CT 10U Consumers Compensating Use Tax Returns and Instructions Rev 7 24 2024-2026

What is the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24

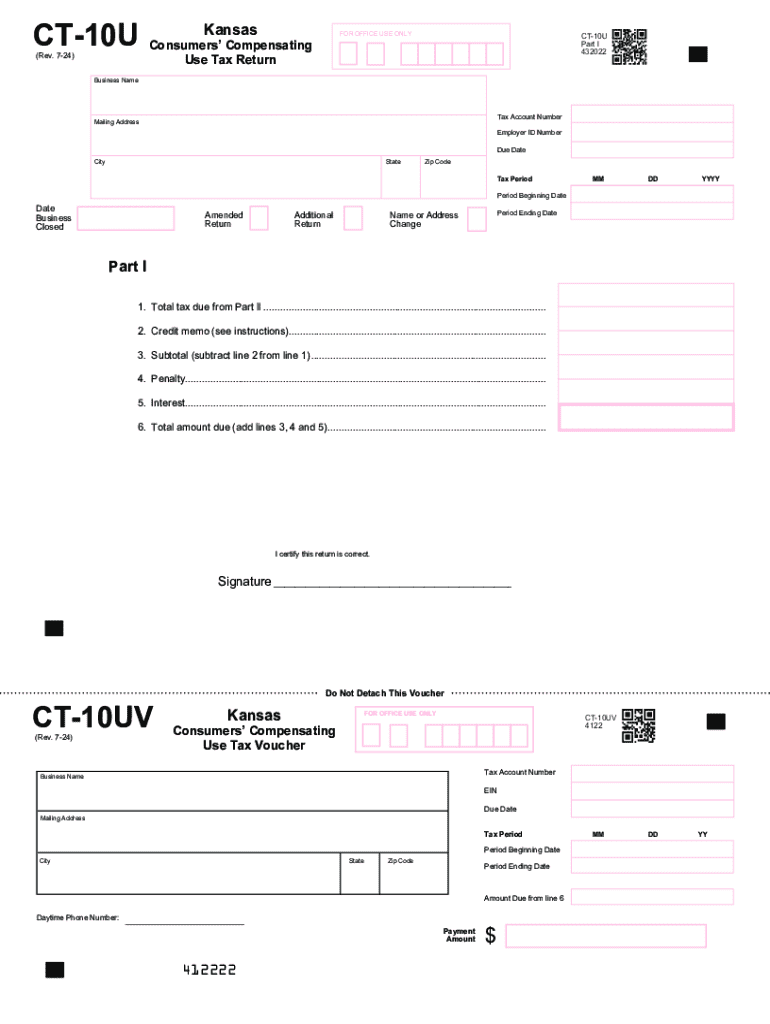

The CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24 is a tax form used by consumers in Connecticut to report and pay compensating use tax on taxable purchases made from out-of-state vendors. This form is essential for individuals and businesses that acquire goods or services from sellers who do not collect Connecticut sales tax. The compensating use tax ensures that consumers fulfill their tax obligations on these transactions, maintaining fairness in the state's tax system.

Steps to complete the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24

Completing the CT 10U involves several steps to ensure accurate reporting and compliance. Begin by gathering all relevant information about your purchases, including dates, amounts, and descriptions of the items or services acquired. Next, fill out the form by entering your personal details and the total amount of compensating use tax owed. Be sure to calculate the tax based on the applicable rates. After completing the form, review it for accuracy before submitting it to the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the CT 10U form. Typically, the form is due annually, with specific deadlines set by the Connecticut Department of Revenue Services. Failure to file by the deadline may result in penalties or interest on the amount owed. It is advisable to check the official state website or consult with a tax professional for the most current deadlines and any updates related to filing requirements.

Required Documents

When completing the CT 10U form, certain documents may be required to substantiate your claims. These may include receipts or invoices for the purchases made, records of payment, and any previous tax returns that may be relevant. Keeping organized records will help facilitate the completion of the form and ensure compliance with state tax regulations.

Penalties for Non-Compliance

Failing to file the CT 10U form or underreporting the compensating use tax can lead to significant penalties. The Connecticut Department of Revenue Services may impose fines, interest on unpaid taxes, and other consequences for non-compliance. It is essential to understand these penalties to avoid unnecessary financial burdens and maintain compliance with state tax laws.

Who Issues the Form

The CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24 is issued by the Connecticut Department of Revenue Services. This agency is responsible for administering tax laws in the state, including the collection of compensating use tax. For any inquiries or assistance regarding the form, individuals should contact the department directly or visit their official website for resources and support.

Create this form in 5 minutes or less

Find and fill out the correct ct 10u consumers compensating use tax returns and instructions rev 7 24

Create this form in 5 minutes!

How to create an eSignature for the ct 10u consumers compensating use tax returns and instructions rev 7 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24?

The CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24 is a form used by consumers in Connecticut to report and pay compensating use tax on taxable purchases made outside the state. This form ensures compliance with state tax laws and helps maintain accurate tax records.

-

How can airSlate SignNow assist with the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24?

airSlate SignNow provides an efficient platform for electronically signing and submitting the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24. Our solution simplifies the document management process, allowing users to complete their tax returns quickly and securely.

-

What are the pricing options for using airSlate SignNow for tax document management?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our cost-effective solutions ensure that you can manage your CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24 without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for handling tax documents?

With airSlate SignNow, you gain access to features such as customizable templates, secure eSigning, and real-time tracking of document status. These features streamline the process of completing the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24, making it easier for users to stay organized and compliant.

-

Are there any integrations available with airSlate SignNow for tax-related software?

Yes, airSlate SignNow integrates seamlessly with various tax-related software and applications. This allows users to easily import and export their CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24 data, enhancing workflow efficiency and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for signing tax documents like the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24 offers numerous benefits, including increased efficiency, enhanced security, and reduced turnaround times. Our platform ensures that your documents are signed and submitted promptly, helping you meet tax deadlines.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital signing?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate the platform. Whether you're completing the CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24 or any other document, our intuitive interface guides you through the process effortlessly.

Get more for CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24

- And acceptance by form

- A personal representatives guide to informal estate

- Objections to probate form

- Petition by interested person form

- Proposed guardians affidavit pursuant to ars 14 5106 form

- Affidavit evidencing termination of joint tenancy form

- Receipt for restricted funds form

- Order requiring final form

Find out other CT 10U Consumers Compensating Use Tax Returns And Instructions Rev 7 24

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now