Colorado from S 2024-2025 Form

What is the DR 0106, Colorado Partnership And S Corporation And Composite Nonresident Income Tax Return

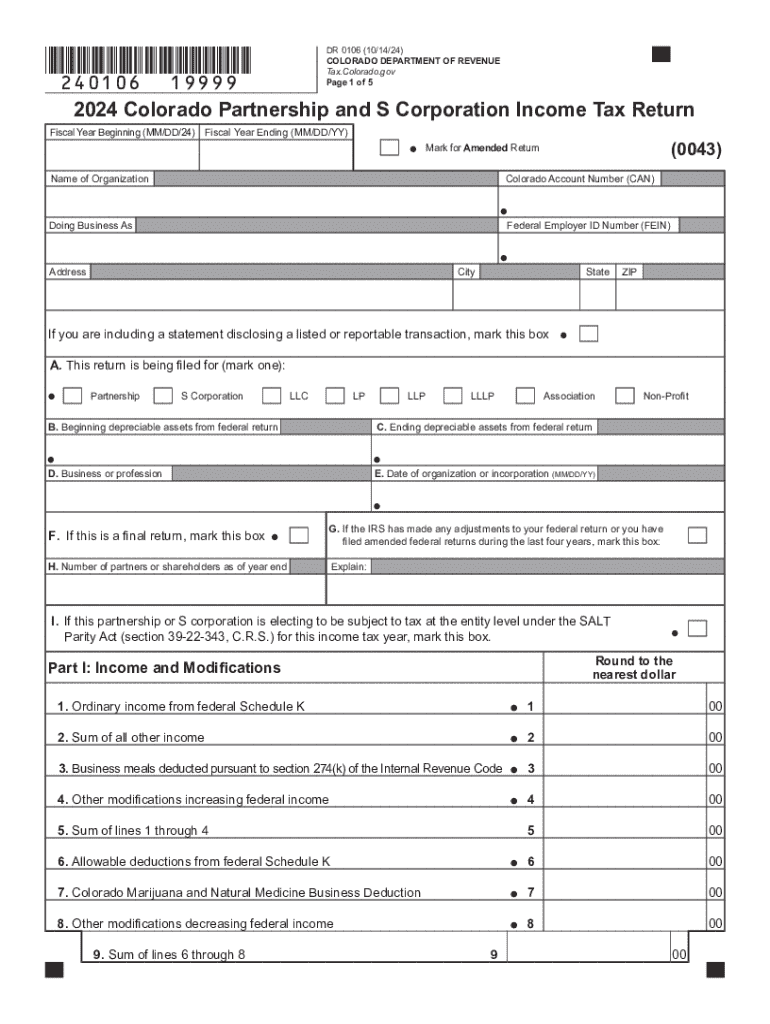

The DR 0106 is a tax form used in Colorado for reporting income generated by partnerships, S corporations, and composite nonresidents. This form is essential for entities that conduct business in Colorado but have partners or shareholders who are not residents of the state. The DR 0106 allows these entities to file a single tax return on behalf of their nonresident partners or shareholders, simplifying the tax process and ensuring compliance with Colorado tax laws.

How to use the DR 0106, Colorado Partnership And S Corporation And Composite Nonresident Income Tax Return

To utilize the DR 0106 effectively, businesses must first gather all necessary financial information related to their income and expenses. This includes details on the income earned by the partnership or S corporation, as well as any deductions that may apply. Once the information is compiled, the form can be filled out, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission, as inaccuracies can lead to penalties or delays in processing.

Steps to complete the DR 0106, Colorado Partnership And S Corporation And Composite Nonresident Income Tax Return

Completing the DR 0106 involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the identification section with details about the partnership or S corporation.

- Report total income and allowable deductions in the appropriate sections.

- Calculate the tax owed based on the net income reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline either electronically or via mail.

Required Documents

When preparing to file the DR 0106, several documents are necessary to ensure accurate reporting. These documents typically include:

- Financial statements detailing income and expenses.

- Partnership or corporation agreements.

- Records of any prior tax filings related to the entity.

- Identification numbers for the business and its partners or shareholders.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines associated with the DR 0106 to avoid penalties. Generally, the form must be submitted by the fifteenth day of the fourth month following the end of the tax year. For entities operating on a calendar year, this typically falls on April 15. However, if the deadline falls on a weekend or holiday, the due date may be extended to the next business day.

Penalties for Non-Compliance

Failing to file the DR 0106 by the deadline or submitting inaccurate information can result in significant penalties. These may include fines based on the amount of tax owed or additional charges for late filing. It is important for businesses to ensure compliance with all tax regulations to avoid these financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct colorado partnership tax return

Related searches to income colorado shareholder latest

Create this form in 5 minutes!

How to create an eSignature for the colorado dr member latest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask colorado return composite template

-

What is airSlate SignNow and how does it work in Colorado from S?

airSlate SignNow is a powerful eSignature solution that allows businesses in Colorado from S to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient. With its user-friendly interface, you can easily manage your documents and track their status in real-time.

-

What are the pricing options for airSlate SignNow in Colorado from S?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses in Colorado from S. You can choose from various subscription tiers based on your usage and feature requirements. This ensures that you only pay for what you need, making it a cost-effective solution.

-

What features does airSlate SignNow provide for users in Colorado from S?

airSlate SignNow includes a range of features designed to enhance document management for users in Colorado from S. Key features include customizable templates, automated workflows, and secure cloud storage. These tools help businesses streamline their processes and improve productivity.

-

How can airSlate SignNow benefit businesses in Colorado from S?

Businesses in Colorado from S can benefit from airSlate SignNow by reducing the time and costs associated with traditional document signing. The platform enhances efficiency, allowing teams to focus on core activities rather than paperwork. Additionally, it improves compliance and security for sensitive documents.

-

Is airSlate SignNow easy to integrate with other tools in Colorado from S?

Yes, airSlate SignNow is designed to integrate seamlessly with various applications commonly used by businesses in Colorado from S. Whether you use CRM systems, cloud storage, or project management tools, airSlate SignNow can connect with them to enhance your workflow. This integration capability helps maintain a smooth operational flow.

-

What security measures does airSlate SignNow implement for users in Colorado from S?

airSlate SignNow prioritizes security for its users in Colorado from S by employing advanced encryption and compliance with industry standards. This ensures that all documents and signatures are protected against unauthorized access. Additionally, the platform provides audit trails for tracking document activity.

-

Can I use airSlate SignNow on mobile devices in Colorado from S?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing users in Colorado from S to send and sign documents on the go. The mobile app provides the same features as the desktop version, ensuring that you can manage your documents anytime, anywhere.

Get more for colorado state tax form 106

- Peace agreement template form

- Peer to peer loan agreement template form

- Penetration test agreement template form

- Peer to peer lending agreement template form

- Penetration testing agreement template form

- People loan agreement template form

- Pentest agreement template form

- Perance agreement template form

Find out other colorado partnership tax return

- How Can I eSignature South Dakota Copyright License Agreement

- Can I eSignature South Dakota Copyright License Agreement

- eSignature South Dakota Copyright License Agreement Free

- Electronic signature New Mexico Indemnity Agreement Template Easy

- eSignature South Dakota Copyright License Agreement Secure

- How To Electronic signature Colorado Promissory Note Template

- Electronic signature New Mexico Indemnity Agreement Template Safe

- How Do I Electronic signature Colorado Promissory Note Template

- eSignature South Dakota Copyright License Agreement Fast

- Help Me With Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Colorado Promissory Note Template

- How Can I Electronic signature Colorado Promissory Note Template

- eSignature South Dakota Copyright License Agreement Easy

- eSignature South Dakota Copyright License Agreement Simple

- Electronic signature Connecticut Promissory Note Template Online

- Electronic signature Connecticut Promissory Note Template Computer

- Electronic signature Connecticut Promissory Note Template Mobile

- eSignature South Dakota Copyright License Agreement Safe

- Electronic signature Connecticut Promissory Note Template Now

- Electronic signature Connecticut Promissory Note Template Myself