Kansas Form CT 10U Consumers' Compensating Use Tax Return 2019

What is the Kansas Form CT 10U Consumers' Compensating Use Tax Return

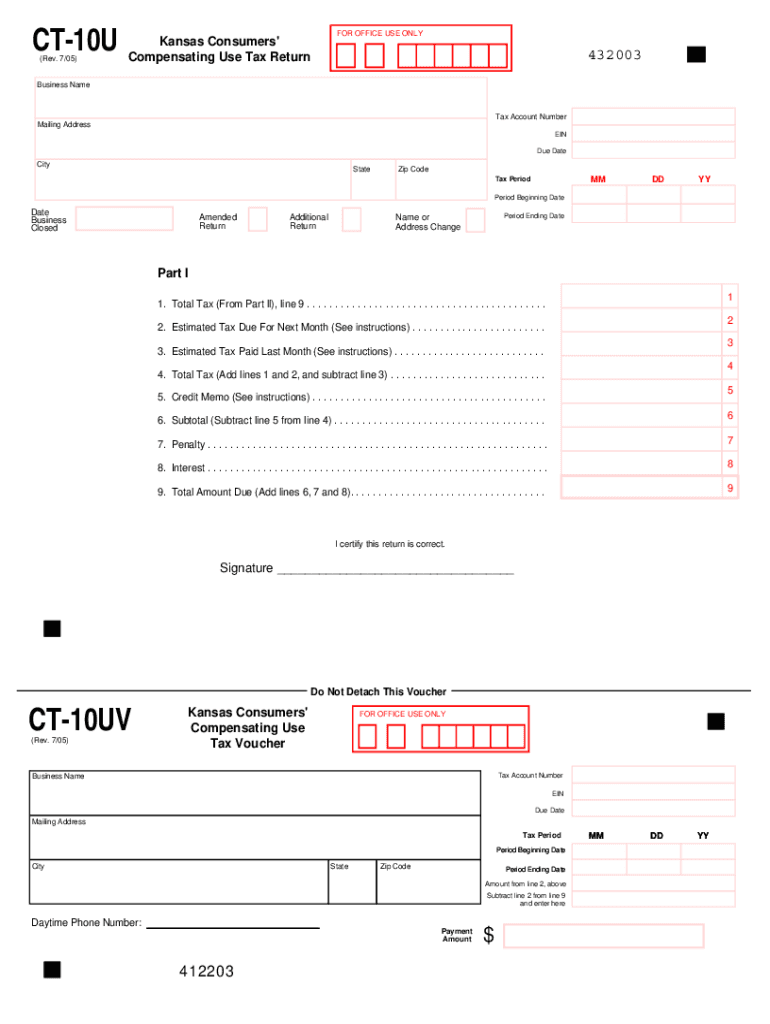

The Kansas Form CT 10U Consumers' Compensating Use Tax Return is a tax document used by individuals and businesses in Kansas to report and pay compensating use tax. This tax applies to purchases made outside of Kansas when the item is used, stored, or consumed within the state. The form is essential for ensuring compliance with Kansas tax laws and helps maintain a fair tax system by requiring users to report taxable purchases that were not taxed at the point of sale.

How to use the Kansas Form CT 10U Consumers' Compensating Use Tax Return

Using the Kansas Form CT 10U involves several steps. First, gather all relevant information regarding your purchases that are subject to compensating use tax. This includes receipts and invoices for items purchased outside of Kansas. Next, accurately fill out the form by entering the total amount of taxable purchases, calculating the tax owed, and providing the necessary personal or business information. Once completed, the form can be submitted either online or via mail, depending on your preference.

Steps to complete the Kansas Form CT 10U Consumers' Compensating Use Tax Return

Completing the Kansas Form CT 10U requires careful attention to detail. Follow these steps:

- Gather all receipts and documentation for purchases made outside of Kansas.

- Calculate the total amount of taxable purchases.

- Determine the compensating use tax rate applicable to your purchases.

- Fill out the form with your personal or business information, total purchases, and calculated tax.

- Review the form for accuracy before submission.

- Submit the completed form online or mail it to the appropriate Kansas tax authority.

Legal use of the Kansas Form CT 10U Consumers' Compensating Use Tax Return

The Kansas Form CT 10U is legally binding when filled out correctly and submitted according to state regulations. To ensure its legal validity, the form must be completed with accurate information and submitted by the designated deadline. Additionally, using a reliable electronic signature solution can enhance the form's legal standing, as it complies with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA).

Filing Deadlines / Important Dates

Filing deadlines for the Kansas Form CT 10U are crucial for compliance. Typically, the form is due on the 15th day of the month following the end of the reporting period. For example, if you are reporting for the month of January, the form must be submitted by February 15. It is important to stay informed about any changes in deadlines or requirements, as these can vary based on state regulations or specific circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Kansas Form CT 10U can be submitted through various methods to accommodate different preferences. Individuals can choose to file online through the Kansas Department of Revenue’s website, making the process quick and efficient. Alternatively, the form can be printed and mailed to the appropriate tax authority. In-person submissions may also be accepted at designated locations, providing flexibility for those who prefer direct interaction.

Quick guide on how to complete kansas form ct 10u consumers compensating use tax return

Complete Kansas Form CT 10U Consumers' Compensating Use Tax Return seamlessly on any gadget

Managing documents online has surged in popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Kansas Form CT 10U Consumers' Compensating Use Tax Return on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Kansas Form CT 10U Consumers' Compensating Use Tax Return with ease

- Obtain Kansas Form CT 10U Consumers' Compensating Use Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Kansas Form CT 10U Consumers' Compensating Use Tax Return and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas form ct 10u consumers compensating use tax return

Create this form in 5 minutes!

How to create an eSignature for the kansas form ct 10u consumers compensating use tax return

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Kansas Form CT 10U Consumers' Compensating Use Tax Return?

The Kansas Form CT 10U Consumers' Compensating Use Tax Return is a tax form used by consumers to report and pay compensating use tax on taxable purchases made outside of Kansas. This return ensures compliance with state tax regulations and aids in maintaining accurate tax records. Completing this form is essential for businesses and individuals who have made taxable purchases not subject to sales tax.

-

How can airSlate SignNow assist with the Kansas Form CT 10U Consumers' Compensating Use Tax Return?

AirSlate SignNow simplifies the process of filling out and submitting the Kansas Form CT 10U Consumers' Compensating Use Tax Return by providing easy-to-use templates and electronic signature capabilities. Users can quickly create, edit, and send their completed forms securely. This streamlines the tax filing process and helps ensure that forms are accurately submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Kansas Form CT 10U?

Yes, there is a pricing structure for using airSlate SignNow, which offers different plans to fit varying business needs. However, the cost is often considered minimal compared to the value provided by the automated document management and e-signature functionalities. Choosing the right plan can greatly enhance the efficiency of managing your Kansas Form CT 10U Consumers' Compensating Use Tax Return.

-

What are the benefits of using airSlate SignNow for tax form management?

Using airSlate SignNow for tax form management offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform allows users to manage all their tax documents, including the Kansas Form CT 10U Consumers' Compensating Use Tax Return, in one convenient location. Additionally, the e-signature feature helps eliminate delays associated with traditional paper forms.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! AirSlate SignNow offers integrations with various accounting software, allowing for seamless data transfers and enhanced workflow efficiencies. These integrations ensure that your Kansas Form CT 10U Consumers' Compensating Use Tax Return and other financial documents are consistently updated and accurate across all platforms.

-

How secure is my information when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your information, employing advanced encryption technologies to protect sensitive data, such as the Kansas Form CT 10U Consumers' Compensating Use Tax Return. The platform also complies with industry standards and regulations, ensuring that your documents are secure during storage and transmission. You can trust that your data is safe with us.

-

What types of documents can I manage besides the Kansas Form CT 10U?

Besides the Kansas Form CT 10U Consumers' Compensating Use Tax Return, airSlate SignNow allows you to manage a variety of documents including contracts, agreements, and other tax forms. This versatility makes it an invaluable tool for businesses looking to streamline their document management processes. You can easily create, send, and store all your essential documents securely.

Get more for Kansas Form CT 10U Consumers' Compensating Use Tax Return

- Time ampm form

- Kansas subcontractor agreement template form

- Oil rendition kansas department of revenue form

- Kansas adjutant generalamp39s department orientation checklist kansastag form

- Oil assessment rendition kansas department of revenue form

- Gas assessment rendition renogov form

- Section vii abstract value for county use only form

- City of topeka police department topeka form

Find out other Kansas Form CT 10U Consumers' Compensating Use Tax Return

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter