DR 0106 Book 2020

What is the DR 0106 Book

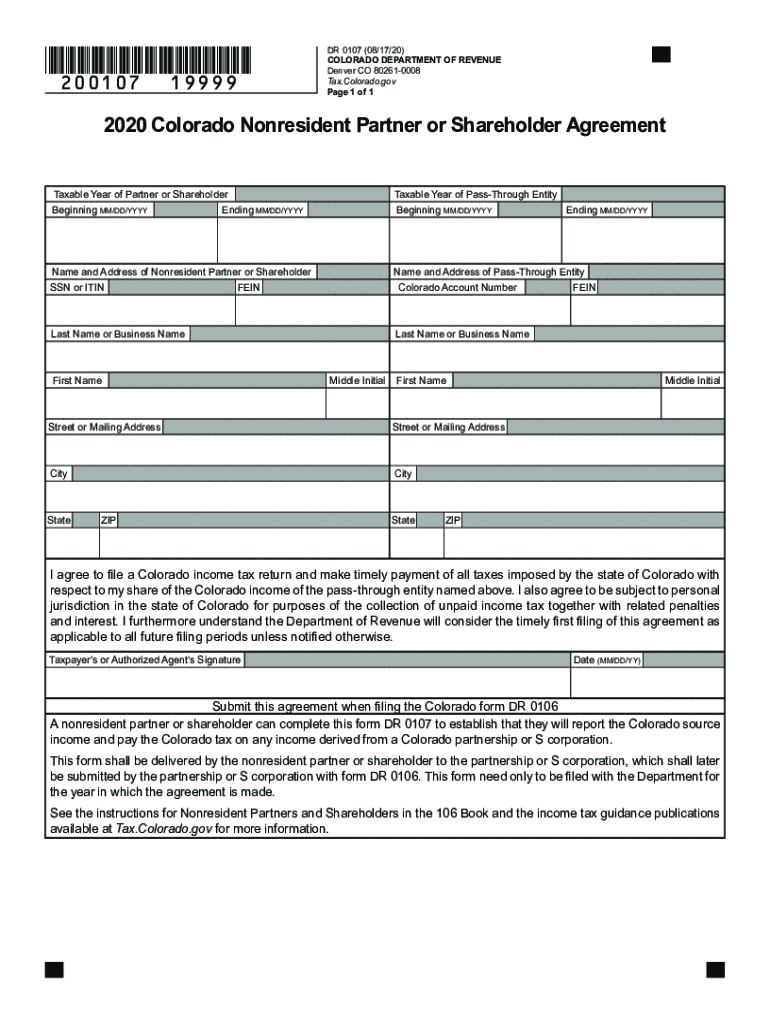

The DR 0106 Book is a crucial document for taxpayers in Colorado, specifically designed for reporting income and calculating taxes owed. This form is essential for individuals and entities that need to file their state taxes accurately. It provides a structured format for taxpayers to declare their income, deductions, and credits, ensuring compliance with Colorado tax regulations. Understanding the purpose and components of the DR 0106 Book is vital for effective tax reporting.

Steps to complete the DR 0106 Book

Completing the DR 0106 Book involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, W-2 forms, and any relevant receipts for deductions. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, and dividends.

- Detail any deductions you qualify for, such as business expenses or educational credits.

- Calculate your total tax liability based on the provided income and deductions.

- Review the completed form for accuracy before submission.

By following these steps, you can ensure that your DR 0106 Book is filled out correctly, minimizing the risk of errors that could lead to penalties.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for taxpayers using the DR 0106 Book. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay updated on any changes to these dates, as timely submission is essential to avoid penalties and interest on unpaid taxes. Mark your calendar to ensure you meet all required deadlines.

Required Documents

When preparing to complete the DR 0106 Book, certain documents are necessary to ensure accurate reporting. These include:

- Your previous year's tax return for reference.

- W-2 forms from employers detailing your income.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or charitable contributions.

- Any documentation related to tax credits you intend to claim.

Having these documents on hand will facilitate a smoother and more accurate completion of your tax form.

Legal use of the DR 0106 Book

The DR 0106 Book must be completed in accordance with Colorado state tax laws to ensure its legal validity. This includes adhering to guidelines set forth by the Colorado Department of Revenue. The form serves as a legal declaration of income and tax liability, and any inaccuracies or omissions could result in penalties or legal consequences. It is advisable to consult with a tax professional if you have questions about the legal implications of your filings.

Form Submission Methods

Taxpayers can submit the DR 0106 Book through various methods, providing flexibility based on individual preferences. The available submission methods include:

- Online submission through the Colorado Department of Revenue's e-filing system.

- Mailing a printed copy of the completed form to the appropriate state tax office.

- In-person submission at designated tax offices across Colorado.

Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete dr 0106 book

Complete DR 0106 Book effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage DR 0106 Book on any gadget with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to modify and eSign DR 0106 Book easily

- Find DR 0106 Book and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or black out confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your alterations.

- Choose how you wish to send your form, via email, text message (SMS), or link invitation, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, and errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and eSign DR 0106 Book to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0106 book

Create this form in 5 minutes!

How to create an eSignature for the dr 0106 book

The best way to generate an e-signature for your PDF file in the online mode

The best way to generate an e-signature for your PDF file in Chrome

How to make an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is the significance of 2011 106 Colorado in relation to airSlate SignNow?

The term '2011 106 Colorado' refers to a specific legal statute that impacts how electronic signatures are recognized in Colorado. airSlate SignNow fully complies with these regulations, ensuring that your eSigned documents are legally binding and recognized in the state.

-

How much does airSlate SignNow cost for businesses in Colorado?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes in Colorado. The pricing is designed to be cost-effective, particularly for users needing to comply with regulations such as '2011 106 Colorado' for electronic signatures.

-

What features does airSlate SignNow provide to comply with 2011 106 Colorado?

airSlate SignNow provides features like secure eSigning, customizable templates, and compliance tracking to ensure that your documents meet the requirements set forth in '2011 106 Colorado'. These tools help streamline transactions while maintaining legal compliance.

-

How does airSlate SignNow enhance document management for Colorado businesses?

With airSlate SignNow, businesses in Colorado can enhance document management through easy eSigning, automated workflows, and integration with other software. This aligns with the stipulations of '2011 106 Colorado', allowing for efficient processing of electronic documents.

-

Can airSlate SignNow integrate with existing tools I use for my business?

Yes, airSlate SignNow seamlessly integrates with various business tools and applications, allowing users in Colorado to maintain their workflows. This helps ensure compliance with '2011 106 Colorado' while leveraging existing technologies to streamline processes.

-

What benefits does airSlate SignNow offer to businesses regarding legal compliance?

airSlate SignNow offers numerous benefits for legal compliance, especially concerning '2011 106 Colorado'. By using this platform, businesses can ensure their electronic signatures and documents are valid and recognized, reducing legal risks associated with document handling.

-

Is airSlate SignNow user-friendly for newcomers in Colorado?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for newcomers in Colorado. With a straightforward interface and guided processes, you can easily manage eSignatures while adhering to '2011 106 Colorado' requirements.

Get more for DR 0106 Book

- Special durable power of attorney for bank account matters connecticut form

- Ct small 497301361 form

- Connecticut property management package connecticut form

- Connecticut annual 497301364 form

- Ct professional corporation form

- Connecticut professional corporation form

- Connecticut a corporation form

- Connecticut sample certificate form

Find out other DR 0106 Book

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT