Form or 40, Oregon Individual Income Tax Return for Full Year Residents, 150 101 040

Understanding the Form OR 40, Oregon Individual Income Tax Return

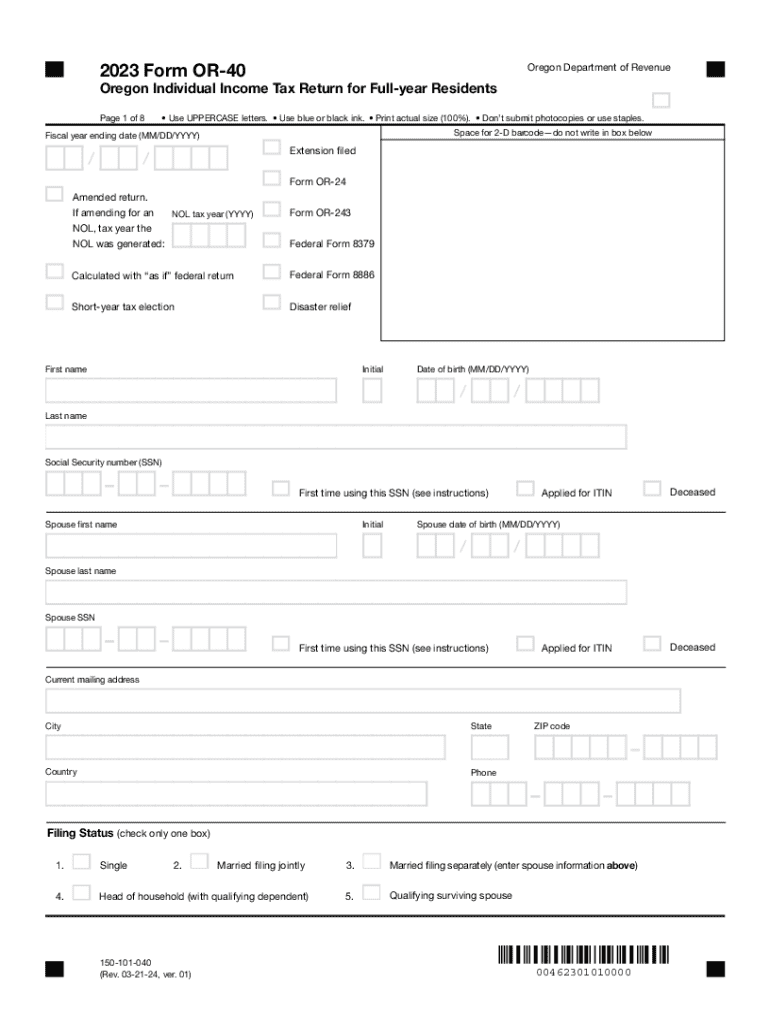

The Form OR 40 is the official Oregon Individual Income Tax Return for full-year residents. This form is essential for individuals living in Oregon who need to report their income and calculate their state tax liability. The information reported on this form is used by the Oregon Department of Revenue to determine the amount of tax owed or any refund due. It is important to accurately complete this form to ensure compliance with state tax laws.

Steps to Complete the Form OR 40

Completing the Form OR 40 involves several key steps:

- Gather Required Information: Collect all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: List all sources of income, including wages, interest, and dividends, in the appropriate sections.

- Calculate Deductions: Identify any deductions you qualify for, such as standard or itemized deductions, and subtract them from your total income.

- Determine Tax Liability: Use the tax tables provided in the instructions to calculate your tax based on your taxable income.

- Review and Sign: Carefully review your completed form for accuracy before signing and dating it.

How to Obtain the Form OR 40

The Form OR 40 can be obtained through various methods:

- Online: Download the form directly from the Oregon Department of Revenue's website.

- In-Person: Visit local tax offices or public libraries where physical copies may be available.

- By Mail: Request a copy to be mailed to you by contacting the Oregon Department of Revenue.

Key Elements of the Form OR 40

The Form OR 40 includes several important sections:

- Personal Information: Details about the taxpayer, including name, address, and Social Security number.

- Income Reporting: Sections to report different types of income, such as wages and self-employment income.

- Deductions and Credits: Areas to claim deductions and tax credits that may reduce tax liability.

- Signature Line: A section where the taxpayer must sign and date the form, affirming the accuracy of the information provided.

Filing Deadlines for the Form OR 40

It is crucial to be aware of the filing deadlines to avoid penalties:

- The standard deadline for submitting the Form OR 40 is April 15 of the following year.

- If the deadline falls on a weekend or holiday, it is typically extended to the next business day.

- Extensions may be available, but it is important to file for an extension before the original deadline.

Legal Use of the Form OR 40

The Form OR 40 serves as a legal document for reporting income and calculating tax liability in Oregon. Filing this form is a legal requirement for all full-year residents who earn income. Failure to file can result in penalties, interest on unpaid taxes, and potential legal action by the state. It is important to ensure that all information is truthful and accurate to avoid any legal complications.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form or 40 oregon individual income tax return for full year residents 150 101 040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Oregon tax forms and why are they important?

Oregon tax forms are official documents required for filing state taxes in Oregon. They are essential for individuals and businesses to report income, claim deductions, and ensure compliance with state tax laws. Understanding these forms can help you avoid penalties and maximize your tax benefits.

-

How can airSlate SignNow help with Oregon tax forms?

airSlate SignNow provides a seamless platform for sending and eSigning Oregon tax forms. Our solution simplifies the process, allowing you to complete and submit your tax documents quickly and securely. With our user-friendly interface, managing your Oregon tax forms has never been easier.

-

What features does airSlate SignNow offer for managing Oregon tax forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Oregon tax forms. These tools streamline the preparation and submission process, ensuring that your forms are completed accurately and on time. Additionally, our platform supports collaboration, making it easy to work with tax professionals.

-

Is airSlate SignNow cost-effective for handling Oregon tax forms?

Yes, airSlate SignNow is a cost-effective solution for managing Oregon tax forms. Our pricing plans are designed to fit various budgets, allowing individuals and businesses to choose the option that best meets their needs. By reducing the time spent on paperwork, you can save money and focus on what matters most.

-

Can I integrate airSlate SignNow with other software for Oregon tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage your Oregon tax forms. This integration helps streamline your workflow, ensuring that all your documents are in one place and easily accessible. You can connect with popular platforms to enhance your tax preparation process.

-

What are the benefits of using airSlate SignNow for Oregon tax forms?

Using airSlate SignNow for Oregon tax forms offers numerous benefits, including increased efficiency, enhanced security, and improved accuracy. Our platform allows you to complete and sign documents from anywhere, reducing the hassle of paper forms. Additionally, our secure storage ensures that your sensitive information is protected.

-

How do I get started with airSlate SignNow for Oregon tax forms?

Getting started with airSlate SignNow for Oregon tax forms is simple. Sign up for an account on our website, choose a pricing plan that suits your needs, and start creating or uploading your tax documents. Our intuitive interface guides you through the process, making it easy to manage your Oregon tax forms efficiently.

Get more for Form OR 40, Oregon Individual Income Tax Return For Full year Residents, 150 101 040

- Emailrm25jun10evlanrao public wiki nrao safe server form

- How to install software from the iwu application catalog indiana form

- Below is designed to assign you complete the fields contained in the form

- Find specific products for children or parents with disabilities prince form

- This article provides for the establishment of a trust for the benefit of minor form

- Type name or names of persons to receive estate if form

- How to clean your computer inside and outwired form

- Spouse predeceases you form

Find out other Form OR 40, Oregon Individual Income Tax Return For Full year Residents, 150 101 040

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now