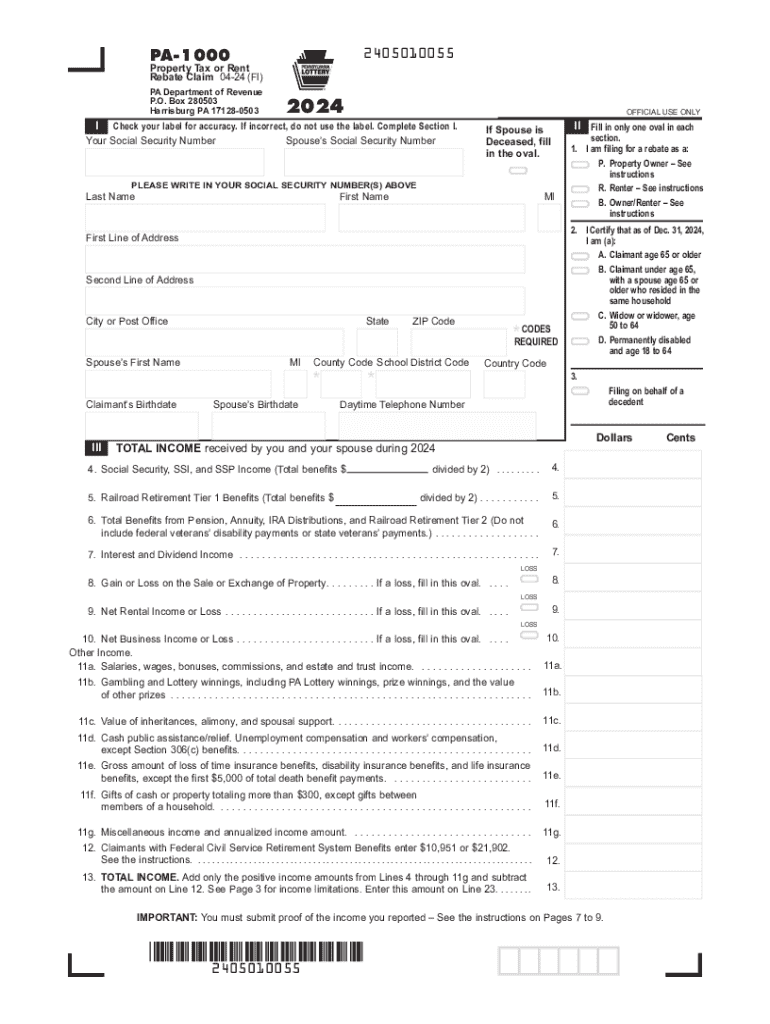

Property Tax or Rent Rebate Claim PA 1000 Form

What is the Property Tax Or Rent Rebate Claim PA 1000

The Property Tax or Rent Rebate Claim PA 1000 is a form used in Pennsylvania to provide financial relief to eligible residents who pay property taxes or rent on their homes. This program is designed to assist low-income individuals, including seniors and people with disabilities, by offering rebates based on their income and the amount of rent or property taxes paid. The PA 1000 form is essential for claiming these benefits and helps ensure that residents receive the financial support they need to maintain their housing.

Eligibility Criteria

To qualify for the Property Tax or Rent Rebate Claim PA 1000, applicants must meet specific criteria. Generally, the eligibility requirements include:

- Being a Pennsylvania resident.

- Being at least sixty-five years old, or being a widow/widower aged fifty-one or older, or being permanently disabled.

- Having a total income below a specified threshold, which may vary from year to year.

- Paying property taxes or rent for the year in which the rebate is being claimed.

It is important for applicants to review the most current eligibility guidelines to ensure they meet all requirements before submitting their application.

Steps to complete the Property Tax Or Rent Rebate Claim PA 1000

Completing the Property Tax or Rent Rebate Claim PA 1000 involves several key steps:

- Gather necessary documentation, including proof of income and records of rent or property tax payments.

- Obtain the PA 1000 form, which can be downloaded online or requested from local government offices.

- Fill out the form accurately, ensuring all required information is provided.

- Attach any supporting documents that verify income and payments.

- Submit the completed form and documents by mail or through designated submission methods.

Following these steps carefully will help ensure a smooth application process and timely receipt of any rebates due.

Required Documents

When applying for the Property Tax or Rent Rebate Claim PA 1000, applicants must provide specific documents to support their claims. Required documents typically include:

- Proof of income, such as tax returns or pay stubs.

- Receipts or statements showing rent payments or property tax bills.

- Identification documents, if necessary, to verify age or disability status.

Having these documents ready will facilitate the application process and help avoid delays in receiving benefits.

Form Submission Methods

Applicants can submit the Property Tax or Rent Rebate Claim PA 1000 through various methods, ensuring flexibility in how they choose to apply. The available submission methods include:

- Online submission through designated state portals, if available.

- Mailing the completed form and documents to the appropriate state office.

- In-person submission at local government offices or designated locations.

Choosing the most convenient submission method can help applicants ensure their forms are processed efficiently.

Filing Deadlines / Important Dates

It is crucial for applicants to be aware of the filing deadlines associated with the Property Tax or Rent Rebate Claim PA 1000. Typically, the deadline for submitting the application is June 30 of the year following the tax year for which the rebate is claimed. Keeping track of these important dates helps ensure that applicants do not miss out on potential benefits.

Handy tips for filling out Property Tax Or Rent Rebate Claim PA 1000 online

Quick steps to complete and e-sign Property Tax Or Rent Rebate Claim PA 1000 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and send Property Tax Or Rent Rebate Claim PA 1000 for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax or rent rebate claim pa 1000

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a rent rebate application?

A rent rebate application is a formal request submitted by tenants to receive a reduction in their rent due to specific circumstances, such as financial hardship or property issues. Using airSlate SignNow, you can easily create, send, and eSign your rent rebate application, streamlining the process and ensuring timely submissions.

-

How does airSlate SignNow simplify the rent rebate application process?

airSlate SignNow simplifies the rent rebate application process by providing an intuitive platform for document creation and electronic signatures. This allows tenants to fill out their applications quickly and submit them directly to landlords or property managers, reducing delays and improving communication.

-

What features does airSlate SignNow offer for rent rebate applications?

airSlate SignNow offers features such as customizable templates for rent rebate applications, secure eSigning, and real-time tracking of document status. These features ensure that your application is completed accurately and submitted efficiently, enhancing your chances of approval.

-

Is there a cost associated with using airSlate SignNow for rent rebate applications?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and reflects the value of a streamlined rent rebate application process, making it a cost-effective solution for tenants.

-

Can I integrate airSlate SignNow with other applications for my rent rebate application?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including cloud storage services and project management tools. This allows you to manage your rent rebate application alongside other important documents and workflows, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for my rent rebate application?

Using airSlate SignNow for your rent rebate application provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. The platform ensures that your sensitive information is protected while allowing you to focus on what matters most—getting your rebate approved.

-

How secure is the information submitted in a rent rebate application via airSlate SignNow?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with industry standards. When you submit your rent rebate application through the platform, you can trust that your personal information is safeguarded against unauthorized access.

Get more for Property Tax Or Rent Rebate Claim PA 1000

- Civ 511 judgment debtor booklet state of alaska form

- Do not use this form for as 09

- Fillable online to clerk do not use this form for as 09 fax email

- Iciv 525 writ of execution for garnishment of earnings 9 10 civil forms

- Civ 526 employers response 11 12 civil forms

- Civ 530 notice of garnishment ampamp notice of right to exemptions 1112 pdf fill in civil forms

- Civ 531 claim of exemption from garnishment 710 civil forms 490101779

- Creditors response to request to return pfd taken by form

Find out other Property Tax Or Rent Rebate Claim PA 1000

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online