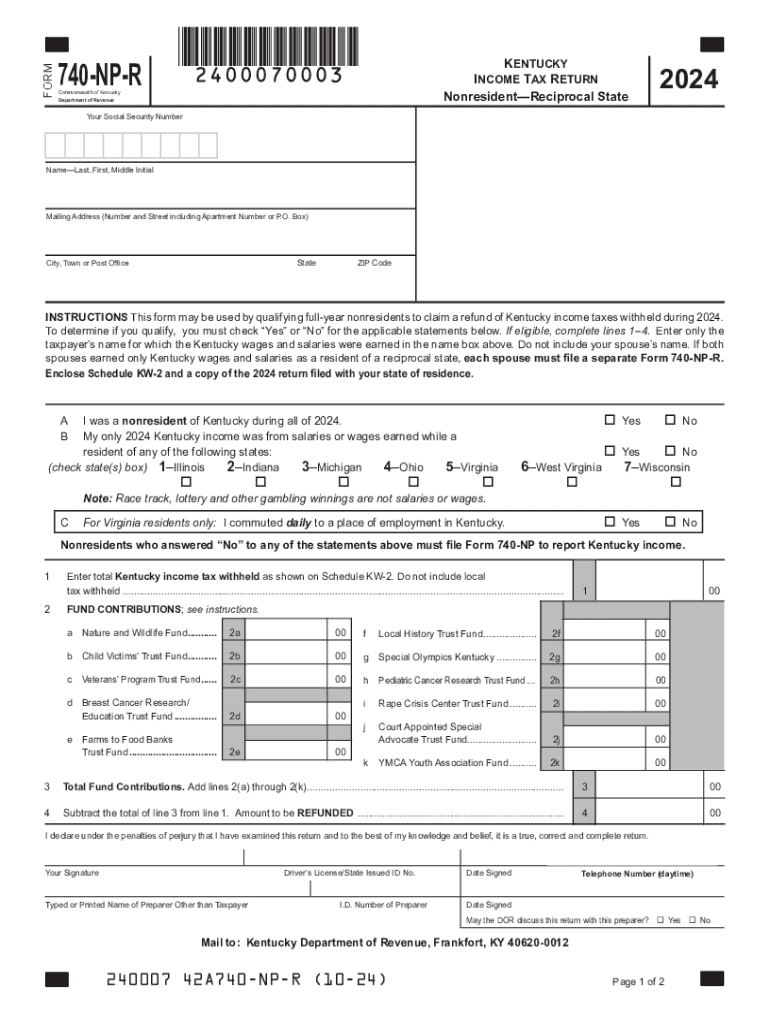

740 Np R 2024-2026

What is the 740 NP R?

The 740 NP R is a specific tax form used by residents of Kentucky to report their income and calculate their tax liability. This form is designed for individuals who have no federal income tax liability or who are not required to file a federal return. The 740 NP R allows taxpayers to report their income from various sources, including wages, interest, and dividends, while also claiming any applicable credits and deductions. Understanding this form is essential for ensuring compliance with state tax regulations.

Steps to Complete the 740 NP R

Completing the 740 NP R involves several steps to ensure accurate reporting and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your income in the designated sections, ensuring to include all relevant sources. After calculating your total income, apply any deductions and credits you qualify for, and determine your final tax liability. Finally, review the form for accuracy before submitting it to the Kentucky Department of Revenue.

Required Documents

To successfully complete the 740 NP R, you will need several key documents. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for any other income sources, such as rental income or interest

- Records of any deductions or credits you intend to claim, such as receipts for charitable donations

Having these documents organized and accessible will streamline the process of filling out the form and help ensure that you do not miss any important information.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the 740 NP R to avoid penalties. Typically, the deadline for submitting your Kentucky state tax return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers should be aware of any extensions that may be available, which can provide additional time to file the form. Always check for any updates or changes to deadlines that may occur in a given tax year.

Form Submission Methods

There are several methods available for submitting the 740 NP R. Taxpayers can file the form online through the Kentucky Department of Revenue’s e-filing system, which provides a convenient and efficient way to submit your return. Alternatively, you may choose to mail your completed form to the appropriate address provided by the state. If you prefer a more personal approach, in-person submissions are also accepted at designated tax offices. Each method has its own advantages, so consider your preferences when deciding how to file.

Legal Use of the 740 NP R

The 740 NP R is legally recognized by the state of Kentucky as a valid form for reporting income and calculating tax liability. It is essential for taxpayers to use this form correctly to ensure compliance with state tax laws. Misuse or failure to file the form can result in penalties, including fines or interest on unpaid taxes. Understanding the legal implications of using the 740 NP R is vital for maintaining good standing with the Kentucky Department of Revenue.

Create this form in 5 minutes or less

Find and fill out the correct 740 np r 771339438

Create this form in 5 minutes!

How to create an eSignature for the 740 np r 771339438

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Kentucky 740 tax form?

The 2024 Kentucky 740 tax form is the official document used by residents of Kentucky to file their state income taxes. This form is essential for reporting income, deductions, and tax credits to ensure compliance with state tax laws.

-

How can airSlate SignNow help with the 2024 Kentucky 740 tax form?

airSlate SignNow simplifies the process of completing and submitting the 2024 Kentucky 740 tax form by allowing users to eSign documents securely. Our platform ensures that your tax forms are filled out accurately and submitted on time, reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 2024 Kentucky 740 tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions provide access to features that streamline the completion and eSigning of the 2024 Kentucky 740 tax form, making it a worthwhile investment.

-

What features does airSlate SignNow offer for the 2024 Kentucky 740 tax form?

airSlate SignNow provides features such as document templates, secure eSigning, and real-time collaboration. These tools make it easier to manage the 2024 Kentucky 740 tax form, ensuring that all necessary information is included and accurately submitted.

-

Can I integrate airSlate SignNow with other software for the 2024 Kentucky 740 tax form?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, allowing for seamless data transfer when preparing the 2024 Kentucky 740 tax form. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for tax forms like the 2024 Kentucky 740?

Using airSlate SignNow for the 2024 Kentucky 740 tax form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your sensitive information is protected while making the filing process faster and easier.

-

How secure is airSlate SignNow when handling the 2024 Kentucky 740 tax form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your data while you complete and eSign the 2024 Kentucky 740 tax form, ensuring that your information remains confidential and safe.

Get more for 740 np r

- Order on motion to transfer mississippi form

- Answer to complaint and motion to dismiss mississippi form

- Answer to crossclaim mississippi form

- Motion for order compelling discovery mississippi form

- Mississippi motion dismiss 497314217 form

- Motion to amend their answer and add another cross defendant mississippi form

- Mississippi counterclaim 497314219 form

- Order allowing parties to amend answer and cross complaint mississippi form

Find out other 740 np r

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile