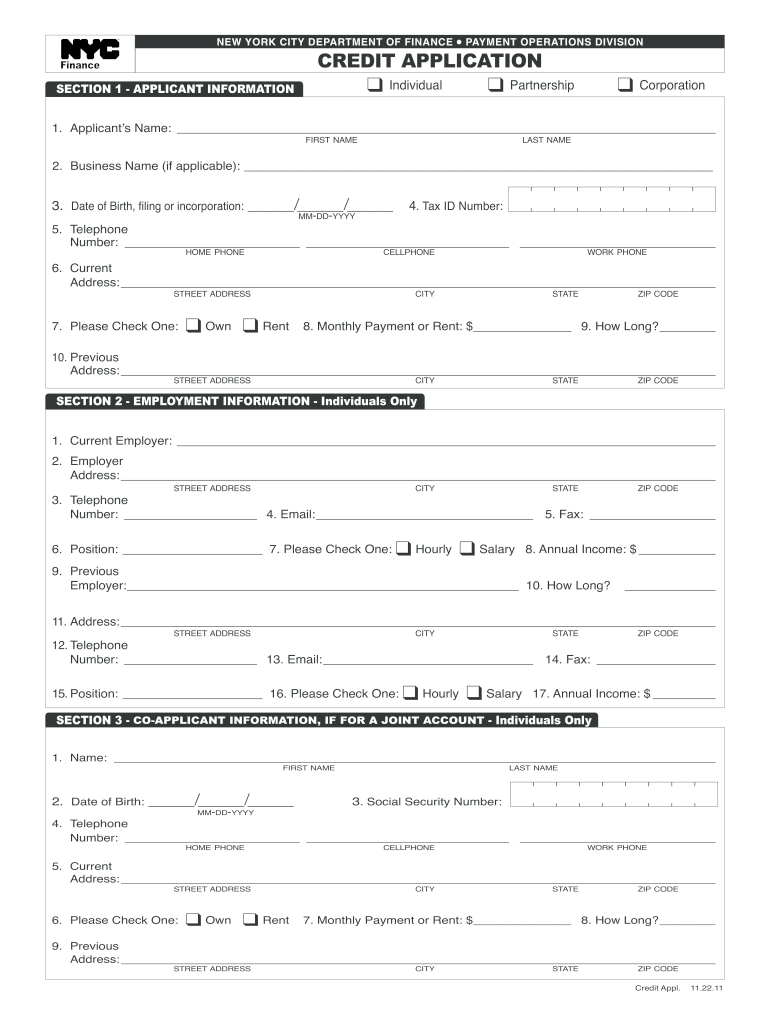

The New York credit application is a formal document used by individuals and businesses to apply for credit from financial institutions or lenders within the state of New York. This application typically collects essential information about the applicant's financial history, creditworthiness, and personal details. It serves as a critical tool for lenders to assess the risk associated with granting credit and to determine the terms of the loan or credit offered. Understanding the components of this application can help applicants present their financial situation more effectively.

How to Use the New York Credit Application

Utilizing the New York credit application involves several key steps. First, gather all necessary personal and financial information, including income details, employment history, and existing debts. Next, fill out the application accurately, ensuring that all information is complete and truthful. After submitting the application, it is crucial to monitor its status and respond promptly to any requests for additional information from the lender. Using a digital platform can streamline this process, allowing for easy access and submission of the application online.

Steps to Complete the New York Credit Application

Completing the New York credit application involves a systematic approach:

- Gather necessary documents, such as identification, proof of income, and credit history.

- Fill in personal details, including name, address, and Social Security number.

- Provide financial information, such as current employment, income, and monthly expenses.

- Disclose any existing debts and liabilities to give a complete picture of your financial status.

- Review the application for accuracy before submission.

Following these steps can enhance the likelihood of approval by presenting a clear and comprehensive financial profile to the lender.

Legal Use of the New York Credit Application

The legal use of the New York credit application is governed by various regulations that ensure consumer protection and fair lending practices. It is essential for applicants to understand their rights, including the right to receive a copy of their credit report and the right to dispute inaccuracies. The application must comply with federal and state laws, such as the Fair Credit Reporting Act, which mandates transparency in how credit information is used. Ensuring compliance with these legal standards protects both the applicant and the lender.

Required Documents

When completing the New York credit application, several documents are typically required to verify the applicant's identity and financial status. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Proof of income, which may include pay stubs, tax returns, or bank statements.

- Credit history reports, which can be obtained from credit bureaus.

- Documentation of existing debts, such as loan statements or credit card bills.

Having these documents ready can facilitate a smoother application process and improve the chances of approval.

Application Process & Approval Time

The application process for the New York credit application typically involves submitting the completed form along with required documentation to the lender. Once submitted, the lender reviews the application, which may take anywhere from a few hours to several days, depending on the institution's policies and the complexity of the application. Factors such as the applicant's credit score, income stability, and existing debts can influence the approval time. Being prepared with all necessary information can help expedite the process.

Quick guide on how to complete new york credit application

Complete New York Credit Application effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage New York Credit Application on any device with the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to edit and eSign New York Credit Application effortlessly

- Obtain New York Credit Application and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign New York Credit Application and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york credit application

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the new york credit application process with airSlate SignNow?

The new york credit application process with airSlate SignNow is designed to be simple and efficient. Users can create, send, and eSign credit applications electronically, reducing paper usage and streamlining workflows. Our platform ensures that all documents are secured and compliant, making the process not only fast but also reliable.

-

What features does airSlate SignNow offer for the new york credit application?

airSlate SignNow offers an intuitive interface for the new york credit application, including templates, automated reminders, and status tracking. Users can easily customize their applications and integrate them with existing workflows. These features enhance user experience and increase the speed of document processing.

-

How much does it cost to use airSlate SignNow for a new york credit application?

Our pricing plans for using airSlate SignNow for a new york credit application are competitive and tailored to meet different business needs. We offer a variety of subscription options, including monthly and annual plans, ensuring that businesses of all sizes can find a solution that fits their budget. Additionally, a free trial is available to help you get started.

-

Can I integrate airSlate SignNow with other applications for the new york credit application?

Yes, airSlate SignNow allows for seamless integrations with various applications to enhance the new york credit application process. You can connect with CRM platforms, document management systems, and other tools to streamline your workflow. This flexibility enables you to maintain efficiency across different platforms.

-

What are the benefits of using airSlate SignNow for a new york credit application?

Using airSlate SignNow for a new york credit application offers numerous benefits, including faster document turnaround and improved accuracy. The electronic signature feature reduces the time spent on manual processes, while ensuring compliance with industry regulations. Businesses also save costs on paper and printing, making it a smart choice.

-

Is airSlate SignNow secure for handling new york credit applications?

Absolutely, airSlate SignNow prioritizes security in handling new york credit applications. We utilize advanced encryption methods and provide secure access controls to protect sensitive information. Compliance with industry standards further ensures that your documents are safe and confidential.

-

How does airSlate SignNow improve the user experience for new york credit applications?

airSlate SignNow signNowly improves the user experience for new york credit applications by offering an easy-to-navigate platform with user-friendly features. Automated workflows help reduce bottlenecks, while real-time notifications keep users informed of application statuses. This streamlined approach enhances customer satisfaction and operational efficiency.

Get more for New York Credit Application

- Art loan agreement template form

- Super teacher worksheets username and password form

- Bureau of motor vehicles letterhead in form

- Fictitious name form classified notice under in print

- Vcvc nbcot form

- E9 obrazec form

- Narragansett rental registration form

- Www victoriasheriff orguploadpagevictoria county public health department environmental services form

Find out other New York Credit Application

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document