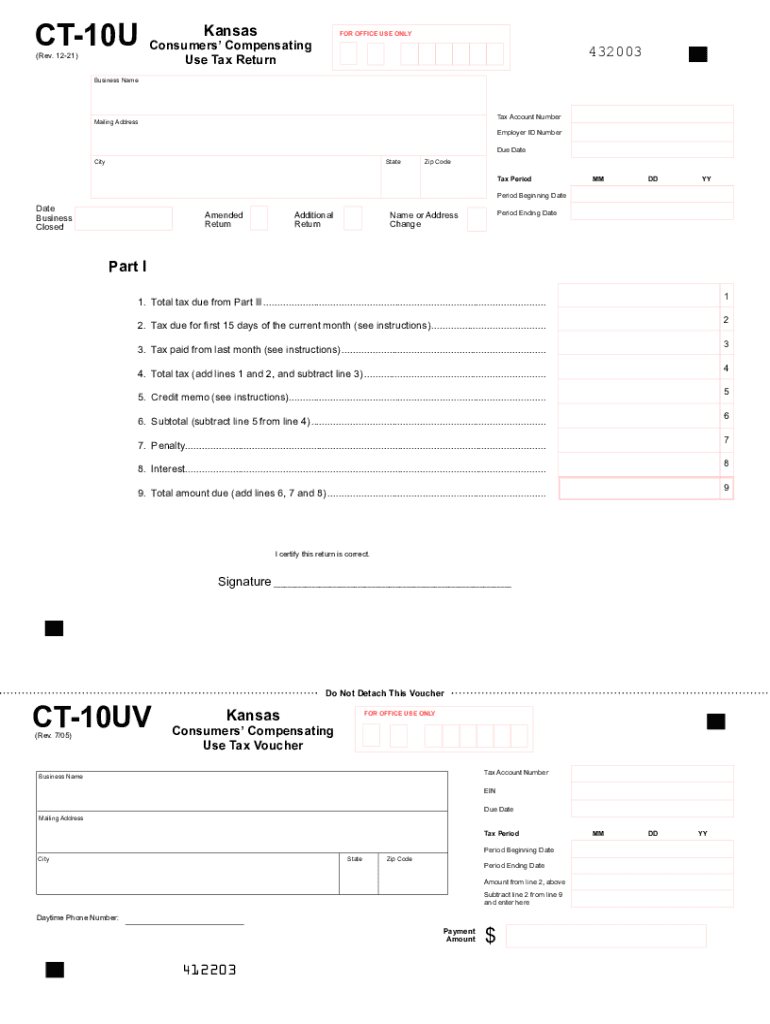

Consumers Compensating Use Tax Fill Out and Sign 2021

Understanding the Consumers Compensating Use Tax

The Consumers Compensating Use Tax is a tax imposed on the use of goods purchased outside of the state but used within the state. This tax ensures that consumers who buy items from out-of-state vendors contribute to the local economy. It is particularly relevant for individuals who purchase goods online or from vendors who do not charge sales tax. Understanding this tax is essential for compliance and financial planning.

Steps to Complete the Consumers Compensating Use Tax Form

Filling out the Consumers Compensating Use Tax form involves several key steps:

- Gather Required Information: Collect details about the purchases, including dates, descriptions, and amounts.

- Access the Form: Obtain the ct 10u form from the appropriate state revenue department website or office.

- Fill Out the Form: Input all necessary information accurately, ensuring that all purchases are accounted for.

- Review for Accuracy: Double-check all entries to avoid errors that could result in penalties.

- Submit the Form: Follow the submission guidelines, which may include online submission, mailing, or in-person delivery.

Legal Use of the Consumers Compensating Use Tax Form

The legal use of the Consumers Compensating Use Tax form is crucial for ensuring compliance with state tax laws. This form serves as a declaration of taxable purchases made by consumers. Proper completion and timely submission help avoid potential legal issues, including fines or audits from state tax authorities. It is important to understand the legal implications of failing to report taxable purchases accurately.

Filing Deadlines and Important Dates

Filing deadlines for the Consumers Compensating Use Tax form vary by state. Generally, consumers must file the form annually or quarterly, depending on the amount of tax owed. It is essential to keep track of these deadlines to avoid late fees or penalties. Checking the state revenue department's website for specific dates and requirements is advisable.

Required Documents for Submission

When submitting the Consumers Compensating Use Tax form, certain documents may be required to support your claims. These typically include:

- Receipts or invoices for all taxable purchases.

- Proof of payment, such as credit card statements or bank statements.

- Any additional documentation requested by the state revenue department.

Having these documents ready can streamline the filing process and support your tax claims.

Examples of Using the Consumers Compensating Use Tax Form

There are various scenarios in which a consumer might need to use the Consumers Compensating Use Tax form. Common examples include:

- Purchasing furniture from an out-of-state retailer and using it in your home.

- Buying electronics online from a vendor that does not charge sales tax.

- Acquiring goods during travel that are later brought back to your home state.

These examples illustrate the importance of understanding and complying with the Consumers Compensating Use Tax requirements.

Quick guide on how to complete consumers compensating use tax fill out and sign

Complete Consumers Compensating Use Tax Fill Out And Sign effortlessly on any device

Digital document management has become favored by companies and individuals alike. It serves as an excellent eco-conscious alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Consumers Compensating Use Tax Fill Out And Sign on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Consumers Compensating Use Tax Fill Out And Sign with ease

- Find Consumers Compensating Use Tax Fill Out And Sign and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate any concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Consumers Compensating Use Tax Fill Out And Sign to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct consumers compensating use tax fill out and sign

Create this form in 5 minutes!

How to create an eSignature for the consumers compensating use tax fill out and sign

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the ct10u compensating download feature in airSlate SignNow?

The ct10u compensating download feature in airSlate SignNow allows users to easily download and store documents that require signatures. This feature streamlines the eSigning process, ensuring your important documents are securely saved and easily accessible whenever needed.

-

How much does the ct10u compensating download feature cost?

Pricing for the ct10u compensating download feature is part of the airSlate SignNow subscription plans. You can choose from flexible pricing options tailored to your business needs, enabling you to utilize this vital feature without breaking the bank.

-

What are the main benefits of using ct10u compensating download?

Using the ct10u compensating download feature enhances your workflow by reducing the time spent on document handling. It ensures compliance and security, making it ideal for businesses that prioritize efficiency and document integrity in their processes.

-

Is the ct10u compensating download feature easy to integrate with other applications?

Absolutely! The ct10u compensating download feature seamlessly integrates with numerous applications, ranging from CRM tools to cloud storage services. This compatibility enhances your overall document management system, making it easier to synchronize information across platforms.

-

Can I use ct10u compensating download for large files?

Yes, the ct10u compensating download feature supports large file uploads, allowing you to send and receive extensive documents effortlessly. This flexibility is crucial for businesses handling substantial contracts or project-related paperwork.

-

Does the ct10u compensating download feature support electronic signatures?

Yes, the ct10u compensating download feature includes support for electronic signatures, making it easier for you to sign documents online. This functionality is fully compliant with legal standards, ensuring your signed documents are valid and enforceable.

-

How secure is the ct10u compensating download feature?

The ct10u compensating download feature is designed with robust security measures to protect your documents. airSlate SignNow employs encryption and secure servers, ensuring that sensitive information remains safe during transfer and storage.

Get more for Consumers Compensating Use Tax Fill Out And Sign

- Order mississippi 497314517 form

- Order authorizing withdrawal and substitution mississippi form

- Order substituting attorney mississippi form

- Amended complaint mississippi 497314521 form

- Motion venue form

- Scheduling order purchase form

- Notice of video deposition to use at trial mississippi form

- With prejudice 497314525 form

Find out other Consumers Compensating Use Tax Fill Out And Sign

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile