4924, Withholding Certificate for Michigan Pension or Annuity Payments MI W 4P 2025-2026

Understanding the MI W-4P Form

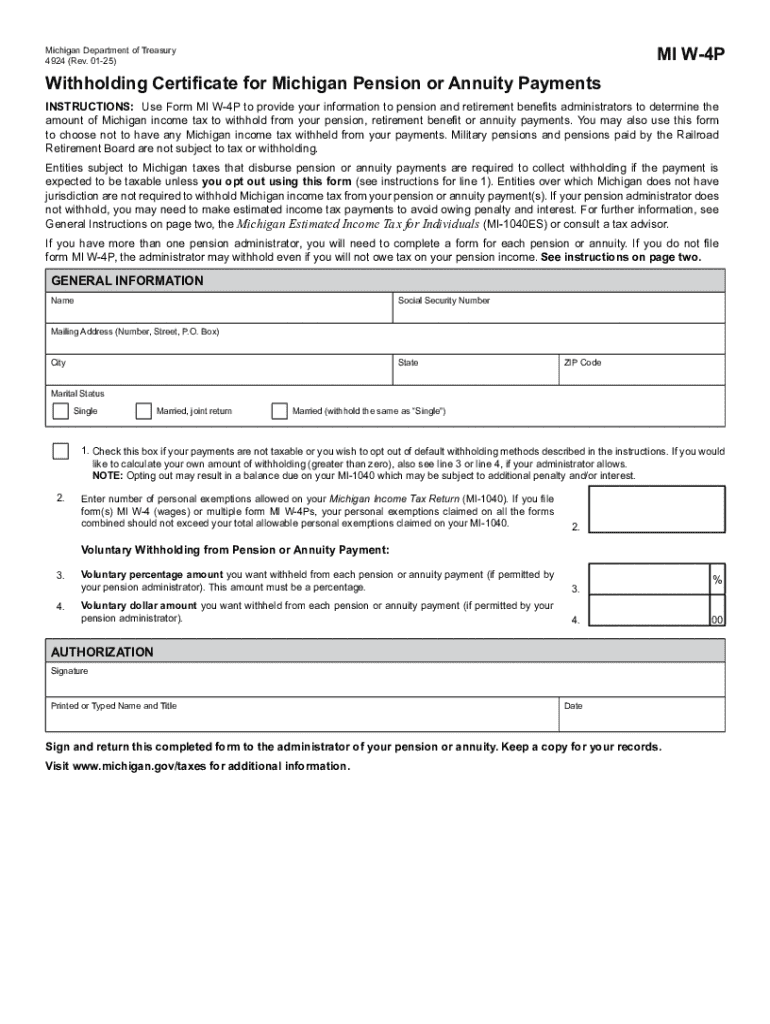

The MI W-4P, also known as the Withholding Certificate for Michigan Pension or Annuity Payments, is a form used by individuals receiving pension or annuity payments in Michigan. This form allows recipients to specify the amount of state income tax to be withheld from their payments. It is essential for ensuring that the correct amount of tax is deducted, helping to avoid underpayment penalties during tax season.

Steps to Complete the MI W-4P Form

Completing the MI W-4P form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single or married, which will affect the withholding amount.

- Specify any additional amount you wish to have withheld from your payments, if applicable.

- Sign and date the form to certify that the information provided is accurate.

How to Obtain the MI W-4P Form

The MI W-4P form can be obtained from the Michigan Department of Treasury's website or through your pension plan administrator. It is available in a printable format, allowing you to fill it out by hand or digitally. Ensure you have the most current version of the form to comply with any recent changes in tax regulations.

Key Elements of the MI W-4P Form

Understanding the key elements of the MI W-4P form is crucial for accurate completion:

- Personal Information: Required details such as name, address, and Social Security number.

- Filing Status: Selection of your tax filing status, which influences withholding rates.

- Additional Withholding: Option to specify any extra amount you wish to be withheld.

Legal Use of the MI W-4P Form

The MI W-4P form is legally recognized for specifying withholding amounts from pension or annuity payments in Michigan. It is important to submit this form to your pension plan administrator to ensure compliance with state tax laws. Failure to submit the form may result in incorrect withholding, leading to potential tax liabilities.

Examples of Using the MI W-4P Form

Here are a few scenarios illustrating the use of the MI W-4P form:

- A retiree receiving monthly pension payments can use the form to adjust their withholding based on their current income and tax situation.

- An individual who has other sources of income may choose to increase their withholding to cover potential tax liabilities.

- A person transitioning from full-time employment to retirement can use the MI W-4P to manage their tax obligations effectively.

Handy tips for filling out 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P online

Quick steps to complete and e-sign 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant service for optimum simpleness. Use signNow to electronically sign and send 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct 4924 withholding certificate for michigan pension or annuity payments mi w 4p 771975077

Create this form in 5 minutes!

How to create an eSignature for the 4924 withholding certificate for michigan pension or annuity payments mi w 4p 771975077

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is miw4p and how does it relate to airSlate SignNow?

miw4p is a key term associated with airSlate SignNow, which is a powerful tool for sending and eSigning documents. This solution simplifies the signing process, making it accessible for businesses of all sizes. By utilizing miw4p, users can enhance their document workflows efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. The plans are designed to be cost-effective, ensuring that users can find a solution that fits their budget while leveraging the benefits of miw4p. You can choose from monthly or annual subscriptions based on your requirements.

-

What features does airSlate SignNow provide?

airSlate SignNow includes a range of features such as document templates, real-time tracking, and secure eSigning capabilities. These features are designed to streamline your document management process, making it easier to utilize miw4p effectively. Users can also customize workflows to suit their specific needs.

-

How can miw4p benefit my business?

By implementing miw4p through airSlate SignNow, businesses can signNowly reduce the time spent on document management. The platform enhances productivity by allowing users to send and sign documents quickly and securely. This leads to faster turnaround times and improved customer satisfaction.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing its functionality. This includes popular tools like CRM systems and cloud storage services, allowing users to incorporate miw4p into their existing workflows. These integrations help streamline processes and improve overall efficiency.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents signed through the platform are protected. With features like encryption and secure access, users can trust that their sensitive information is safe while utilizing miw4p. Compliance with industry standards further enhances the platform's reliability.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile use, allowing users to send and sign documents on the go. This flexibility is a key advantage of miw4p, as it enables businesses to operate efficiently from anywhere. The mobile app provides a user-friendly experience, ensuring accessibility at all times.

Get more for 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P

- Legal last will and testament form for single person with adult children new york

- Legal last will and testament for married person with minor children from prior marriage new york form

- Legal last will and testament form for married person with adult children from prior marriage new york

- Legal last will and testament form for divorced person not remarried with adult children new york

- Legal last will and testament form for divorced person not remarried with no children new york

- Legal last will and testament form for divorced person not remarried with minor children new york

- Legal last will and testament form for divorced person not remarried with adult and minor children new york

- Mutual wills package with last wills and testaments for married couple with adult children new york form

Find out other 4924, Withholding Certificate For Michigan Pension Or Annuity Payments MI W 4P

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document