740 NP R 2019

What is the 740 NP R

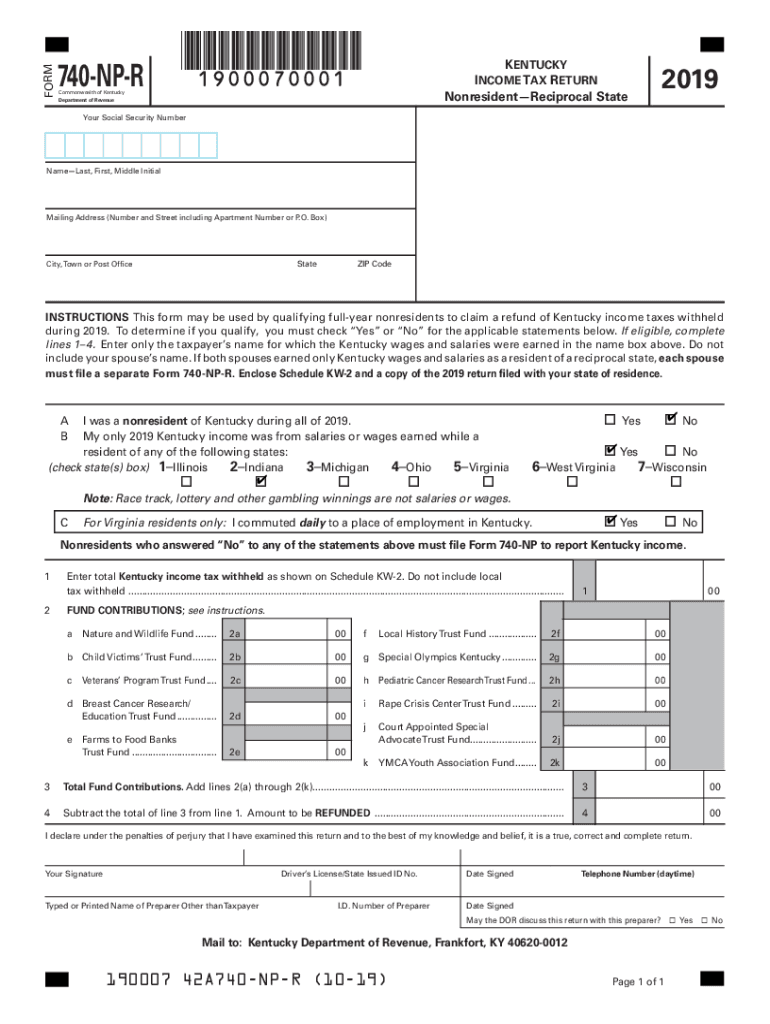

The 740 NP R form, also known as the Kentucky 740 NP tax form, is a state income tax return used by individuals who are non-residents of Kentucky. This form allows non-residents to report their income earned within the state and calculate their tax liability accordingly. It is essential for individuals who have income sourced from Kentucky but do not reside there, ensuring compliance with state tax laws.

Steps to complete the 740 NP R

Completing the Kentucky 740 NP R involves several steps to ensure accuracy and compliance with state regulations. Here are the key steps:

- Gather necessary documents, such as W-2 forms, 1099 forms, and any other income statements relevant to your earnings in Kentucky.

- Fill out personal information, including your name, address, and Social Security number, at the top of the form.

- Report your total income earned in Kentucky in the designated sections, ensuring to include all applicable income sources.

- Calculate your tax liability based on the income reported, applying any deductions or credits you may qualify for.

- Review the completed form for accuracy before signing and dating it.

Legal use of the 740 NP R

The Kentucky 740 NP R form is legally binding when completed accurately and submitted within the required deadlines. It must be filed with the Kentucky Department of Revenue to ensure compliance with state tax laws. Failure to file this form can result in penalties and interest on any unpaid taxes. It is crucial to follow the guidelines set forth by the Kentucky Department of Revenue to maintain legal standing and avoid complications.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky 740 NP R are critical to avoid penalties. Typically, the form must be submitted by April 15 of the year following the tax year being reported. For example, the deadline for the 2019 Kentucky 740 NP R would be April 15, 2020. It is important to stay informed about any extensions or changes to these deadlines, as they can vary based on specific circumstances or state announcements.

Required Documents

To complete the 740 NP R form accurately, certain documents are necessary. These include:

- W-2 forms from employers for income earned in Kentucky.

- 1099 forms for any freelance or contract work performed in the state.

- Documentation of any deductions or credits you plan to claim, such as receipts for business expenses.

Having these documents ready will streamline the process and help ensure that all income is reported correctly.

Form Submission Methods (Online / Mail / In-Person)

The Kentucky 740 NP R can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online through the Kentucky Department of Revenue's e-filing system, which offers a convenient and efficient way to submit tax returns. Alternatively, the form can be mailed to the appropriate address provided by the Department of Revenue. In-person submissions may also be possible at designated tax offices, although checking for local availability is recommended.

Quick guide on how to complete 740 np r

Complete 740 NP R Seamlessly on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Handle 740 NP R on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related processes today.

How to Modify and Electronically Sign 740 NP R Effortlessly

- Locate 740 NP R and click Get Form to start.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Formulate your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Verify all details and then click the Done button to preserve your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and electronically sign 740 NP R while ensuring outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 740 np r

Create this form in 5 minutes!

How to create an eSignature for the 740 np r

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2019 Kentucky 740 NP form?

The 2019 Kentucky 740 NP is a state tax form used by non-residents to report income earned in Kentucky. It is specifically designed for individuals who have income sourced from Kentucky but reside in another state. Completing this form accurately can ensure compliance with Kentucky tax laws.

-

How can I obtain a 2019 Kentucky 740 NP form?

You can obtain the 2019 Kentucky 740 NP form from the Kentucky Department of Revenue's website or directly through tax preparation software. It is also available at various tax assistance offices. Ensure that you have the latest version to avoid any discrepancies.

-

What are the filing deadlines for the 2019 Kentucky 740 NP?

The deadline for filing the 2019 Kentucky 740 NP form is typically April 15th of the following year. If you require additional time, you can request an extension, but it's important to submit any taxes owed by the deadline to avoid penalties. Always check for updated deadlines since they may vary.

-

What are the key features of the 2019 Kentucky 740 NP form?

The 2019 Kentucky 740 NP form includes sections for reporting income, deductions, and credits available specifically to non-residents. It also provides options for taxpayers to claim exemptions or additional deductions based on their individual situations. Understanding these features can help optimize your tax return.

-

Are there penalties for not filing the 2019 Kentucky 740 NP?

Yes, there are penalties for failing to file the 2019 Kentucky 740 NP form by the due date, which can include fines and interest on unpaid taxes. To avoid these penalties, ensure that you file your form timely and accurately. If you suspect you may miss the deadline, it is advisable to file an extension.

-

Can I eFile my 2019 Kentucky 740 NP form?

Yes, you can eFile your 2019 Kentucky 740 NP form using approved tax preparation software that supports Kentucky state tax forms. eFiling is often faster and reduces the likelihood of errors compared to paper filing. Check that the software allows for eFiling of the 740 NP to streamline the process.

-

What benefits can I receive from filing the 2019 Kentucky 740 NP?

Filing the 2019 Kentucky 740 NP can entitle you to refunds if you’ve overpaid taxes or can help you claim state tax credits that reduce your overall tax liability. It also ensures you are compliant with Kentucky tax regulations and protects you from potential audits or penalties. Understanding these benefits can help maximize your tax advantages.

Get more for 740 NP R

- Supplemental payments reimbursement request for workers compensation wisconsin form

- Wisconsin workers compensation form

- Subpoena for workers compensation wisconsin form

- Wi workers compensation 497431470 form

- Compromise agreement sample form

- Stipulation for workers compensation wisconsin form

- Admission to service for workers compensation wisconsin form

- Medical treatment statement for workers compensation wisconsin form

Find out other 740 NP R

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast