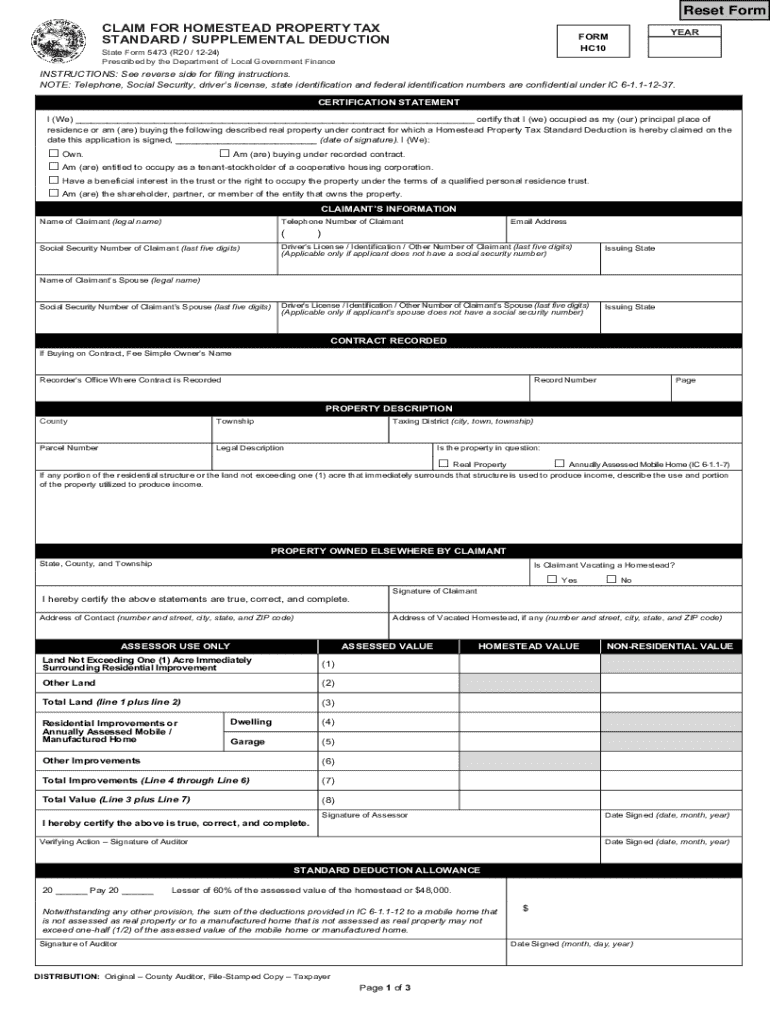

Reset Form CLAIM for HOMESTEAD PROPERTY TAX STANDA

Understanding the Indiana Homestead Exemption

The Indiana homestead exemption provides property tax benefits to homeowners, helping to reduce the taxable value of their primary residence. This exemption is designed to make homeownership more affordable for Indiana residents. Homeowners can receive a standard deduction, which lowers the assessed value of their property, ultimately reducing the amount of property tax owed. The exemption applies to various types of properties, including single-family homes and certain types of manufactured homes.

Eligibility Criteria for the Indiana Homestead Exemption

To qualify for the Indiana homestead exemption, applicants must meet specific criteria, including:

- The property must be the applicant's primary residence.

- The applicant must be a legal resident of Indiana.

- The applicant must not have claimed a homestead exemption on any other property.

Additionally, there are income limits for certain deductions, which may affect eligibility. Homeowners should verify their qualifications before applying.

Steps to Complete the Indiana Homestead Exemption Application

Applying for the Indiana homestead exemption involves several key steps:

- Obtain the Indiana homestead exemption application form, which can be found online.

- Fill out the form with accurate personal and property information.

- Gather necessary documentation, such as proof of residency and identification.

- Submit the completed application form along with the required documents to the local county assessor's office.

It is important to ensure that all information is correct to avoid delays in processing the application.

Form Submission Methods for the Indiana Homestead Exemption

Homeowners can submit their Indiana homestead exemption application through various methods:

- Online submission via the county assessor's website.

- Mailing the completed application to the local county assessor's office.

- In-person submission at the county assessor's office.

Choosing the right submission method can help streamline the application process and ensure timely processing.

Required Documents for the Indiana Homestead Exemption

When applying for the Indiana homestead exemption, homeowners must provide certain documents to support their application. Commonly required documents include:

- Proof of Indiana residency, such as a driver's license or utility bill.

- Identification, like a Social Security card or state-issued ID.

- Any additional documentation specified by the local assessor's office.

Having these documents ready can help facilitate a smoother application process.

Filing Deadlines for the Indiana Homestead Exemption

Homeowners should be aware of the important deadlines when applying for the Indiana homestead exemption. Typically, applications must be submitted by the end of the calendar year to be eligible for the following year's tax benefits. It is advisable to check with the local county assessor's office for any specific deadlines or changes to the application timeline.

Handy tips for filling out Reset Form CLAIM FOR HOMESTEAD PROPERTY TAX STANDA online

Quick steps to complete and e-sign Reset Form CLAIM FOR HOMESTEAD PROPERTY TAX STANDA online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for maximum efficiency. Use signNow to electronically sign and send out Reset Form CLAIM FOR HOMESTEAD PROPERTY TAX STANDA for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reset form claim for homestead property tax standa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana homestead exemption online process?

The Indiana homestead exemption online process allows homeowners to apply for property tax exemptions through a user-friendly digital platform. By using airSlate SignNow, you can easily complete and submit your application without the hassle of paperwork. This streamlined approach saves time and ensures that your application is processed efficiently.

-

How much does it cost to apply for the Indiana homestead exemption online?

Applying for the Indiana homestead exemption online through airSlate SignNow is cost-effective, with minimal fees associated with eSigning and document management. The exact cost may vary depending on the services you choose, but overall, it is designed to be budget-friendly for homeowners. This affordability makes it accessible for everyone looking to benefit from the exemption.

-

What features does airSlate SignNow offer for the Indiana homestead exemption online?

airSlate SignNow provides a range of features for the Indiana homestead exemption online, including customizable templates, secure eSigning, and real-time tracking of your application status. These features enhance the user experience and ensure that your documents are handled securely and efficiently. Additionally, the platform is designed to be intuitive, making it easy for anyone to navigate.

-

What are the benefits of using airSlate SignNow for the Indiana homestead exemption online?

Using airSlate SignNow for the Indiana homestead exemption online offers numerous benefits, including increased efficiency and reduced paperwork. The platform allows you to manage your documents from anywhere, making it convenient for busy homeowners. Furthermore, the electronic signature feature speeds up the approval process, ensuring you receive your exemption in a timely manner.

-

Is the Indiana homestead exemption online application secure?

Yes, the Indiana homestead exemption online application through airSlate SignNow is highly secure. The platform employs advanced encryption and security protocols to protect your personal information and documents. You can confidently submit your application knowing that your data is safe and secure throughout the process.

-

Can I track my Indiana homestead exemption online application status?

Absolutely! airSlate SignNow allows you to track the status of your Indiana homestead exemption online application in real-time. This feature provides peace of mind, as you can easily see where your application stands and receive notifications about any updates or required actions.

-

What integrations does airSlate SignNow offer for the Indiana homestead exemption online?

airSlate SignNow integrates seamlessly with various applications and platforms to enhance your experience with the Indiana homestead exemption online. These integrations allow you to connect with popular tools for document management, CRM systems, and more. This flexibility ensures that you can work within your preferred ecosystem while managing your exemption application.

Get more for Reset Form CLAIM FOR HOMESTEAD PROPERTY TAX STANDA

- Request for compromise on a debt form

- Your membership to the national light club has been revoked form

- Reference character reference from a friend form

- Confirmation of oral agreement form

- Letter to restaurant complaint form

- 2nd3rd contact form

- Learn the rules related to employees use of vehicles bizfilings form

- Letter withdrawing offer to purchase house form

Find out other Reset Form CLAIM FOR HOMESTEAD PROPERTY TAX STANDA

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy